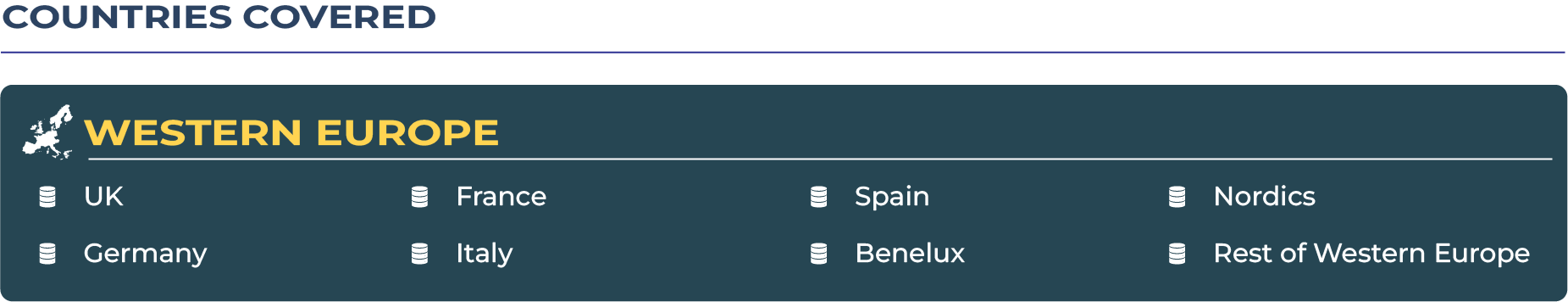

Western Europe Diabetes Care Devices Market Outlook: Structuring Multi-Country Tender and HTA Strategies for Sustainable Growth

The Western Europe diabetes care devices industry is evolving at the intersection of evidence-based medicine and complex procurement systems. Designing outcome-driven evidence packages and building tender strategies that address divergent health technology assessment (HTA) requirements remain pivotal for scaling device adoption across countries such as Germany, France, the UK, and Italy. The market is increasingly shaped by how companies structure HTA dossiers, present cost-offset evidence, and negotiate reimbursement pathways that align with country-specific procurement priorities. According to DataCube Research, the Western Europe diabetes care devices market is valued at USD 7.45 billion in 2025 and is projected to reach USD 12.10 billion by 2033, registering a CAGR of 6.2% between 2025 and 2033. This steady growth reflects robust reimbursement structures, a mature patient base, and the ability of companies to align with public payers’ value-based expectations.

How Multi-Country Tendering and HTA Dossier Strategies Define the Future of Diabetes Care Devices

The Western Europe diabetes care devices market is driven by its reliance on public healthcare systems, where procurement practices and HTA evaluations dominate reimbursement decisions. With each country following unique HTA frameworks—such as NICE in the UK, HAS in France, and IQWiG in Germany—manufacturers are increasingly focused on designing cross-country evidence packages that demonstrate not just clinical efficacy but also long-term economic value. The emphasis on demonstrating outcomes such as reduced hospitalizations, lower complications, and integration into digital health pathways is reshaping product development and market positioning. Countries with centralized tender systems, such as Italy and Spain, present both opportunities and challenges as cost-containment policies pressure suppliers to lower prices while simultaneously demanding higher outcome proof. This landscape compels market players to innovate not just in technology, but also in commercial models, paving the way for sustainable growth despite macroeconomic pressures and political uncertainties.

Drivers & Restraints: Balancing Mature Reimbursement with Procurement Fragmentation

Drivers: Mature reimbursement and high per-capita uptake sustaining growth

One of the key drivers fueling growth in the Western Europe diabetes care devices sector is the maturity of reimbursement frameworks across countries. National health systems, backed by strong payer support, have enabled widespread adoption of continuous glucose monitoring (CGM), insulin pumps, and smart monitoring solutions. High per-capita income and advanced healthcare infrastructure further enhance device penetration in urban populations. Digital health integration, exemplified by Germany’s DiGA program, has accelerated the adoption of app-connected diabetes management solutions, showcasing how reimbursement models can shape consumer behavior and device scaling.

Restraints: Procurement fragmentation and pricing transparency pressures

Despite strong reimbursement, the market faces procurement-related challenges that limit growth potential. Fragmentation across regional and national tendering systems creates complexities for manufacturers, who must adapt strategies to satisfy varying evidence requirements. Increasing pressure for price transparency, particularly in France and Benelux, has heightened competition, forcing companies to launch tiered product lines with differentiated value propositions. Additionally, broader geopolitical tensions and inflationary pressures are constraining national healthcare budgets, leading to stricter payer negotiations and delayed procurement cycles. These constraints underline the importance of outcome-based contracting and innovative financing strategies to sustain margins in a highly scrutinized environment.

Trends & Opportunities: Digital Pilots, Hospital-to-Homecare Models, and Premium Launches

Trend: Digital pilots and hospital-to-homecare integration redefining device adoption

The Western Europe diabetes care devices industry is increasingly shaped by digital pilots that link hospitals to home-based care ecosystems. Countries such as the UK and Nordics are leading in deploying connected monitoring systems that enable remote consultations, reduce hospital burden, and empower patients to self-manage diabetes more effectively. Hospital-to-homecare models are gaining traction, supported by government investments in telehealth, which have become central to long-term strategies following the pandemic. These pilots are expected to mature into standardized programs across Western Europe, accelerating adoption of smart monitoring and app-integrated insulin delivery devices.

Opportunity: Premium device launches and outcome-based contracting models

Premium continuous glucose monitoring devices and implantable sensors are emerging as key opportunities across Western Europe. Manufacturers are actively pursuing outcome-based contracting, where reimbursement is tied to demonstrated patient outcomes, thus mitigating payer resistance. Spain and Italy, for example, are increasingly adopting contracting models that align payments with real-world evidence. This trend provides significant opportunities for manufacturers that can demonstrate not just clinical efficacy but also cost savings for national health systems. Furthermore, premium device launches targeting affluent urban segments in France and Germany are creating opportunities to differentiate products in a price-sensitive market.

Regional Analysis by Country

UK Diabetes Care Devices Market

- The UK market is driven by the National Health Service’s structured reimbursement system and the influence of NICE in evaluating device cost-effectiveness. CGM adoption is rapidly growing, supported by digital health pilots and nationwide diabetes management programs. However, pricing pressures and regional disparities in procurement remain challenges.

Germany Diabetes Care Devices Market

- Germany stands out with high per-capita device uptake and progressive digital health integration under the DiGA initiative. IQWiG’s stringent HTA requirements influence device reimbursement, but the country’s strong focus on innovation and patient access makes it a lucrative market for CGM and smart management devices.

France Diabetes Care Devices Market

- France diabetes care devices sector is anchored by the HAS framework, which emphasizes health economics in procurement. The market is expanding with strong urban adoption of insulin pumps and adjunctive devices, but pricing transparency regulations are limiting manufacturer flexibility in premium product launches.

Italy Diabetes Care Devices Market

- Italy’s centralized procurement system creates opportunities for large-scale tenders, but aggressive cost-containment measures hinder pricing flexibility. The adoption of CGM and insulin patch pumps is growing, supported by regional diabetes management initiatives targeting both adult and pediatric populations.

Spain Diabetes Care Devices Market

- Spain Diabetes Care Devices market is characterized by rising CGM uptake and improved awareness among patients. However, regional disparities in reimbursement policies continue to slow uniform adoption. Value-based procurement and partnerships with hospital networks are key strategies shaping market expansion.

Benelux Diabetes Care Devices Market

- Benelux countries emphasize price transparency and value-for-money in procurement. While adoption of smart management devices is strong, strict cost controls and evidence-heavy procurement reviews make the region competitive and challenging for premium device launches.

Nordics Diabetes Care Devices Market

- The Nordics represent one of the most advanced markets, with strong digital health integration and high adoption of smart diabetes management devices. Government-led pilots in Sweden and Denmark highlight the shift towards hospital-to-homecare models, creating an attractive environment for innovative device launches.

Competitive Landscape: Innovations, Multi-Country Tender Strategies, and Outcome-Based Approaches

The Western Europe diabetes care devices landscape is dominated by global leaders such as Abbott, Roche, Medtronic, and local innovators like DiaMonTech. A significant development occurred in July 2024, when DiaMonTech, a Germany-based company, won the Health-i Award for its non-invasive glucose laser technology, highlighting the growing focus on breakthrough sensing solutions. Multinationals are increasingly prioritizing clinical evidence to reduce payer resistance across borders. Strategies such as outcome-based contracting, multi-country HTA dossier alignment, and partnerships with public hospitals are becoming central to market expansion. The emphasis on negotiating tenders across multiple countries while aligning evidence with EU-wide payer expectations reflects a shift towards standardized procurement approaches that favor companies with robust R&D pipelines and strong policy engagement.