Zimbabwe Dental Devices Market Outlook: Navigating Economic Hardship with Gradual Modernization

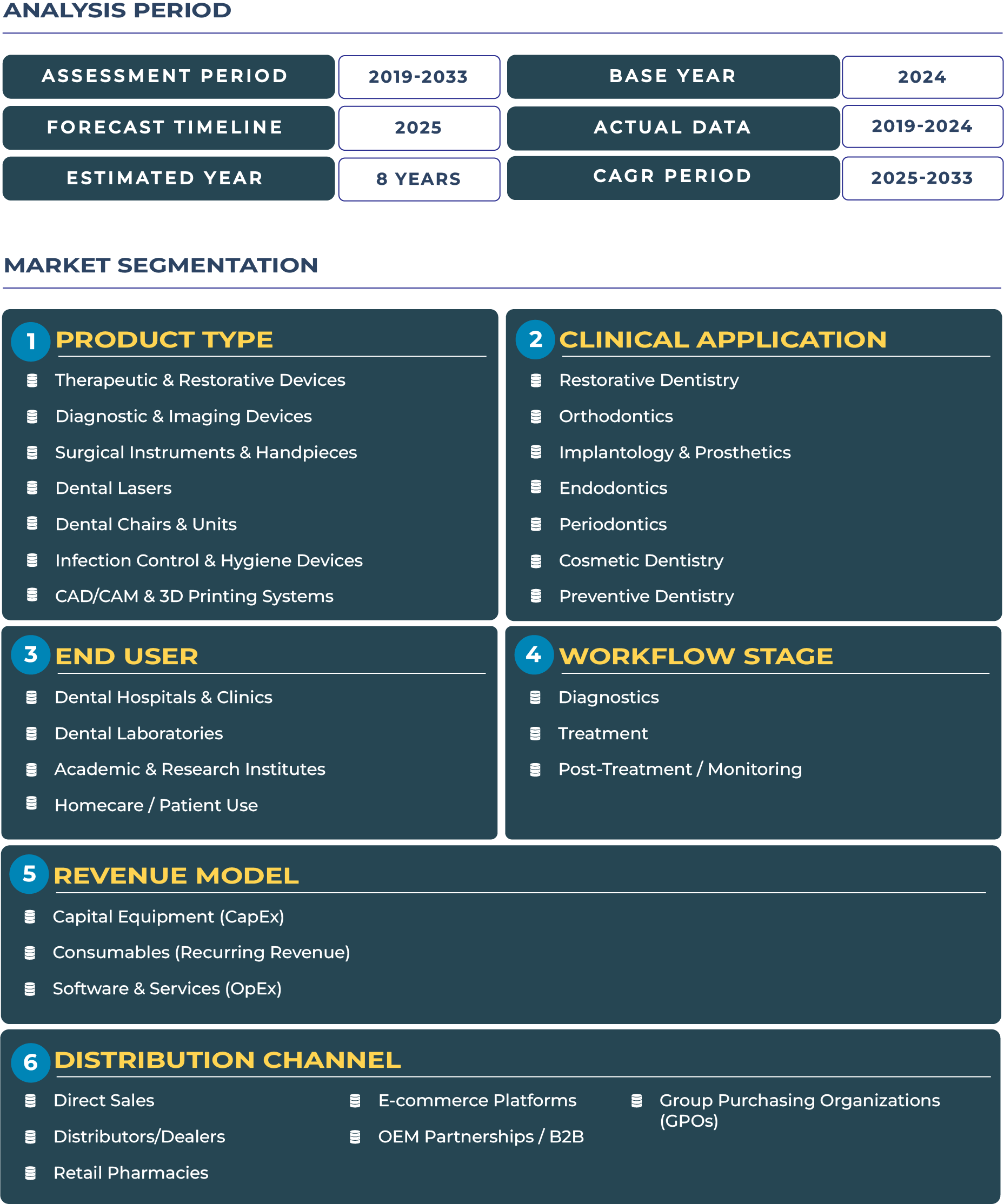

Zimbabwe dental devices market represents a delicate balance between economic hardship and gradual modernization. The sector is witnessing slow but steady upgrades in private clinics, despite the country’s broader macroeconomic struggles. In 2025, the Zimbabwe dental devices market is valued at USD 27.9 million, with projections to reach USD 43.4 million by 2033, reflecting a CAGR of 5.7% (2025–2033). This performance is fueled by the modernization efforts in Harare and Bulawayo, rising awareness of oral health, and niche private demand. While affordability challenges and currency risks persist, the resilience of the dental ecosystem in Zimbabwe illustrates the market’s ability to sustain gradual growth even under uncertain conditions.

Dental Modernization in Zimbabwe Amid Economic Volatility

The outlook for Zimbabwe dental devices industry is shaped by both opportunities and constraints. Urban clinics, particularly in Harare, are investing in diagnostic and imaging devices and CAD/CAM systems to improve service quality, while donor-funded programs occasionally provide essential infection control equipment. However, persistent inflation, currency volatility, and high import dependency limit rapid adoption. Yet, modernization initiatives supported by private stakeholders demonstrate that even within economic uncertainty, the dental devices sector in Zimbabwe is positioned for incremental progress. Rising demand for restorative solutions such as prosthetics and therapeutic devices signals a clear shift toward better oral healthcare practices in the coming decade.

Drivers & Restraints: Understanding Market Growth Catalysts and Barriers

Growth Drivers: Niche Demand and Urban Private Clinics

The dental devices landscape in Zimbabwe benefits from small but targeted demand within urban areas. Private clinics in Harare and Bulawayo act as niche hubs, introducing restorative and diagnostic tools to improve patient outcomes. Low baseline penetration of modern dental devices creates space for steady adoption, with private operators using consumable-heavy packages to meet patient affordability constraints. This momentum, combined with increasing oral health awareness in middle-income segments, underscores the steady but resilient demand pattern.

Restraints: Macroeconomic Instability and Import Restrictions

Despite these drivers, Zimbabwe dental devices ecosystem faces serious structural barriers. Hyperinflation, currency instability, and frequent import restrictions disrupt the supply of critical surgical instruments and handpieces. Rural healthcare infrastructure remains fragmented, while private insurance penetration is minimal, leaving patients exposed to out-of-pocket costs. Limited technical expertise for servicing advanced devices further hampers adoption. These systemic challenges restrict the speed of modernization, keeping the market reliant on donor-driven or consignment-based procurement models.

Trends & Opportunities: Shaping the Future of Dental Devices in Zimbabwe

Trends: Slow Modernization and Donor-Led Procurements

The modernization of Zimbabwe dental devices industry is progressing at a very slow pace, with occasional donor-led initiatives playing a critical role in supporting public facilities. High dependence on imports for spare parts and consumables continues, with private clinics adopting dental chairs and infection control units where feasible. While modernization is gradual, it highlights the incremental path the market is likely to take over the next decade.

Opportunities: Consignment, Leasing, and Consumable-Heavy Packages

Despite structural barriers, opportunities exist for firms that can design innovative business models. Consignment and leasing of dental lasers and imaging systems could reduce upfront capital risks for clinics. Offering consumable-heavy packages tailored to Harare and Bulawayo’s private operators presents another revenue pathway. Moreover, partnerships with training institutions to build local servicing capacity can mitigate dependency on foreign expertise. These strategies highlight how companies can align with Zimbabwe’s market realities while building long-term trust with stakeholders.

Competitive Landscape: Strategic Adaptations in a Volatile Market

The dental devices sector in Zimbabwe is shaped by a mix of international suppliers and regional distributors. Companies like Dentsply Sirona maintain brand presence through regional distributors, while smaller local players focus on consumables and infection control products. Between 2022 and 2025, Zimbabwe’s healthcare procurement reports highlighted increased reliance on consignment and donor-supported imports to overcome foreign exchange risks. Strategies such as short-term equipment leasing and offering consumable-heavy packages in Harare and Bulawayo demonstrate how firms are adapting to economic volatility while ensuring continuity of services. As global players cautiously engage, localized approaches remain the most effective for navigating Zimbabwe’s challenging dental devices market.