Digital Lending & Wallet Surge Amid Argentina Banking Evolution

Argentina retail banking sector is navigating a high-stakes transformation period, in which digital lending and mobile wallet adoption are becoming the vanguards of financial inclusion, even as macro volatility looms large. In a market where consumers have long distrusted the peso and externalized savings into U.S. dollars, new mobile-centric banking models are striving to reverse decades of fragmentation.

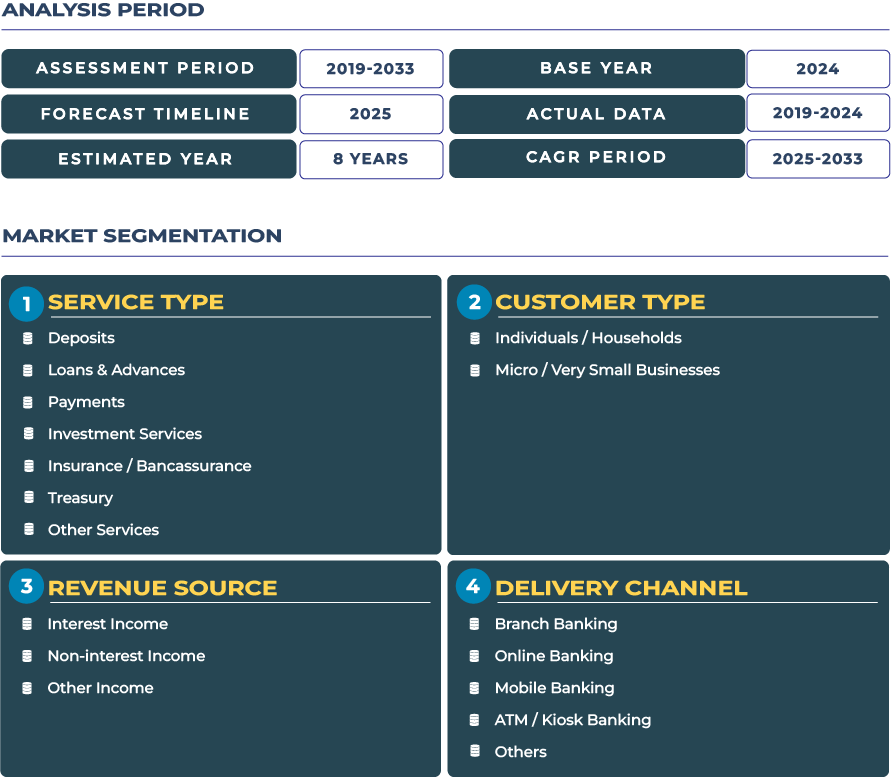

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

Market Outlook That Grabs Stakeholders’ Attention: Why Argentina Retail Banking Future Is a Strategic Battleground

The projected rise from USD 21.2 billion to USD 28.7 billion CAGR 3.9% frames a moderate but strategically critical growth path. Growth in Argentina retail banking will not come from branch rollouts but from deepening digital engagement, especially in consumer loans, wallet top-ups, and cross-sell services such as micro-insurance and investment advisory embedded in mobile platforms. The payments infrastructure, propelled by QR code payments and wallet rails, is becoming fertile ground for banks to capture transactional flows and anchor customer relationships.

Drivers & Restraints Shaping Argentina Retail Banking Market Trajectory

High Smartphone Penetration and Fintech Momentum as Catalysts for Retail Banking Growth

Argentina enjoys high digital adoption-87% of Argentines accessed the Internet by early 2023, according to public data sources-providing foundational infrastructure for mobile-first banking. In response, consumers increasingly favor digital wallets over traditional cash, elevating the relevance of wallet operators, remittance rails, and instant transfers. Institutional players are leaning into this trend by embedding micro-loans at checkout, launching digital credit lines via apps, and integrating small investment or savings modules within wallet ecosystems.

Moreover, fintech ventures like Ualá, which secured a fresh USD 300 million funding round in 2024, are expanding their reach into full banking verticals, threatening the incumbent guard. These fintechs offer lean user experience, frictionless onboarding, and alternative scoring models-forcing legacy retailers to respond or cede ground. Concurrently, under new regulatory interaction, the Central Bank of Argentina mandated that wallet providers permit linking of external bank accounts to improve interoperability. These shifts accelerate adoption of embedded finance and unlock revenue pools across lending, payments, and insurance services.

Inflation, Currency Instability & Regulatory Complexity as Growth Constraints

Chronic inflation, peso devaluation, and repeated currency controls have destabilized retail banking dynamics. In an environment where depositors distrust local currency, many hold savings in U.S. dollars or offshore, weakening the deposit base and complicating funding models. Recently, dollar deposits in Argentinian banks spiked by approximately USD 8 billion under President Javier Milei’s incentives, illustrating the fragility and sensitivity of trust. Regulatory policy shifts aimed at encouraging dollar repatriation may have side effects on capital flows and compliance risk.

On the regulatory front, Argentina lacks a unified open banking law, and fintech regulation remains fragmented. Financial institutions must navigate the mandates of the Central Bank of Argentina, the Comisión Nacional de Valores (CNV), and anti-money laundering authorities. Restrictions that prevent financial institutions from facilitating unregistered digital asset transactions further complicate product innovation. Fraud, cybersecurity, and data privacy risks escalate as digital adoption deepens. The dual challenge: growth must be balanced with cautious compliance, brand protection, and macro hedging.

Trends & Opportunities Transforming Argentina Retail Banking Landscape

Trend Highlight: Digital Lending & Wallet Infrastructure Convergence

Brazil’s Pix may be better known, but Argentina payments rails are evolving rapidly-QR codes, instant transfers, and wallet-to-wallet rails are gaining ubiquity. Institutions are layering micro-credit, “buy-now-pay-later” (BNPL), and loyalty-finance features into these payments flows, converting every transaction into a potential banking touchpoint. In metropolitan zones such as Greater Buenos Aires, Córdoba, and Rosario, wallet uptake is already significant, and banks are converting transactional dominance into cross-sell pipelines.

Also rising: digital-only neobanks and challenger brands. These players compete purely on UX, low fees, and speed. They often adopt modular architectures so that users can plug in insurance, micro-investment, or credit modules. In this trend environment, legacy banks are under pressure to transform into platform providers rather than monolithic institutions.

Opportunity Focus: AI Credit Scoring & Mobile Banking Expansion into Underbanked Zones

One of Argentina most promising frontiers is deploying AI-powered credit engines that leverage alternative data-such as telecom usage, bill payments, geolocation patterns, or social media signals-to underwrite formerly thin-file borrowers. These models can support micro-loans, POS financing, and revolving credit for segments previously excluded under standard scoring systems.

Simultaneously, banks can expand mobile banking into underbanked provinces by deploying mobile branches and shared agents. The Central Bank recently authorized “automated dependence” branches: small units with ATM, digital access capabilities, and limited staff, to expand reach beyond urban centers. These hybrid physical-digital touchpoints can anchor trust and serve as onboarding hubs for digital products. Regional tailoring-such as agrarian microfinance or localized micro-insurance in rural zones-provides anchoring opportunities for retail banking in Argentina heterogenous geography.

Competitive Landscape That Demands Strategic Acumen in Argentina Retail Banking Arena

Argentina retail banking sector is a blend of entrenched incumbents and agile challengers. Leading players such as Banco Santander Argentina, Banco Patagonia, and ICBC Argentina are investing in digital transformation, while fintechs like Ualá push aggressively into banking offerings. Ualá’s expansion and funding underscore the threat to incumbents that fail to modernize. Meanwhile, traditional banks are forming partnerships or acquiring fintech assets to accelerate digital capabilities.

A key strategic move is the adoption of AI credit scoring platforms to reduce approval friction and mitigate default risk. Banks are also redesigning mobile apps to integrate full-stack services-payments, loans, insurance, advisory modules-into single interfaces. Some are leveraging open APIs and third-party embedding to host fintech modules within the app ecosystem. In mid-2025, Revolut announced its plan to acquire Cetelem Argentina (held by BNP Paribas), signaling global entrants' appetite for Argentina digital banking potential. These developments intensify competition but also validate the market’s strategic direction.