Brazil Retail Banking Market Outlook: Renaissance Through Mobile-First Inclusion

Brazil retail banking landscape is undergoing a transformational shift - one driven not by legacy branch expansion, but by mobile-first financial inclusion. In a country where smartphone penetration exceeded 80% and digital connectivity is ubiquitous, financial institutions are increasingly leveraging AI onboarding, digital wallets, and algorithmic credit scoring to bring banking services to regions historically underserved. This digital pivot is not merely convenience - it is a structural redefinition of retail banking in Brazil.

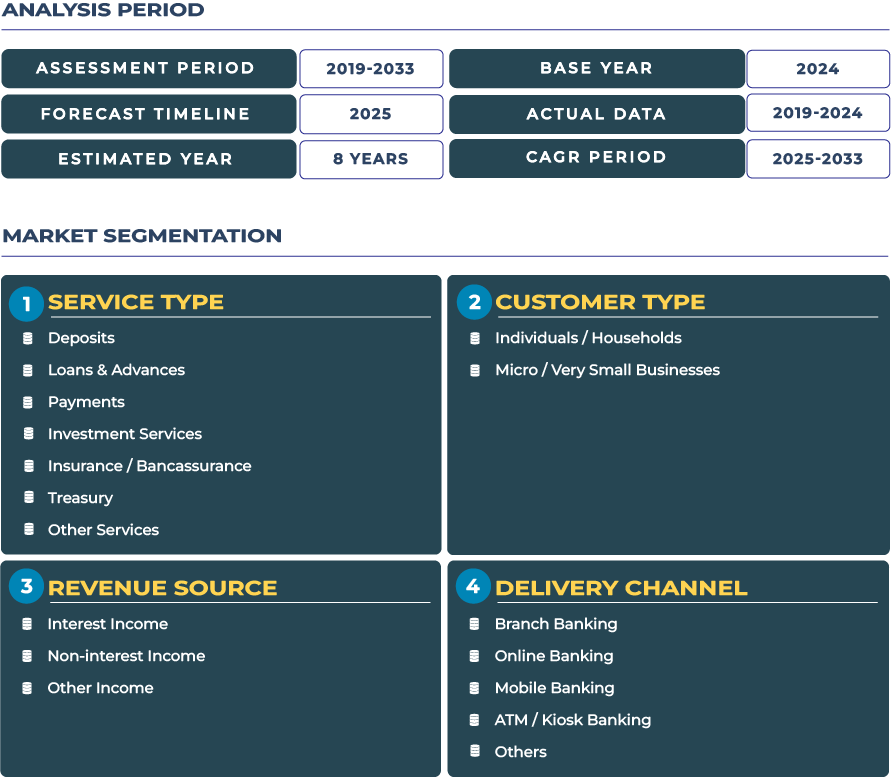

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

Against this backdrop, the Brazil retail banking market is projected to grow from USD 100.4 billion in 2025 to USD 140.5 billion by 2033, reflecting a CAGR of 4.3% over the forecast period. Anchored in mobile-enabled deposits, instant payments, and digital lending platforms, this growth narrative underscores how inclusive, technology-driven banking is reshaping access, profitability, and competitive positioning.

Drivers & Restraints That Define Brazil Retail Banking Trajectory

High Unbanked Base and Smartphone Penetration: The Growth Levers in Brazil Retail Banking Market

Brazil still hosts a sizable underbanked and unbanked population, especially in its interior and rural regions. That demographic offers opportunity for deposit onboarding, micro-savings, and small loans via mobile-first channels. The near-ubiquity of smartphones, even in low-income households, enables digital wallet adoption across demographics. Moreover, as fintech penetration intensifies, consumers are more willing to migrate from cash-based financial habits toward integrated retail banking apps. In 2024, Brazil instant payments system Pix processed over 15.4 billion quarterly transactions, illustrating how a digital rails infrastructure accelerates inclusion and volume growth.

Financial institutions that build robust AI credit models, lean onboarding flows, and localized product design (e.g. microloans, rural-agriculture advances) are unlocking new segments. Partnerships with telecommunications companies to enable zero-rating of banking apps further accelerate uptake in remote regions. Deposits and digital payments become entry points to upsell loans, investments, insurance, and treasury products - creating a “digital funnel” within retail banking.

Economic Volatility, Regulatory Uncertainty & Cyber Risks: The Checkpoints on Expansion

Brazil macroeconomic environment remains challenging. Fluctuating inflation, currency depreciation, and rate volatility can tighten bank spreads and increase default risk. Brazil high interest rate environment, coupled with elevated credit cost, makes consumer credit risk a critical concern. Structural spreads in Brazilian banking are influenced by industrial indices, default rates, and monetary policy (Selic), further emphasizing exposure to macro swings.

Regulatory uncertainty adds complexity. Changes to open banking, consumer data protection (LGPD), and evolving central bank rules on digital onboarding or credit provisioning can force strategic pivots. Banks must maintain agility and regulatory foresight. Furthermore, cybersecurity and fraud risk scale as digital channels deepen; sophisticated attacks, identity theft, and API exploits require ongoing investment in security, data governance, and resilience. A data breach or fraud wave could erode consumer trust rapidly and undermine digital adoption.

Hence, while the Brazilian retail banking market shows durable growth potential, its pace is constrained by macro and cyber headwinds, demanding rigorous risk management and disciplined capital allocation.

Trends & Opportunities That Set Brazil Retail Banking Apart

Trend Spotlight: Digital Wallets, Super-Apps & Embedded Banking Emergence

Digital wallets and embedded finance are no longer fringe in Brazil - they are central to the retail banking playbook. Banks and fintechs alike are layering payments, credit, investment, and insurance into unified finance super-apps. The success of Pix has emboldened banks to expand into real-time mobile peer-to-peer (P2P), recurring payments, and installment (parcelado) offerings. This trend is particularly pronounced in metropolitan areas like São Paulo, Rio de Janeiro, and Brasília, where consumer expectations are shaped by high fintech penetration.

Moreover, “banking-as-a-service” APIs are enabling non-banking platforms (retailers, utilities, telecoms) to embed banking services. These embedded banking models allow consumer touchpoints - such as e-commerce checkout or telecom billing - to function as banking gateways. In cities like Belo Horizonte and Porto Alegre, partnerships between regional banks and large retail chains are unfolding super-apps that combine local commerce, loyalty programs, and banking services. This convergence intensifies competition but also unlocks access into consumer micro-moments.

Opportunity Focus: Microfinance Platforms & AI-Built Credit Engines

One of the most fertile growth streams lies in underwriting microloans and credit for underserved segments using AI-powered credit scoring. Conventional credit scoring remains rigid, excluding informal or thin-file consumers. But machine-learning models leveraging alternative data (mobile usage, utility payments, social behavior proxies) can expand credit extents to new clientele while controlling risk. Retail banks that pioneer such underwriting engines can capture growth in personal lending, microcredit, and POS finance.

Simultaneously, mobile-first microfinance platforms aligned with local consumption patterns can embed short-term credit, buy-now-pay-later (BNPL), and incremental savings modules. Brazil fintech market projected to grow significantly through 2033 amplifies these opportunities.

In rural and peri-urban zones, microfinance integrated into agricultural cycles (crop loans, equipment finance, micro-insurance) offers cross-sell potential. Banks capable of customizing microfinance to regional agrarian dynamics stand to shape new revenue streams in Brazil retail banking ecosystem.

Competitive Landscape: Strategic Moves in Brazil Retail Banking Arena

Brazil retail banking market is fiercely competitive, blending legacy incumbents with nimble fintech challengers. Major players such as Itaú Unibanco, Banco do Brasil, Bradesco, Santander Brasil,Caixa Econômica Federal, and the neobank Nubank are all jockeying for digital leadership. Nubank has disrupted through zero-fee accounts, credit cards, and consumer apps. In 2024, Nubank announced ambitions beyond banking, venturing into a mobile telecom service, NuCel, to bundle banking, connectivity, and payment services.

Strategically, incumbents are forming fintech partnerships or launching internal innovation units to match agility. They are deploying AI-based underwriting platforms to accelerate loan approvals and reduce defaults. Banks are rationalizing physical branches, pivoting to fee-based services and cross-sell models within digital channels. Also, many firms are embedding open banking APIs so third-party providers can layer niche services over core banking rails.