Hong Kong Retail Banking Market Outlook: Cross-Border Digital Finance Nexus Setting the Stage for Retail Banking Evolution

Hong Kong has long been recognised as a premier cross-border digital financial hub, bridging capital flows between Mainland China and international markets. This positioning is increasingly shaping the character and trajectory of its retail banking industry. The city’s regulatory architecture, bilingual infrastructure, and proximity to the Chinese banking ecosystem have empowered local retail banks to compete not only domestically but regionally. In this context, the retail banking sector is evolving beyond mere deposit and lending functions to become a critical node in cross-border payments, digital advisory, and syndicated financing for consumers and small businesses alike.

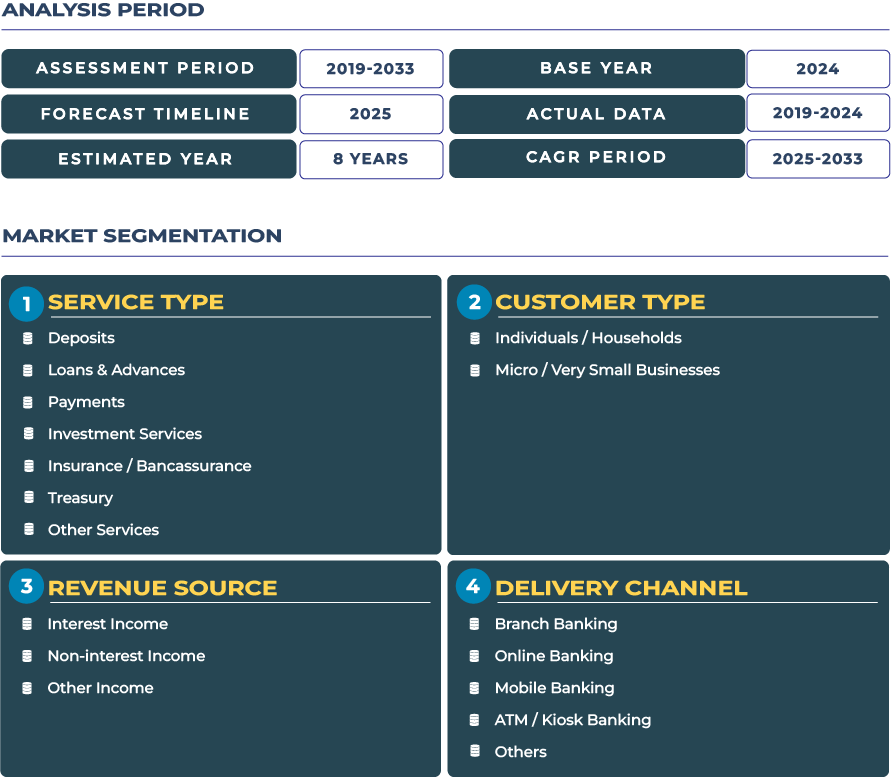

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

The Hong Kong retail banking market, estimated at USD 23.7 billion in 2025, is forecast to expand to USD 31.9 billion by 2033, representing a CAGR of 3.8%. This moderate yet steady growth underscores the dual pressures of maturation in core banking segments and the rising opportunity in adjacent digital services. As traditional interest margins compress, banks are shifting focus toward higher-value offerings such as treasury optimization, investment services, and embedded insurance. The broader marketplace is also seeing convergence with fintech ecosystems, enabling retail banks to become platforms rather than standalone product providers.

The Rising Tide of Integrated Digital Retail Banking Services

The future of Hong Kong retail banking market is being shaped by the interplay of digital sophistication, cross-border demand, and regulatory enablement. Over the forecast period, the retail banking ecosystem will pivot toward integrated digital services that combine deposit, credit, payment, investment, and risk mitigation offerings under unified customer journeys. The rising affluence and wealth accumulation of the middle class, especially among expatriates and Mainland–Hong Kong cross-border workers, will create demand for seamless multi-currency accounts, instant remittances, and AI-driven wealth advisory capabilities.

Cross-border demand will remain a key tailwind. With the June 2025 launch of Payment Connect, linking the Mainland’s Internet Banking Payment System (IBPS) and Hong Kong Faster Payment System (FPS), retail banks can now support real-time remittances in RMB and HKD across jurisdictions. The initiative is jointly overseen by the Hong Kong Monetary Authority and the People’s Bank of China. This infrastructure substantially enhances liquidity flows within the retail segment and underpins expansion of digital payment services for individual customers. Banks that embed this capability into their retail platforms will unlock new customer loyalty and revenue streams.

Yet growth will not be frictionless. As the core retail banking space matures, competition intensity will rise, regulatory scrutiny will tighten, and macro-geopolitical tensions may inject intermittent volatility. Nonetheless, the market retains a structural tilt toward digital transformation, and institutions that reposition toward platform capabilities, data monetization, and modular service offerings will be best placed to thrive.

Drivers & Restraints: Forces Shaping Hong Kong Retail Banking Trajectory

Growth Catalyst: Convergence of Fintech Adoption, Strategic Hub Status, and Ecosystem Synergy

Hong Kong status as a global financial hub confers a distinct advantage: access to international capital, investor confidence, and institutional clustering. Retail banks benefit from this by anchoring partnerships across asset managers, InsurTech firms, and cross-border payment networks. The city’s high smartphone penetration and consumer comfort with digital services accelerate adoption of advanced banking channels-mobile banking penetration is estimated around 80%, and many users interact weekly via app. Customer expectations emphasize speed, clarity, and privacy in digital banking experiences. Such expectations are enabling banks to deep-link payments, lending, investments, and insurance within a frictionless interface.

Another potent driver is regulatory modernization and collaboration. The HKMA’s opening of virtual banking licences since 2019 has created new digital entrants that pressure incumbents to evolve. The Payment Connect mechanism and Hong Kong integration with Mainland systems further lower the barriers for retail banks to expand cross-border offerings. Moreover, initiatives like digital yuan pilot acceptance in Hong Kong shops support the gradual embedding of central bank digital currency into retail banking flows. These structural enablers encourage incumbents and challengers alike to pursue new revenue models beyond interest margins.

Growth Inhibitor: Policy Uncertainty, Margin Pressures, and Competitive Encroachment

Political tensions and regulatory unpredictability present meaningful hurdles. Hong Kong unique governance status, evolving national security laws, and shifting U.S.–China dynamics impose additional compliance risk for global banks and cross-border flows. Retail banks must manage capital, data, and operational alignments in a fluid regulatory environment. Traditional interest margins continue to erode under low rates and intense competition, squeezing profitability on core banking. This compels many institutions to chase scale or shift to fee-based models prematurely.

Competition is also intensifying-from regional Chinese banks, fintech adversaries, and virtual banks. Mainland banks are strengthening offshore capabilities, while fintech platforms offer capital markets access, insurance distribution, and credit to retail customers in Hong Kong. Virtual banks, although still striving for profitability, are aggressively pursuing deposit growth and lending niches. Their lower cost base and digital-first approach raise the bar for incumbents, especially in targeting younger, digitally native customers. In aggregate, these dynamics constrain legacy players from relying solely on existing retail franchises unless they rapidly transform.

Trends & Opportunities: Where the Horizon Opens for Innovative Retail Banking

Trend Spotlight: Digital Currency Integration, Virtual Banks Proliferation, and Cross-Border Payment Orchestration

The confluence of digital currency initiatives and banking digitization is redefining retail banking trends. Hong Kong decision to permit use of China pilot e-CNY (digital yuan) in local retail and online shops is a landmark step toward mainstreaming CBDC usage in consumer finance. This move invites retail banks to embed digital currency wallets into banking apps, enabling seamless transactions, micropayments, and cross-border flows. Meanwhile, the virtual banking wave continues-Hong Kong licenses eight virtual banks (such as ZA Bank, WeLab Bank, Airstar, Livi, Mox, Ant Bank, Fusion) that operate without physical branches yet compete on deposit, lending, investment, and insurance channels. Their rapid customer acquisition underscores a paradigm shift: digital banking is becoming default consumer touchpoint.

Cross-border payments stand as a defining vector. Payment Connect enables instantaneous remittance between Mainland and Hong Kong, which in turn empowers retail banks to integrate foreign exchange, multi-currency vaults, and real-time settlement into consumer journeys. Further, moves such as HSBC joining China CIPS system amplify Hong Kong role in alternative global payment rails. These trends collectively push retail banking toward a seamless, borderless architecture.

Opportunity Horizon: AI-Driven Advisory, Embedded Insurance, and Modular Banking Platforms

Retail banks that adopt AI and data science to deliver personalized financial advice will gain a critical edge. Instead of reactive dashboards, the next wave is proactive guidance: conversational agents that can propose investment allocations, insurance top-ups, or credit offers in real time. Because of the robust KYC and client data foundations in Hong Kong, banks can monetize customer insights across services. Embedded insurance (bancassurance) presents another compelling opportunity: contextual insurance upsells tied to retail banking usage will drive incremental premiums without excessive acquisition cost.

Modular banking platforms represent a structural opportunity. Rather than monolithic systems, future retail banks may evolve into marketplace-like platforms, integrating fintech modules for payments, savings, wealth, loyalty, and trade finance applications. This modularity allows faster innovation, partner onboarding, and customer customisation. As banks transition from product silos to unified ecosystems, cross-selling depth and stickiness improve. In a mature monolithic landscape, this shift can unlock new per-client revenue streams and improve unit economics.

Competitive Landscape: Strategic Moves That Signal Next-Gen Retail Banking Rivalry

The Hong Kong retail banking ecosystem features intense rivalry among established incumbents, regional Chinese banks, and digital challengers. HSBC, Bank of China (Hong Kong), Hang Seng, Standard Chartered, and DBS are prominent players, each now responding to disruption pressure. Digital banks such as ZA Bank and WeLab Bank are emblematic challengers. ZA Bank, one of Hong Kong first virtual banks, offers retail deposit, lending, and insurance distribution via mobile app and continues to expand through partnerships and cross-border integrations. WeLab Bank, backed by fintech parent WeLab, has focused on online lending and wealth management and reportedly is narrowing its path to profitability. Some virtual banks still operate at losses, but they use growth and scale to legitimize monetization in the medium term.

In 2025, strategic investment is converging around cross-border infrastructure and crypto innovation. For example, Standard Chartered’s Hong Kong unit is partnering with Animoca and HKT to apply for an HKD-stablecoin issuance license-a move that could redefine retail payments rails. Meanwhile, many retail banks are investing AI advisory capabilities, modular APIs, and cloud platforms to counter fintech erosion. Incumbents are also forging alliances and acquisitions in wealthtech, insurtech, and payments to shore up innovation velocity. The next decade of competition in Hong Kong retail banking industry will likely be waged less on branch density and more on digital stickiness, partner ecosystems, and cross-border reach.