Balancing Efficiency and Innovation Amid Financial Strain in Zimbabwe Banking Sector

Zimbabwe banking market is navigating an intricate balancing act: optimizing cost structures and injecting innovation while grappling with political risk, hyperinflation cycles, and regulatory pressures. As the country endures macro volatility, the banking sector’s survival, and growth, hinges on lean operations, resilient risk controls, and selective fintech-enabled disruption.

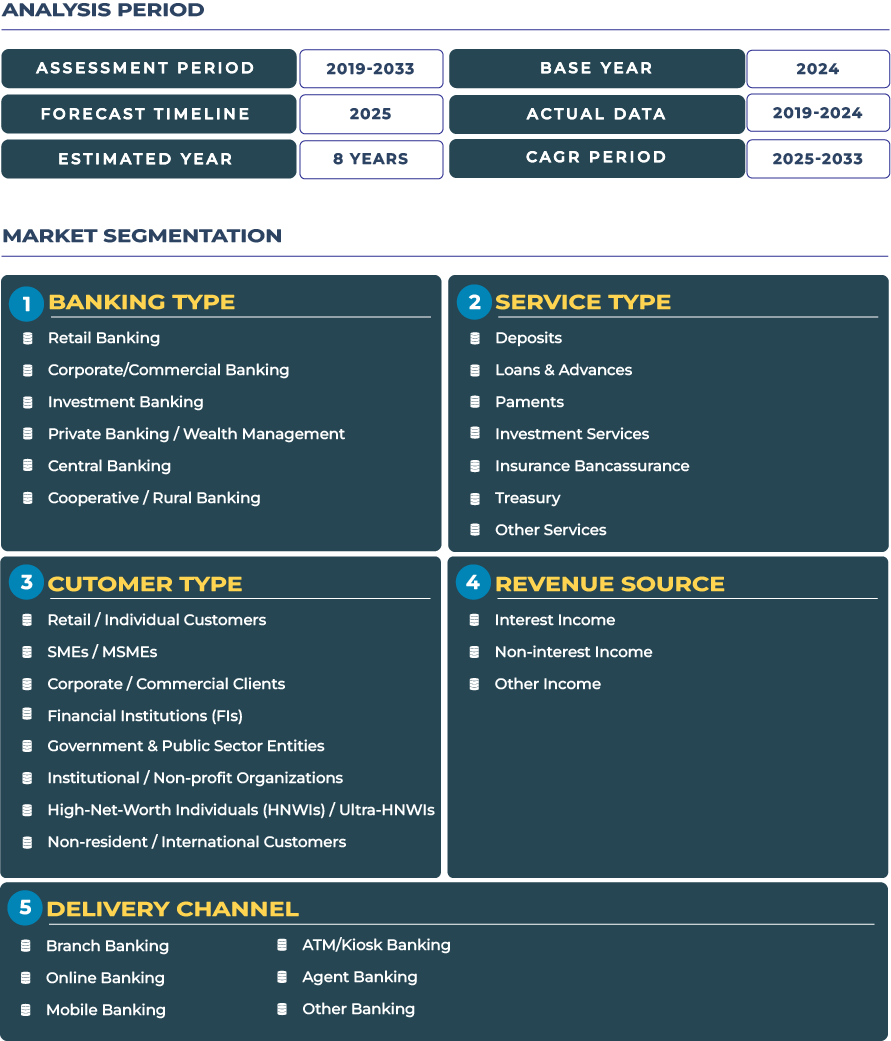

Note:* The banking market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

Under a calibrated outlook, the Zimbabwe banking market is projected to grow from USD 8.0 billion in 2025 to USD 9.4 billion by 2033, implying a CAGR of 2.2 %. While this growth is modest, it reflects the reality that Zimbabwe’s banks must compete under economic duress, currency fluctuation, and constrained demand, making efficiency and targeted innovation the true levers of resilience.

Given persistent external headwinds, capital constraints, and limited access to external funding, Zimbabwean banks must focus less on aggressive expansion and more on optimizing processes, reducing cost of funds, adopting digital credit engines, and deploying micro-lending that balances scale with risk. The dual pressures of high compliance and political uncertainty elevate the cost of operations; thus banks that can maintain lean structures while selectively investing in automation, risk analytics, and regional outreach will differentiate themselves. In effect, growth in Zimbabwe’s banking landscape will be about doing more with less, and turning structural challenges into competitive advantage.

Market Outlook: Modest Expansion Under Strain, with Room for Strategic Differentiation

The Zimbabwe banking market’s future is projected as cautious but structurally important. The forecasted market size underscores that traditional banking growth will remain muted under macro constraints, yet it leaves space for players who differentiate via operational excellence and product innovation. The limited growth in core credit is offset by opportunities in digital banking, microfinance scaling, payments, diaspora remittances, and cross-border banking in the Southern African region.

Zimbabwe faces uniquely severe challenges: chronic foreign exchange scarcity, fiscal debt burdens, currency uncertainty, and episodic policy shifts. The banking sector’s role is not only to intermediate credit and deposits but to act as a stabilizer for the real economy, especially for SMEs, agriculture, and the diaspora flows. In 2025, the central bank maintained its key policy rate at 35 %, reflecting inflationary pressure and currency risk. Meanwhile, reforms such as sweeping reductions in bank charges and licensing fees have been announced to reduce cost burdens on financial institutions.

That environment suggests that banks seeking growth cannot rely solely on lending expansion but must capture new margins via payments, micro-loans, embedded services, and cost rationalization. The growth path will be bumpy, but those institutions that adapt will emerge stronger in the next cycle.

Drivers & Restraints: Digital Youth Demand and Green Finance versus Political & Compliance Headwinds

Driving Force: Gen Z Digital-Native Banking Demand & Green / Sustainable Lending Products

One potential source of uplift is the growing cohort of Gen Z consumers who expect seamless digital banking from day one. Even amid macro stress, demand for mobile banking, instant credit, micro-savings, and buy now, pay later options is rising. Banks that invest in frictionless onboarding, intelligent credit scoring, embedded micro-loans, and mobile-first experience can gain stickiness among younger segments. In addition, green finance and sustainable lending, tying credit to climate resilience, agricultural sustainability, renewable energy projects, or social impact metrics, offer new product differentiation. Zimbabwe’s agriculture and mining sectors offer potential domains for sustainability-linked credit, especially where donor or climate financing intersects with banking capital.

Restraining Force: High Compliance & Reporting Costs and Political Instability Impacting Banking Operations

On the flip side, compliance and reporting costs are acutely burdensome in Zimbabwe. The Reserve Bank of Zimbabwe (RBZ) demands frequent circulars, strict reporting, capital buffer requirements, and credit registry obligations. Moreover, political instability, policy unpredictability, and regulatory shifts create risk of abrupt changes to foreign exchange regimes, interest rate policy, or banking taxes. These challenges can deter investment in digital infrastructure or expansion initiatives. Many banks are constrained in capital, and the risk of policy reversal or regulatory burdens may reduce appetite for innovation or scaling operations aggressively.

Trends & Opportunities: AI Credit Scoring, Super-Regional Banking & Micro-Lending Growth

Trend: AI-Enabled Credit Scoring and Emergence of Super-Regional Banking

A leading trend is the adoption of AI-enabled credit scoring using alternative data, mobile usage, utility payments, transaction history, social signals, to underwrite micro and retail credit in the absence of robust credit histories. This shift lowers default risk and can unlock previously underserved segments. Concurrently, Zimbabwe faces the possibility of super-regional banking expansion, with local banks seeking to establish footprints in neighboring countries (Mozambique, Zambia, Botswana), or regional institutions expanding into Zimbabwe. Such cross-border moves may help diversify currency risk, attract foreign funding, and scale balance sheet beyond local constraints.

Opportunity: AI-Powered Micro-Lending Platforms & Cross-Border Regional Banking Expansion

In terms of opportunity, AI-powered micro-lending platforms offer perhaps the most scalable growth line under constraint. By integrating with mobile wallets or agent networks, banks can deliver small loans instantly, underwrite via smart engines, and earn margin with controlled risk. Coupled with insurance upsell or savings bundling, micro-lending becomes a high-frequency revenue stream. Another opportunity is cross-border regional banking expansion, Zimbabwean banks may leverage local knowledge to expand into Southern African markets, perhaps especially in Zimbabwe diaspora hubs, and offer trade finance, remittance gateways, and corporate banking across borders.

Regulatory Framework & Reform: Navigating the RBZ Mandate and Evolving Licensing Regimes

The Reserve Bank of Zimbabwe (RBZ) is the key regulator and supervisor for banking and payments. Under the RBZ Act (Chapter 22:15) and Banking Act (Chapter 24:20), the central bank controls licensing, reporting, supervision, and payment system regulation. In recent years, the RBZ has introduced fintech sandbox guidelines, allowing regulated experimentation in digital currencies, payments, mobile banking, and limited banking models.

Recently, S.I. 17 of 2025 revised licensing and fee structures for payment service providers and mobile banking services, setting application fees in USD and capping annual license fees. This regulatory shift increases predictability but also imposes new cost burdens on fintech and banking entrants. Additionally, credit risk, leverage, large exposure, and capital buffer guidelines are being refined under IMF technical assistance to align Zimbabwe’s banking sector with global standards. Recent regulatory relaxations such as reductions in licensing fees aim to stimulate investment in banking services.

Key Impacting Variables: NPA, CAR, Exchange Regimes & Liquidity Pressures

Several metrics are particularly influential in shaping Zimbabwe’s banking sector growth and risk dynamics:

- Non-Performing Assets (NPA) ratio: Elevated default rates, especially in agriculture, SMEs, or foreign currency exposures, consume capital and reduce lending capacity.

- Capital Adequacy Ratio (CAR): In a low growth environment, maintaining strong CAR buffers is essential to sustain operations under stress and regulatory demands.

- Exchange rate regime & dual currency flows: Zimbabwe operates in a partial multi-currency regime (USD and local currency). Exchange volatility generates credit and liquidity risk for foreign-denominated exposures.

- Liquidity and funding stress: Banks often face deposit flight, currency mismatches, and funding strain in tight macro cycles.

- Regulatory capital alignment and large exposure limits: Reforms via IMF TA are pushing banks toward better risk-weighted asset management and limits on concentration.

Competitive Landscape: Banks Navigating Cost Pressures and Strategic Positioning

Zimbabwe banking sector comprises commercial banks, development institutions, microfinance, and building societies. According to the RBZ, leading commercial banks include CBZ Bank, FBC Bank, Ecobank Zimbabwe, Nedbank Zimbabwe, Stanbic Zimbabwe, ZB Bank, Steward Bank, and others. Among them, FBC Bank is noteworthy for its push into digital banking, mobile platforms, and diversified financial services.

Another significant bank is ZB Bank, which offers a range of retail, corporate, and mortgage products and has been active in repositioning its brand and digital channels. Additionally, Nedbank Zimbabwe operates as part of the South African Nedbank Group, leveraging regional affiliations.

Competitive strategy in Zimbabwe is increasingly focused on cost optimization, lean digital delivery, micro-lending, agent networks, and regional expansion. Some banks are consolidating or merging to meet capital requirements. The sector is also responding to policy reforms, such as reduced banking charges, to ease competitiveness burdens. The successful banks will be those that can combine operational efficiency, risk discipline, lean digital innovation, and cross-border reach.

Conclusion: Strengthening Zimbabwe’s Banking Sector via Efficiency, Innovation & Selective Outreach

Zimbabwe banking market is not ripe for high-velocity expansion; rather, it is a terrain where efficiency, resilience, and targeted innovation must carry the load. Under the forecast, the market growth reflects a cautious but steady path. The differentiators will be agile cost structures, AI-driven micro-lending, embedded payment flows, and selective regional banking moves.

To succeed, banks must streamline operations, invest in automation, embed digital credit engines, and adopt nimble product architectures. They must also navigate regulatory complexity, foreign exchange volatility, capital pressures, and political uncertainty. The regulatory environment is evolving, and incentives such as reduced fees may help, but banks must act under constraint. Those that can maintain capital resilience, balance risk dynamically, and selectively expand via technology will emerge as leaders in Zimbabwe’s next banking cycle. The future of Zimbabwe’s banking sector rests not in size, but in strategic differentiation, operational excellence, and cross-border connectivity in a challenging but opportunistic environment.