Asia Pacific Banking Market Outlook: Digital-First Transformation with a Green Finance Edge

In 2024, the Asia Pacific banking industry emerged as one of the most dynamic globally, fueled by a growing middle class, rapid adoption of mobile-first solutions, and sustainability-driven investments. Banks across Asia Pacific are restructuring their operating models to meet customer expectations for instant, personalized, and environmentally conscious financial services. The convergence of retail banking digitization, corporate sustainability mandates, and cross-border fintech collaborations is creating a landscape that is more agile, resilient, and inclusive.

Note:* The banking market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

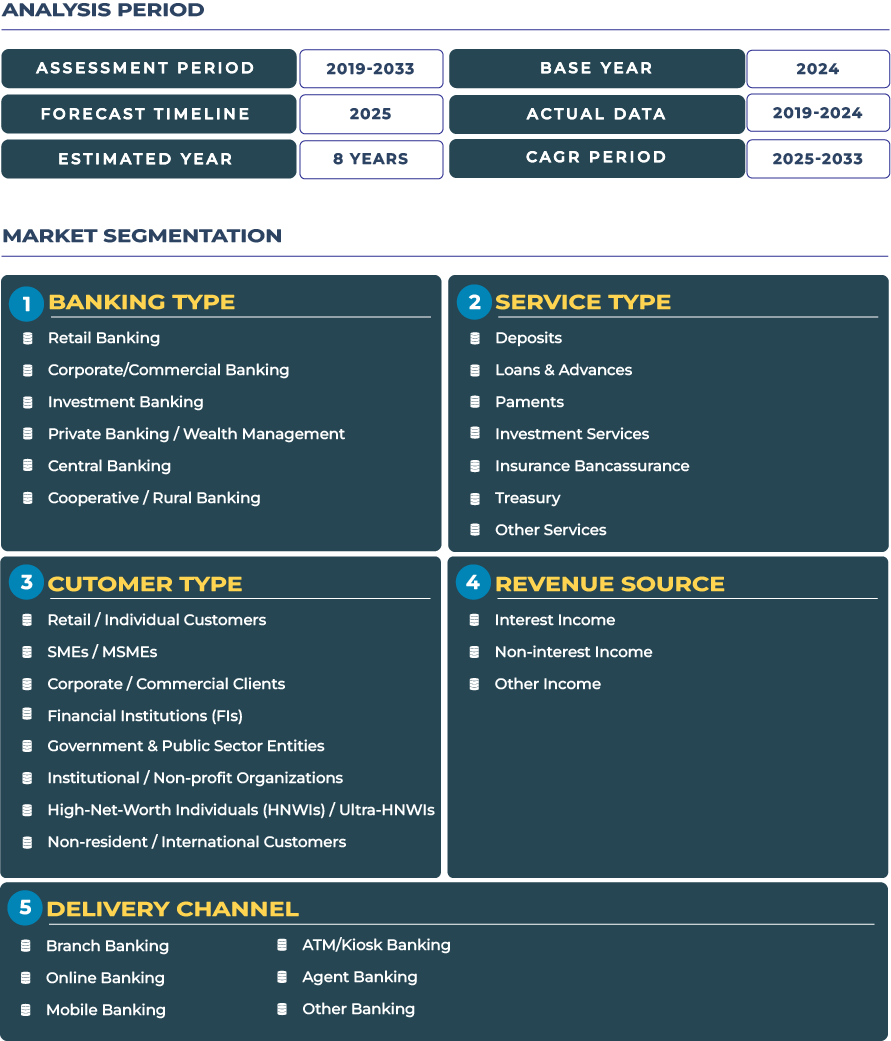

The Asia Pacific banking market is projected to grow from USD 2,356.7 billion in 2025 to USD 3,447.6 billion by 2033, advancing at a CAGR of 4.9% during 2025–2033. Growth is supported by three critical dynamics: the rising influence of digital-native Gen Z customers, regulatory encouragement for sustainable finance, and the region’s role as a hub for fintech innovations. From China’s state-led green finance programs to Singapore’s fintech accelerators and India’s UPI-led payment infrastructure, regional heterogeneity is shaping unique growth pathways. The banking ecosystem is navigating geopolitical uncertainties, inflationary pressures, and compliance complexities while staying focused on digital-first strategies and sustainable lending practices.

Drivers and Restraints: Balancing Gen Z Expectations and Sustainability with Structural Headwinds

Gen Z digital-native demand shaping the banking experience – A central driver of Asia Pacific’s banking growth is the digital-first mindset of Gen Z customers. This demographic prioritizes mobile payments, personalized wealth management tools, and frictionless lending products. Banks in India and South Korea are embedding AI-enabled chatbots, gamified savings apps, and robo-advisors to capture this segment. In countries like Indonesia, digital wallets integrated with microcredit offerings are becoming a lifeline for underserved populations, further enhancing financial inclusion.

Green finance and sustainable lending innovation creating new value streams – Another major driver is the rise of sustainable finance. Banks in China and Japan are channeling resources into green bonds, climate-linked lending, and carbon-neutral investment portfolios. This aligns with regional government priorities such as Japan’s “Green Transformation” strategy and Australia’s climate resilience initiatives. For banks, the ability to link profitability with climate responsibility is emerging as a competitive differentiator.

Compliance costs and political instability restraining growth – On the other hand, compliance pressures are weighing on profitability. The cost of regulatory reporting, cybersecurity mandates, and ESG disclosures is rising sharply across countries like Singapore and Hong Kong. Political instability in certain markets, including Myanmar and to some extent the broader South China Sea tensions, also affects cross-border banking flows. These restraints make it challenging for banks to allocate resources efficiently while maintaining competitiveness in a rapidly digitizing environment.

Trends and Opportunities: Insurtech Partnerships and Green-Linked Financial Products Gaining Momentum

Insurtech partnerships expanding banking ecosystems – Banks across Asia Pacific are increasingly partnering with insurtech firms to diversify their service offerings. In markets like Malaysia and Thailand, bancassurance is becoming an integrated model where customers can access insurance alongside traditional banking products within the same digital platform. This trend addresses customer convenience while opening new revenue streams for banks.

Sustainability reporting integrated into core banking frameworks – Sustainability reporting has moved from being a compliance task to a central operational pillar. Leading banks in Australia and Singapore are embedding ESG metrics into their credit assessment and investment strategies. This trend reflects the growing importance of aligning banking services with sustainable development goals, particularly in light of increasing scrutiny from regulators and investors.

Carbon-footprint tracking products as new opportunities – A key opportunity lies in offering carbon-footprint tracking for retail customers and SMEs. Banks in South Korea and Singapore are experimenting with green debit cards and SME sustainability dashboards that calculate emissions linked to financial activity. These services not only meet regulatory demands but also resonate with environmentally conscious consumers.

Bancassurance targeting the emerging middle class – Another opportunity is the rapid expansion of bancassurance, particularly in India, Vietnam, and the Philippines, where insurance penetration remains low. Offering integrated banking and insurance services through mobile platforms enables banks to tap into the growing middle class that seeks affordable protection and savings products.

Regulatory Environment: Building Trust and Enabling Innovation Across Borders

Asia Pacific’s regulatory landscape is both diverse and transformative. Authorities such as the Monetary Authority of Singapore (MAS) and the Reserve Bank of Australia are leading with frameworks that balance innovation with financial stability. MAS, for instance, has launched green finance taxonomies to guide sustainable investments, while the Reserve Bank of India is enhancing digital lending rules to safeguard consumers. Meanwhile, China’s central bank has expanded its oversight of fintechs, emphasizing risk management amid rapid growth. These regulatory initiatives foster cross-border collaboration, enhance consumer trust, and support Asia Pacific’s emergence as a global leader in digital and sustainable finance.

Key Impacting Factors: How Macroeconomic and Digital Shifts Reshape Asia Pacific Banking

Several external forces are redefining Asia Pacific’s banking performance. Interest rate adjustments in 2024, particularly by the Reserve Bank of Australia and the Bank of Japan, have impacted lending margins and investment appetite. Inflationary pressures across India and Indonesia have increased demand for safe investment products while dampening discretionary spending. At the same time, the region’s accelerated digital transformation—evidenced by more than 85% mobile banking penetration in markets like South Korea and Singapore—continues to raise customer expectations. Collectively, these factors highlight the balancing act between macroeconomic stability and the push for digital-first customer engagement.

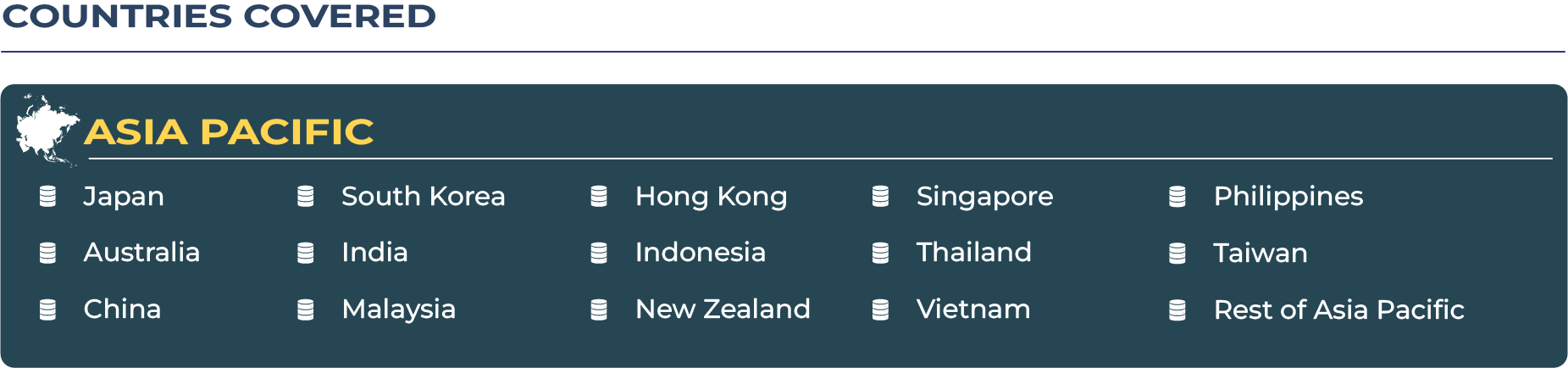

Regional Analysis: Diverse Growth Narratives Across Asia Pacific Economies

- India: Digital payments infrastructure like UPI is reshaping retail banking, with banks aligning microcredit and wealth management to serve SMEs and the middle class.

- China: State-led green finance initiatives and AI-powered credit systems are redefining banking efficiency while central bank oversight ensures risk mitigation.

- Japan: Focus on aging population needs and sustainable investment products is driving wealth management and green bond adoption.

- South Korea: Advanced digital maturity enables AI-driven banking experiences, with fintech collaborations enhancing SME access to credit.

- Australia: Strong regulatory focus on ESG integration is reshaping corporate banking, while retail customers adopt mobile-first solutions.

- New Zealand: Cooperative banking models remain central, with sustainability-linked loans gaining traction in agriculture-focused regions.

- Malaysia: Fintech accelerators and bancassurance growth are expanding the digital banking ecosystem, especially among SMEs.

- Hong Kong: Virtual banks are reshaping the competitive landscape, supported by government-backed fintech licensing frameworks.

- Indonesia: Digital wallets and microfinance solutions are expanding financial inclusion, particularly in rural areas.

- Singapore: A global fintech hub where MAS-led initiatives drive sustainable finance and cross-border banking integration.

- Thailand: Banks are embedding insurtech collaborations and cross-border remittance services for migrant workers.

- Vietnam: Retail banking is expanding rapidly, with mobile-first services becoming the primary channel for consumer engagement.

- Philippines: Overseas remittances remain a growth driver, with banks leveraging digital platforms to streamline inflows.

- Taiwan: Wealth management and SME lending dominate the banking landscape, supported by strong technology infrastructure.

Competitive Landscape: Leading Banks Adopting Digital-First and Sustainable Models

Major banks in the region are accelerating digital-first transformation strategies. DBS Bank in Singapore has expanded its AI-powered advisory services, launching new sustainable investment products in 2024 to meet ESG-conscious customer demand. In Japan, MUFG Bank is focusing on green bonds and climate-linked lending, while in India, State Bank of India has increased partnerships with fintech startups to enhance its mobile banking suite. In 2025, DBS announced a regional partnership with insurtech firms to provide integrated bancassurance offerings, reinforcing its leadership in Asia Pacific’s digital-first ecosystem.

These developments highlight how competition is shifting from scale to customer experience. Banks are competing on personalization, digital agility, and sustainability credentials rather than only asset size. Digital-first models reduce operational costs, while green finance products create new growth engines. Together, these strategies underline how Asia Pacific banks are redefining the global standards of customer-centric and sustainable banking.

Conclusion: Asia Pacific Banking Market Entering a New Era of Digital and Sustainable Convergence

The Asia Pacific banking market is undergoing a structural shift, where digital-first transformation and green finance converge to create a resilient, customer-centric ecosystem. Gen Z demand is pushing banks to innovate with mobile-first and personalized financial products, while regulatory mandates are aligning institutions with sustainable growth objectives. The region’s unique blend of advanced markets like Singapore and Japan and rapidly digitizing economies like India, Vietnam, and Indonesia ensures diversity in growth pathways.

The future of banking in Asia Pacific will not be defined solely by financial performance but by the ability of banks to balance profitability with societal impact. Digital-first models will remain essential to enhance efficiency and customer satisfaction, while green finance will ensure resilience against global environmental challenges. Collectively, these dynamics position Asia Pacific as a leader in shaping the future of global banking.