GCC Connector Market Outlook

Composite and High-Speed Interconnects Powering GCC’s 5G and Aerospace Ambitions

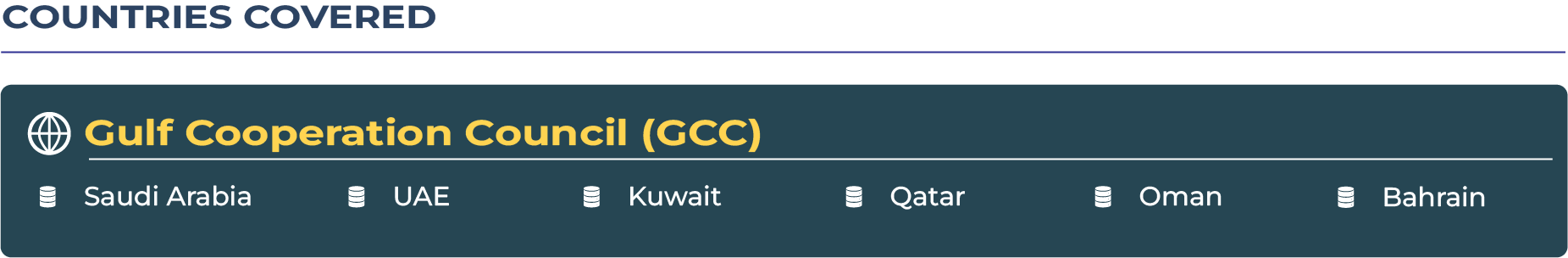

The Gulf Cooperation Council (GCC) countries are undergoing a sweeping transformation driven by investments in advanced connectivity, aerospace technologies, and data-driven ecosystems. In this high-tech pivot, the connector market has emerged as a strategic enabler. Lightweight, high-speed, and precision-engineered connectors are now foundational to GCC’s broader ambitions in 5G deployment, AI-centric data centers, and aerospace modernization. From Saudi Arabia’s Neom initiative to the UAE’s deepening investment in space technologies, the demand for composite-material and application-specific interconnects has surged.

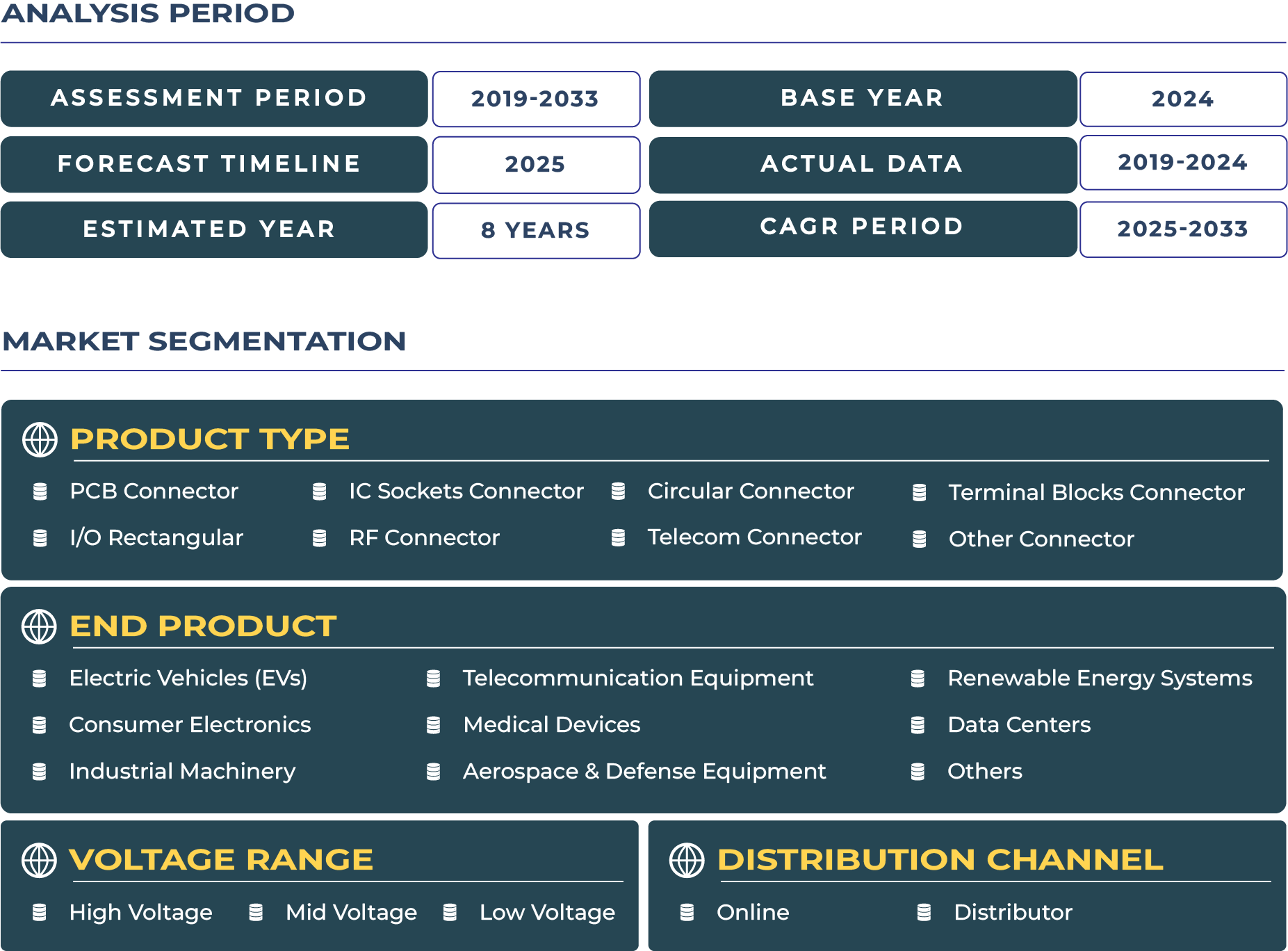

The GCC Connector Market is estimated to grow to USD 2.01 billion by 2033, expanding at a CAGR of 6.9% between 2025 and 2033. This robust growth is attributed to the rapid expansion of 5G infrastructure, increased adoption of unmanned aerial vehicles (UAVs), and the proliferation of AI-powered devices requiring ultra-fast data processing and reliable signal transmission. High-density RF connectors and modular I/O rectangular connectors are witnessing notable traction due to their relevance in telecommunications and cloud edge computing. Composite connector materials are becoming critical in reducing payload weight in aerospace and defense systems across GCC nations.

The market momentum is further reinforced by government-backed technology parks, national space programs, and a policy shift toward defense and space manufacturing localization. For instance, Saudi Arabia’s Vision 2030 explicitly outlines goals to localize 50% of defense spending, directly influencing demand for specialized RF and circular connectors in radar and avionics systems. Meanwhile, UAE’s Mohammed bin Rashid Space Centre increasingly favors composite RF connectors in its satellite programs due to thermal performance efficiency and miniaturization capabilities.

Digital Sovereignty and Smart Infrastructure Fueling Connector Market Acceleration

A central driver of growth in the GCC connector landscape is the region's strategic pivot toward digital sovereignty and smart infrastructure. Across Saudi Arabia, UAE, and Qatar, there is substantial momentum around AI, smart cities, autonomous mobility, and cloud-native architecture. Governments are pouring billions into smart infrastructure—including AI-ready telecom towers, connected industrial parks, and autonomous logistics corridors—that demand fail-proof connector ecosystems.

One illustrative example is Saudi Arabia’s Red Sea project and Neom, where data-intensive autonomous transportation, surveillance, and IoT-enabled buildings depend on robust, low-latency interconnects. PCB connectors and terminal blocks have found increased application across smart city utilities, from energy meters to waste management systems. Simultaneously, the surge in EVs and smart mobility in UAE’s transportation grid is expanding the use case for circular and power connectors with rugged environmental resistance.

These megaprojects often involve transnational technology partnerships, reinforcing the need for connector standardization and inter-compatibility. Telecom connectors are playing a crucial role in managing the data surge across public and private networks, especially with the deployment of 5G base stations and hyperscale data centers in the region. This is elevating demand for high-frequency connectors that can manage escalating bandwidth without compromising latency.

High Import Dependency, Technical Skill Gaps, and Cost Volatility as Key Market Hurdles

While the market trajectory is optimistic, several structural constraints continue to temper short-term growth. Chief among these is the GCC’s high import dependency for advanced connector components. Countries like Bahrain and Oman lack local manufacturing capacities for precision-engineered connectors, making them reliant on imports from Europe and East Asia. This heightens susceptibility to geopolitical disruptions and cost volatility.

The regional shortage of technically skilled professionals further hampers the scalability of connector-intensive projects. Installation, integration, and maintenance of specialized connectors—particularly RF and IC socket connectors used in mission-critical systems—require high-precision expertise that remains scarce. This has led to deployment delays in key sectors, especially aerospace and defense.

Moreover, fluctuating commodity prices—especially copper and rare earth elements essential for connector manufacturing—have affected profit margins and procurement planning. As the regional economy still reels from oil price sensitivity and ongoing realignments post-pandemic, some connector applications in non-essential consumer electronics have witnessed budget cuts.

Rise of Multi-Application Connectors Driven by Luxury Living, Entertainment, and AI Integration

Across GCC nations, the convergence of luxury lifestyle trends, AI integration, and immersive entertainment is creating new application horizons for the connector sector. From ultra-HD content streaming in Qatar’s stadiums to AI-automated smart homes in Dubai, there is increasing reliance on multi-application connectors. These are particularly visible in high-end consumer electronics and audiovisual equipment where I/O rectangular and circular connectors are critical to delivering seamless, high-speed transmission.

Similarly, connectors are being embedded in next-gen wearables and surveillance devices used during live concerts and high-profile events. Saudi Arabia’s commitment to becoming a global destination for sports and entertainment has unlocked a niche yet growing market for compact RF and IC socket connectors. These are used in live broadcasting kits, drones, and real-time analytics hardware to ensure uninterrupted high-resolution data flow.

Connector-Centric Opportunities in Media Cities and Arabic Digitization Initiatives

One of the most promising frontiers for connector industry expansion lies within GCC’s media cities and digital Arabic content ecosystems. Initiatives like Abu Dhabi’s twofour54 and Saudi Arabia’s MBC Media Zone are fast becoming hubs of content creation, which rely heavily on broadcast infrastructure, cloud-based rendering farms, and audiovisual production systems. All these systems require low-interference, high-performance connectors for data, signal, and power transmission.

The localization of Arabic-language OTT platforms is further expected to drive demand for connectors in content delivery networks and mobile edge computing infrastructure. Telecom connectors, particularly those optimized for 5G and fiber broadband systems, will be vital in sustaining high-quality Arabic content delivery across mobile platforms.

Regulatory Guardrails Supporting Localization and Technical Standardization

The GCC governments are proactively fostering a regulatory environment that supports localized manufacturing, technical upskilling, and cybersecurity in critical components—including connectors. Saudi Arabia’s Local Content and Government Procurement Authority (LCGPA) has initiated incentives for companies using domestically sourced electronic components. This has opened up opportunities for regional connector assembly and testing ventures.

In UAE, the Telecommunications and Digital Government Regulatory Authority (TDRA) has set new standards around 5G and edge computing hardware, directly influencing the technical benchmarks for I/O and RF connectors used in licensed communication infrastructure. These frameworks are aimed at enhancing cross-border interoperability and streamlining technical compliance.

Electrification, AI Receptiveness, and Industrial Diversification Reshaping Market Dynamics

The GCC’s commitment to electrification and digital industrialization is profoundly shaping the connector sector. For instance, as part of the Green Middle East initiative, large-scale solar parks in UAE and Saudi Arabia are incorporating terminal block connectors with high thermal resilience. Moreover, the electrification of transport fleets—from airport shuttles to city buses—is fueling demand for durable circular connectors with IP-rated enclosures.

Simultaneously, AI receptiveness is catalyzing the use of high-speed PCB connectors in machine learning servers and robotic systems. As GCC economies diversify beyond hydrocarbons, investment in advanced manufacturing, logistics automation, and healthcare AI is likely to elevate demand for customized connector solutions.

Strategic Collaborations and Local Partnerships Redefining Competitive Landscape

The GCC connector market is witnessing a hybrid competitive environment involving global OEMs and emerging local integrators. Companies like TE Connectivity, Amphenol, and Molex maintain a stronghold in high-precision segments, while regional players such as Al Fanar and GCC Electrical are increasingly partnering with OEMs for local assembly and distribution.

In February 2025, Dubai Electricity and Water Authority (DEWA) adopted smart sensor-embedded power connectors in multiple energy substations—a milestone illustrating the connector sector’s expansion into public infrastructure. Similarly, in March 2025, Saudi-based defense manufacturer SAMI signed a strategic agreement with an international partner for localized RF connector production aligned with Vision 2030.

The market is characterized by increased emphasis on vertical application expansion, modularity, and energy efficiency in connector designs to cater to evolving demands in aerospace, defense, and public utilities.

Engineering Tomorrow's GCC with Resilient and Smart Interconnects

The GCC connector market stands at a critical inflection point where infrastructure ambition meets technological sophistication. From aerospace and defense to smart cities and AI ecosystems, connectors are becoming the hidden enablers of next-generation functionality. Strategic investments, regulatory coherence, and demand for resilient, high-speed, and application-optimized connectors will be the defining factors of long-term growth. The connector sector is no longer a peripheral component industry but a central pillar in GCC’s high-tech economic diversification.