Western Europe Connector Market Outlook

Sim-Ready, Flexible, and Printed Connectors Reinventing Development Paradigms

Western Europe connector market is transitioning toward a design-led, digital-first innovation cycle. Anchored in the region’s advanced simulation-driven automotive development and clean energy mandates, this shift is accelerating demand for flexible, flat, and simulation-compatible connector architectures. Countries like Germany, France, and the Netherlands are increasingly integrating printed connectors into solar farms, EV systems, and aerospace control units. These flexible and lightweight formats support both electronic signal reliability and high-density circuit integration, allowing for optimization of limited space in design-constrained applications.

The Western Europe connector market is projected to be valued at USD 12.9 billion by 2033, the growth is significantly influenced by the adoption of digital twins in automotive manufacturing, rise in renewable power electronics, and demand for foldable, simulation-friendly connector solutions. High-speed telecom applications and modular EV platforms are also pushing OEMs to incorporate connector systems that are both rugged and digitally validated in virtual test environments.

Satellite Ambitions and Renewable Electrification Fueling Connector Momentum

Western Europe’s renewed focus on space-tech development and renewable infrastructure expansion is acting as a powerful catalyst for connector market growth. National satellite launch programs, led by organizations such as CNES (France) and DLR (Germany), are incorporating miniaturized, vibration-proof circular connectors into lightweight satellite payloads. These systems require robust electromagnetic shielding and low insertion force to support compact avionics designs.

On the ground, the ongoing acceleration of renewable energy deployment—particularly wind and solar energy—is driving demand for corrosion-resistant and IP-rated terminal blocks and PCB connectors. These components are used in energy inverters, grid-tied control boxes, and battery management systems where space efficiency and safety certification are vital. In tandem, the EU’s Renewable Energy Directive II (RED II) mandates interoperability and performance verification across components, pushing for greater reliability and traceability.

However, the region’s miniaturization race has also introduced material fatigue issues and connector interface wear, particularly in aerospace and high-vibration automotive contexts. These risks underscore the need for advanced composite materials and resilient contact technologies to extend lifecycle reliability.

Flat, Printed, and Virtualized: The Shaping Trends in Western Europe’s Connector Landscape

Across Western Europe, a major transition is underway from conventional mechanical connectors toward flat, printed, and digitally modeled formats. Automotive OEMs are embedding simulation-ready connector models into their virtual design libraries, enabling seamless integration into digital twin-based product development. This virtual-first approach reduces prototyping time and increases configuration accuracy for hybrid and electric powertrains.

In parallel, printed connectors on flexible substrates are seeing rising uptake in biomedical wearables, aerospace dashboards, and foldable consumer devices. Their low-profile nature supports ergonomic and space-constrained applications while minimizing heat buildup. Additionally, sensor-integrated flat connectors are being leveraged in real-time health monitoring systems and smart logistics equipment.

Opportunities lie in developing foldable, EMI-shielded connectors for electric aviation and designing connector libraries optimized for virtual simulations of mechanical stress and environmental impact. With rising electrification in public transport and logistics fleets, connector manufacturers are now investing in hybrid signal-power designs that allow centralized control of data and current flows in a single physical footprint.

Regulatory Gatekeepers of Compliance and Environmental Stewardship

Regulatory compliance is a foundational pillar of the Western Europe connector market. Under the European Union’s RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) directives, connector manufacturers must adopt non-toxic, traceable, and recyclable material systems. This compliance-first landscape necessitates continuous investment in reformulated polymer housing, lead-free solder joints, and nickel-free plating technologies.

Organizations such as the European Chemicals Agency (ECHA) and national certification bodies across France, Germany, and the Nordics ensure strict validation of connector designs for high-temperature resistance, vibration tolerance, and material safety. These standards are especially rigorous in defense, aerospace, and rail applications. Furthermore, emerging EU-wide proposals on digital product passports and carbon footprint labeling will require connector OEMs to integrate lifecycle transparency into their supply chain documentation.

Key Economic Forces and Their Influence on Market Performance

The performance of Western Europe connector sector is being shaped by a combination of rising design compliance costs and increasing innovation agility in the supply chain. First, high RoHS/REACH compliance rates push firms to redesign legacy products using new environmentally sustainable substrates. Second, the region’s emphasis on IP68 and IP69K protection ratings in harsh outdoor and marine conditions creates pressure for precision molding and sealing processes.

Another significant economic lever is the volume of simulation software usage across industries. As more OEMs utilize digital prototyping and system-level simulations, the need for connector datasets formatted for CAD/EDA platforms has surged. This trend encourages connector firms to shift from purely mechanical part vendors to platform-based solution providers. Moreover, rising investment in public transport electrification (rail, tram, EV buses) is creating scale advantages for companies that can offer modular, easily deployable connectors tailored to national grid compliance.

Compliance-Focused Innovation and Digital Enablement

The connector market in Western Europe is defined by a mix of multinational giants and regional specialists, including TE Connectivity, LEMO, Rosenberger, and HARTING. These firms are focused on delivering IP-rated, REACH-compliant products with simulation-ready digital footprints.

In 2024, TE Connectivity launched a line of IP68 rugged connectors designed specifically for renewable infrastructure in Northern Europe. These connectors include enhanced EMI shielding and materials validated for offshore deployment. Meanwhile, HARTING introduced an EDA-compatible digital library for its full range of rectangular I/O connectors aimed at the automotive simulation ecosystem.

Strategically, companies are adopting compliance-first design and simulation-led customization. They are also building out their aftermarket ecosystems to offer digital twin support, thermal stress simulation, and predictive failure analytics. This aligns with the broader shift toward Industry 5.0, where predictive intelligence and environmental compliance intersect.

Simulation, Sustainability, and Speed as Pillars of Competitive Differentiation

The Western Europe connector market is no longer driven solely by performance benchmarks; it is shaped by simulation integration, sustainability regulation, and deployment agility. As the market crosses USD 12.9 billion by 2033, firms that embed digital compliance, offer simulation-ready models, and engineer lightweight, flat connectors will be positioned to dominate next-generation automotive, energy, and aerospace segments.

Manufacturers must leverage compliant materials, invest in digital twin ecosystems, and foster agile manufacturing models that can scale across design variations. The region’s early adoption of clean energy and simulation platforms makes it a blueprint for connector transformation globally.

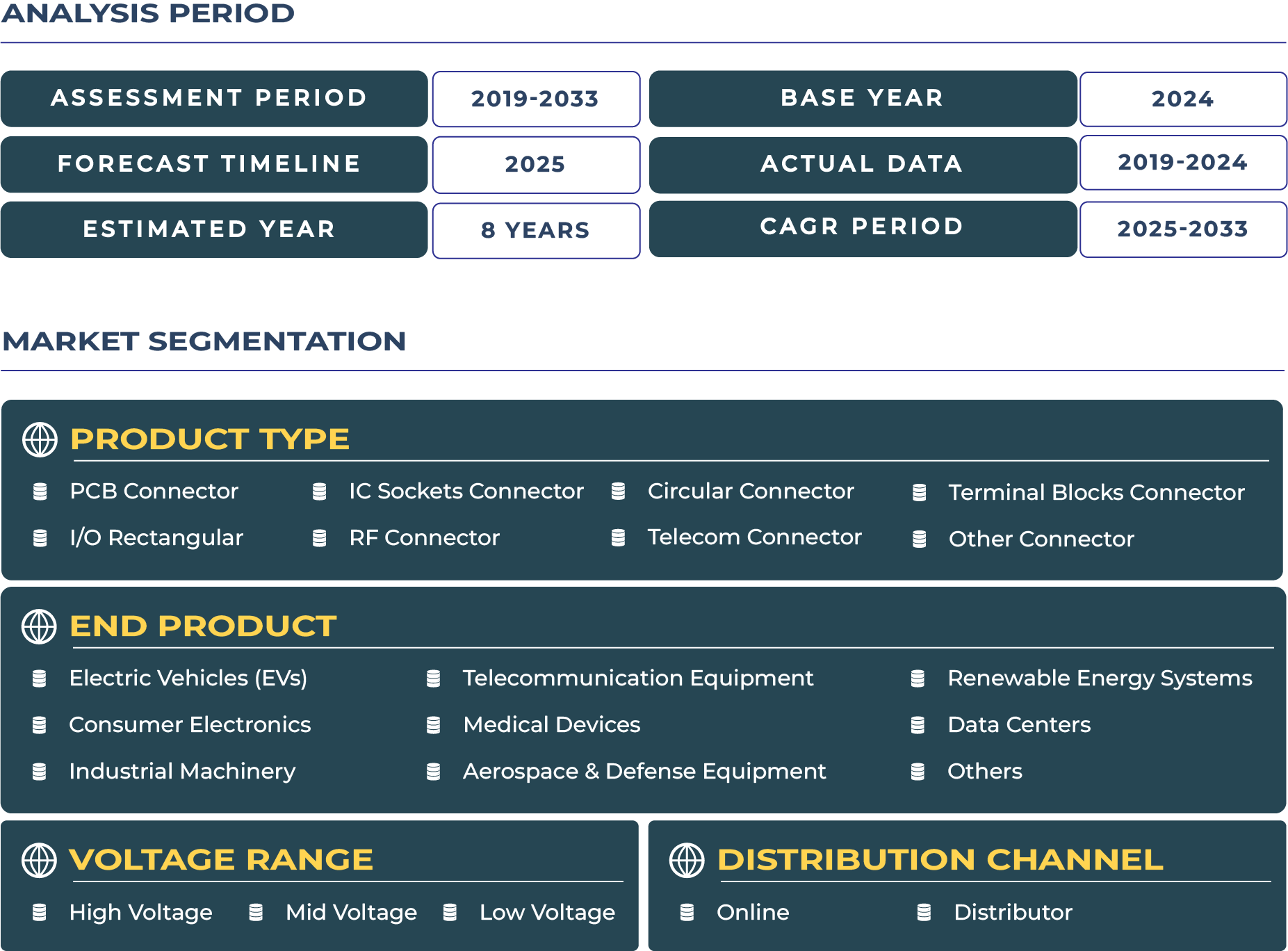

Western Europe Connector Market Segmentation

Western Europe Connector Market Country Coverage

To explore design strategies, competitive forecasts, and market entry frameworks for Western Europe connector landscape, access the exclusive DataCube Research market report.