ASEAN Retail Banking Market Outlook: Mobile-First Financial Inclusion Reshaping the Regional Banking Landscape

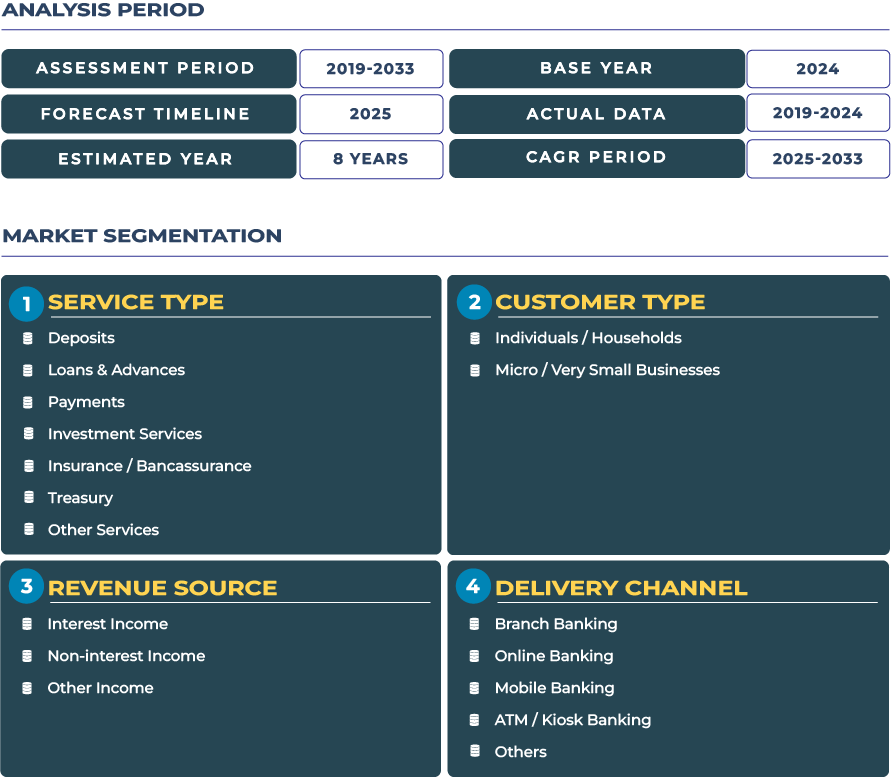

The ASEAN Retail Banking Market is entering a transformative phase, driven by the region’s commitment to achieving deeper financial inclusion through digital innovation. Across Southeast Asia, mobile-first solutions are enabling millions of previously underserved populations to access financial services, bridging the gap between urban and rural economies. In 2025, the ASEAN retail banking market is valued at USD 119.6 billion, and it is projected to reach USD 195.1 billion by 2033, growing at a CAGR of 6.3% during 2025–2033. This expansion is supported by the rapid adoption of digital banking platforms, government initiatives to promote cashless ecosystems, and a growing base of tech-savvy consumers. The integration of ASEAN regional digital economy framework is further propelling interoperability and enhancing the retail banking ecosystem across Indonesia, Malaysia, Thailand, Vietnam, Singapore, and the Philippines.

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

The region’s shift toward mobile banking and digital payment infrastructure has become central to economic resilience. Fintech startups, alongside established institutions like DBS Bank, are creating inclusive models that address micro-lending, SME financing, and cross-border remittances. These developments underline ASEAN growing reputation as an emerging hub for fintech-driven banking modernization.

Drivers & Restraints: Expanding Middle Class, Smartphone Penetration, and Regulatory Fragmentation

The ASEAN retail banking industry’s growth is largely driven by a rapidly expanding middle class and increasing smartphone penetration. The region hosts over 400 million internet users, and mobile adoption exceeds 90% in several ASEAN economies. This widespread connectivity is fueling demand for personalized banking apps, mobile wallets, and instant lending solutions. Governments across the region are implementing digital payment initiatives such as Indonesia’s QRIS and Thailand’s PromptPay to accelerate the shift toward a cashless society. Moreover, the proliferation of fintech hubs in Singapore, Malaysia, and Vietnam is fostering partnerships between banks and startups to enhance customer engagement through artificial intelligence and cloud banking technologies.

However, the market faces several restraints. Limited financial literacy in rural and remote regions continues to restrict the full potential of retail banking penetration. Additionally, a fragmented regulatory landscape across ASEAN member countries poses challenges for cross-border banking integration. Variations in data protection laws, capital requirements, and fintech licensing frameworks often delay digital rollout strategies. While regional cooperation through ASEAN financial integration initiatives aims to address these inconsistencies, achieving uniform standards remains a long-term challenge. Strengthening consumer education and harmonizing regulations will be essential for sustaining market momentum.

Trends & Opportunities: Rise of Neobanks, Digital Wallets, and Cross-Border Payment Innovations

The ASEAN retail banking landscape is witnessing an accelerated transition toward digital-first banking models. Neobanks and digital wallet providers such as GrabPay, GCash, and Maya are disrupting traditional banking systems by offering low-cost, high-access financial services. These platforms are leveraging data analytics and machine learning to design tailored savings and lending solutions, especially for the unbanked and underbanked populations. The growing integration of e-commerce and mobile payment ecosystems is also reinforcing customer loyalty and transaction frequency across markets.

Significant opportunities lie in cross-border payment integration and SME-focused digital lending. ASEAN ongoing push for interoperable QR payment systems is opening new avenues for regional financial connectivity, benefiting consumers and businesses alike. Moreover, the demand for SME lending platforms has surged as small and medium enterprises seek alternative credit solutions. Digital lending models supported by blockchain and open banking APIs are increasingly addressing financing gaps for small businesses, thereby boosting productivity and trade participation within the region. These innovations are positioning ASEAN as a leader in retail banking digital transformation globally.

Regional Analysis by Country: Diversified Growth and Market Maturity

- Indonesia: Leads the ASEAN retail banking market in terms of volume, driven by a large unbanked population and government-backed digital inclusion programs.

- Philippines: Witnessing rapid adoption of mobile wallets and fintech-led payment ecosystems.

- Vietnam: Witnessing rapid adoption of mobile wallets and fintech-led payment ecosystems.

- Thailand: Continues to innovate through open banking initiatives.

- Malaysia: Strengthens fintech regulations to ensure customer protection.

- Singapore: Remains the most advanced market, serving as a regional innovation hub for digital banking models and cross-border payment systems.

- Collectively, these markets represent diverse growth stages but share a unified vision of fostering digital accessibility and inclusivity in banking services.

Competitive Landscape: Strategic Partnerships and Financial Literacy Initiatives Shaping Market Dynamics

The ASEAN retail banking market is marked by dynamic competition among regional and international players. Traditional institutions such as DBS Bank, UOB, and Maybank are expanding digital capabilities through collaborations with fintech startups. In 2024, several banks launched financial literacy campaigns targeting rural populations to enhance trust in digital channels. For instance, banks in the Philippines rolled out “Banking on the Go” programs, offering simplified digital onboarding and micro-loans to local entrepreneurs. Meanwhile, Vietnamese and Malaysian banks are investing in SME lending and mobile-first platforms to capture emerging market opportunities. The focus on digital ecosystem partnerships, cybersecurity strengthening, and ESG-aligned financing is expected to define competitive positioning across ASEAN markets through 2033.