Trust-Centered Open Finance Progression and Regulated Digital Maturity Elevating Canada Fintech Neobanking Market

Canada fintech neobanking ecosystem is evolving under a highly structured financial regulatory environment that enables secure, transparent, and innovation-ready digital banking models. Stable monetary governance from the Bank of Canada, cohesive payment infrastructure modernization through Payments Canada, and universal Interac access create fertile ground for fintech platforms designing digital core-banking layers, identity orchestration modules, spend automation engines, and treasury-grade wallet infrastructure. This market is characterized by technology-driven trust, responsible innovation frameworks, and a multi-rail payment environment designed to balance innovation with financial stability and user protection. Embedded finance adoption continues across SME operations, cross-border commerce hubs, and gig-work platforms as developers prioritize secure account provisioning, remote KYC, real-time onboarding, and dynamic spend controls aligned with evolving digital conduct standards from the Department of Finance Canada.

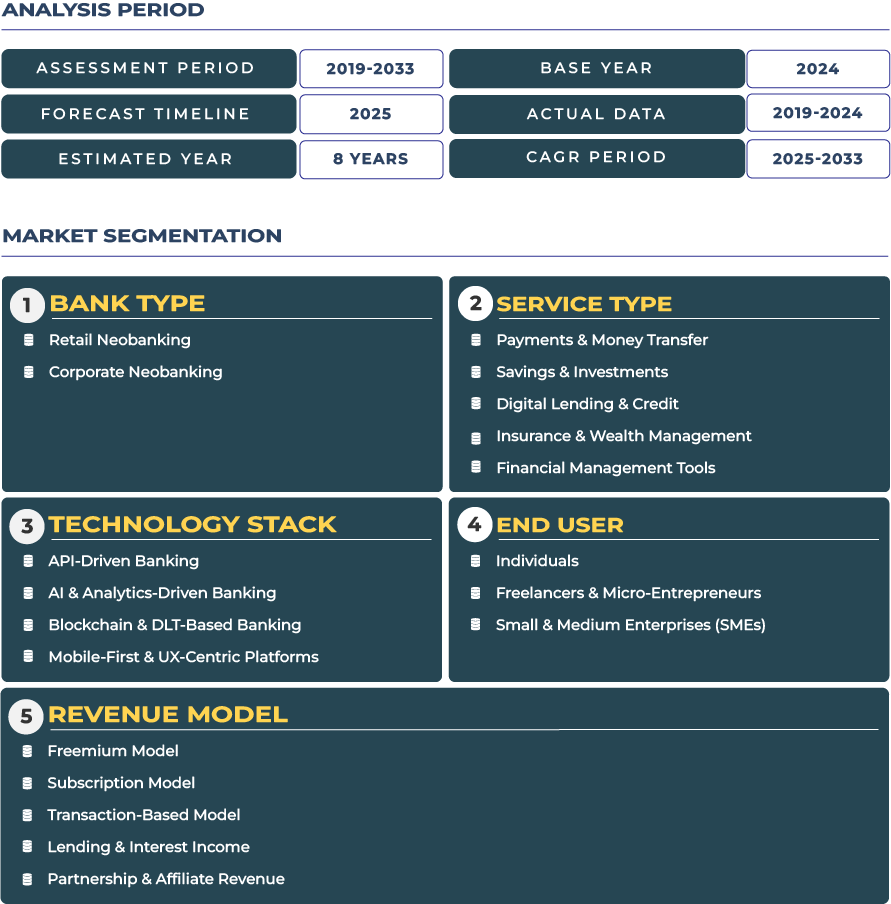

According to DataCube Research, the Canada fintech neobanking market is forecast to reach USD 7,424.9 billion by 2033, expanding at a CAGR of 21.8% from 2025-2033, driven by trust-anchored policy design, rising mobile financial behavior, and structured open-finance rollout expectations. Adoption accelerates across Toronto, Vancouver, Montreal, Calgary, and Ottawa as SaaS payment layers, consumer-finance digital rails, and SME expense and payroll tools integrate with API-powered digital cores. Canadian fintech vendors are uniquely positioned to scale responsibly by leveraging tokenized digital identity, continuous AML monitoring, and analytics-driven financial well-being engines that support consumers, SMEs, and platform-based digital business ecosystems. Leading infrastructure innovators such as Flinks continue strengthening secure data connectivity and consent-driven verification, supporting future interoperability in Canada open-banking and multi-rail payment environment.

Structural Trust, Unified Payments, and Data-Governed Innovation Anchoring Canada Fintech Neobanking Momentum

Interac Rails, Data Consent Standards, and Open-Finance Execution Accelerate Platform Adoption

Canada fintech neobanking market benefits from a robust regulatory commitment to safe innovation, widespread Interac adoption, and structured open-finance progression. Interac’s ubiquity empowers fintech platforms to support low-cost SME transfers, instant consumer disbursements, and secure account-to-account flows with fraud-resistant authentication. Payments Canada modernization efforts and oversight from the Bank of Canada create a stable clearing environment that improves predictability for platform developers embedding ledger controls, remote KYC, and spend orchestration rails. Regulatory clarity from the Department of Finance Canada on open-data rights, combined with Canada privacy-centric digital culture, strengthens adoption of consent-managed fintech identity layers, enabling platform providers to enhance underwriting, affordability scoring, and AML intelligence. Platform-first digital banking growth is also driven by payroll automation in growing workforce hubs such as Toronto, Montreal, and Vancouver, as gig-worker services and SaaS verticals seek compliant expense, payout, and invoice automation rails.

Regulatory Gatekeeping and Interchange Constraints Require Disciplined Growth Execution

At the same time, conservative banking authorization, strict capital rules, and low interchange income caps create revenue-model compression for fintech banking platforms, requiring greater focus on B2B embedded distribution, risk automation, and vertically integrated revenue alternatives. Heightened scrutiny of digital onboarding, real-time identity assurance, and AML controls increases operating discipline, encouraging investment in tokenized data vaults, dual-layer authentication, and audit-grade reporting. While high consumer trust boosts adoption, this trust also heightens expectations for flawless transaction security, accessibility, and dispute transparency. The resulting environment favors platforms with strong compliance technology, privacy-by-design frameworks, and automated risk governance systems.

Cross-Border Digital Commerce, ESG Ledgering, and GIC Sweep Innovation Create Future Opportunity Lanes

Remittance Digitization, ESG-Spend Analytics, and Multi-Currency Wallets Define Market Trajectory

Fintech neobanking vendors in Canada are scaling digital cross-border payment workflows tied to US-Canada commerce, student mobility, and immigrant remittance corridors. Multi-currency wallets, automated FX, and real-time account settlement allow SMEs and digital workers to manage flows across CAD-USD rails. ESG-spend analytics and sustainability-aligned transaction insights are emerging as premium features across workforce-finance platforms, supporting socially responsible treasury decisions. Toronto, Calgary, and Vancouver see rising deployment of carbon-tracking spend tools, climate micro-savings, and ethical merchant tagging layers within digital banking journeys as platforms pursue differentiated, purpose-driven propositions. Meanwhile, GIC sweep functions, automated investment buckets, and CRA-linked SME payroll rails expand opportunities for digital treasury providers.

Competitive Landscape: Consent-Driven Data Connectivity and Trust-Native Finance Architecture Lead Execution

Canada fintech competitive landscape includes spend platforms, API-banking cores, identity orchestration vendors, and payroll-integrated disbursement engines. Secure-data connectivity providers such as Flinks advance consent-driven APIs and affordability intelligence, while global API orchestration firms including Plaid expand secure user-permissioned connectivity in Canada. Embedded finance technology stacks integrate Interac-compatible rails, automated reconciliation, ESG portfolio analytics, and secure digital identity vaults aligned with federal data-use guardrails. Strategies include credit-union distribution partnerships to increase trust-anchored reach, sustainability-analytics layers for premium market segments, and automated dispute intelligence aligned with consumer-protection expectations. Combined, these execution priorities reinforce Canada position as a measured-innovation fintech environment where privacy, resilience, and financial integrity drive long-term scale.