Bahrain Fintech Market Outlook: Sandbox-Driven Islamic Fintech Leadership

Bahrain has emerged as a sandbox-led fintech hub where Shariah-compliant financial innovation is nurtured within a highly regulated ecosystem. The country’s pioneering fintech sandbox, introduced by the Central Bank of Bahrain, has positioned it as a testbed for fintech solutions that balance innovation with compliance. Coupled with Bahrain longstanding role as a regional leader in Islamic finance, the country is now scaling digital platforms that combine regulatory clarity with Shariah-compliant design. This dual advantage is setting the stage for fintech growth across payments, digital banking, lending platforms, and wealth management solutions tailored for both local and regional markets.

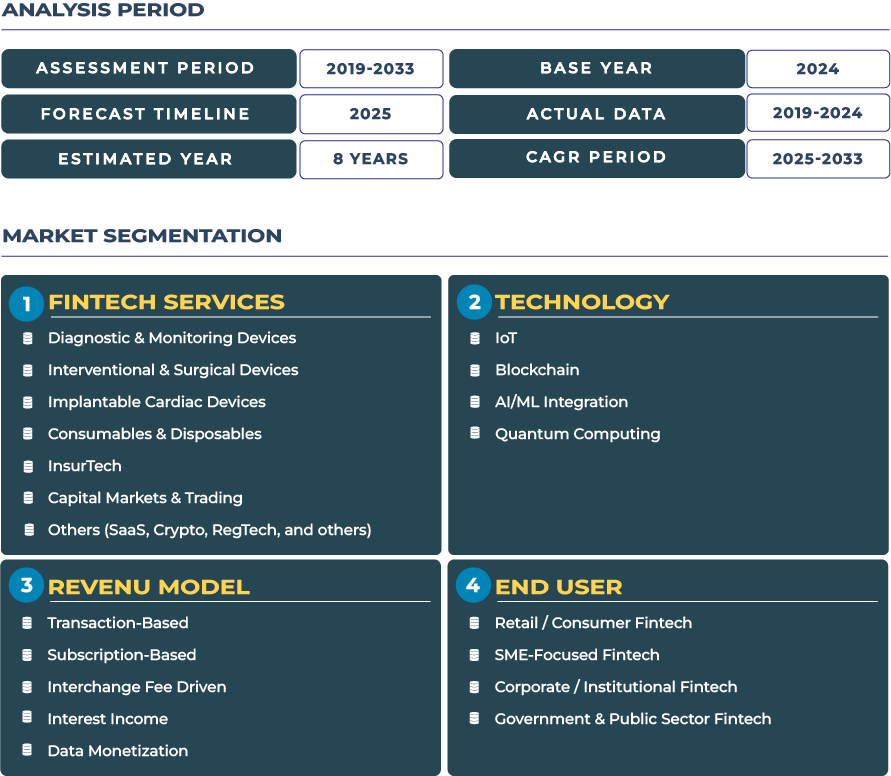

The Bahrain Fintech Market is projected to expand from USD 1.4 billion in 2025 to USD 5.0 billion by 2033, reflecting a CAGR of 17.2% between 2025 and 2033. This growth trajectory reflects a unique blend of policy-driven support, Islamic finance alignment, and increasing regional connectivity. Bahrain fintech ecosystem is also benefiting from the government’s diversification strategies, enabling startups and established institutions to innovate in areas like open banking, RegTech, and digital payments for SMEs and retail consumers. The result is a fintech industry that is both ambitious in scope and differentiated in its compliance-first approach.

Policy-Backed Ecosystem and Islamic Finance Heritage Driving Market Expansion

Bahrain fintech growth is underpinned by its strong Islamic banking tradition and forward-looking policy frameworks. The Bahrain Economic Development Board has prioritized financial technology as a diversification pillar, while the Central Bank’s licensing pathways offer clarity for startups and investors. The synergy between traditional Islamic banking expertise and modern fintech experimentation has created unique opportunities for Shariah-compliant crowdfunding, micro-lending, and wealthtech platforms that cater to both domestic and regional customers.

Digital infrastructure development further amplifies growth. With near-universal mobile penetration and robust digital payment rails, Bahraini consumers and SMEs are rapidly shifting to digital-first solutions. Demand for mobile wallets, instant payments, and cross-border remittances is rising, especially among the younger population. This consumer preference, combined with Bahrain commitment to an innovation-friendly environment, continues to position fintech as a vital component of national economic transformation.

Market Size Constraints and Regional Competition Pose Structural Restraints

Despite favorable regulation and infrastructure, Bahrain relatively small domestic market poses challenges to scaling fintech ventures. Most firms require regional expansion into the broader GCC to achieve meaningful profitability. This need to scale beyond borders adds cost and operational complexity, particularly when competing with larger fintech hubs like the UAE and Saudi Arabia.

Another critical restraint is talent competition. Skilled fintech professionals are in high demand across the GCC, and Bahrain faces challenges retaining top talent due to competitive opportunities in Dubai and Riyadh. Additionally, access to venture capital is limited compared to larger neighbors, creating dependency on regional funding networks. Without consistent capital inflows and workforce retention, Bahrain fintech ecosystem could risk slower scaling despite its strong regulatory foundations.

Open Banking Initiatives and Islamic Fintech Pilots Defining Emerging Trends

One of the most transformative trends in Bahrain is the advancement of open banking initiatives. Bahrain was among the first GCC states to implement mandatory open banking regulations, creating opportunities for fintechs to build API-driven platforms that connect banks, consumers, and third-party service providers. This has enabled innovations in personal finance management, digital investments, and payments aggregation.

Parallel to open banking, Islamic fintech experimentation is reshaping product design. Platforms focusing on Shariah-compliant investment, takaful (insurance), and micro-finance are gaining traction, offering alternatives for a significant consumer base seeking faith-aligned digital services. This dual track of innovation—open banking and Islamic fintech—strengthens Bahrain competitive positioning in the GCC fintech landscape.

Expanding Opportunities in GCC Banking Services and Compliance-Driven RegTech

Key opportunities for Bahrain fintech sector lie in servicing regional banks and financial institutions. By leveraging its sandbox and regulatory know-how, Bahrain can become a hub for banking-as-a-service (BaaS) platforms that regional banks use to host fintechs and expand product offerings. This model has the potential to monetize Bahrain expertise in regulatory frameworks while enhancing scalability for fintech startups.

RegTech also represents a high-growth opportunity, particularly for AML and compliance solutions. With GCC states tightening oversight on digital transactions, Bahraini firms are well-positioned to develop technologies that streamline compliance across borders. RegTech platforms addressing KYC, anti-money laundering, and transaction monitoring are gaining interest from regional and international stakeholders, creating sustainable pathways for Bahrain to strengthen its fintech footprint.

Fintech Regulations and Sandbox Framework Shaping Long-Term Market Stability

Bahrain regulatory framework remains one of the most advanced in the GCC for fintech. The Central Bank of Bahrain has introduced a comprehensive sandbox that allows startups and global firms to test services ranging from digital payments to blockchain and crypto assets in a supervised environment. This reduces regulatory risk while fostering innovation. At the same time, the Kingdom has implemented data protection, AML, and consumer protection rules aligned with global best practices, ensuring that fintech adoption balances innovation with stability.

Such regulatory clarity has been instrumental in attracting global fintechs to pilot solutions in Bahrain before scaling across the GCC, reinforcing the country’s role as a launchpad for compliant financial innovation.

Sandbox Participation and Islamic-Focused Pilots Driving Performance

Key economic factors influencing Bahrain fintech market include the volume of sandbox participation and the number of Islamic fintech pilots under development. By 2024, dozens of firms had already engaged in the sandbox, testing solutions in payments, lending, and RegTech. The expanding pipeline of Islamic fintech initiatives reflects strong domestic demand for Shariah-compliant offerings and provides Bahrain with a comparative edge in the regional fintech ecosystem.

Additionally, Bahrain stable political environment and its position as a financial services hub in the Gulf enhance investor confidence, especially during a period marked by geopolitical tensions and global economic uncertainty. The combination of sandbox-led innovation and Islamic finance pilots ensures that Bahrain fintech performance remains resilient even amid external shocks.

Sandbox-Backed Expansion and Cross-Border Partnerships Defining Competitive Landscape

The competitive landscape in Bahrain is increasingly characterized by sandbox-backed experimentation and partnerships with regional players. In 2024, the Central Bank of Bahrain FinTech and Innovation Unit expanded sandbox resources to cover virtual assets and RegTech, underscoring its role in enabling compliance-driven innovation. Local companies have responded by piloting RegTech solutions and launching Shariah-compliant lending platforms, while international players leverage Bahrain as a regulatory base for entering GCC markets.

Prominent institutions such as Bahrain FinTech Bay have become central to this ecosystem, hosting accelerators, venture programs, and partnerships that bring global startups into the Bahraini fintech landscape. The collaborative environment fosters knowledge exchange and scalability, with product launches such as micro-lending apps, digital insurance platforms, and blockchain-based payment solutions emerging from this competitive yet cooperative market environment.

Conclusion: Bahrain Sandbox-Led Fintech Ecosystem Anchoring Regional Leadership

Bahrain fintech industry is uniquely positioned as a sandbox-led, compliance-first ecosystem that integrates Islamic finance with modern digital innovation. By aligning regulatory clarity with innovation pathways, Bahrain has differentiated itself from larger GCC competitors. The growing adoption of open banking, Islamic fintech, and RegTech highlights the sector’s ability to address both local and regional needs. While challenges such as limited domestic scale and talent competition remain, Bahrain sandbox-driven strategy ensures that it retains a central role in shaping fintech for the Gulf region.

As the sector continues to evolve, Bahrain fintech ecosystem will stand as both a launchpad for compliant innovation and a leader in Shariah-aligned financial technology. Its commitment to regulatory balance, cross-border partnerships, and diversification ensures sustainable growth, making the country an essential fintech hub in the GCC rapidly transforming financial landscape.