Israel Investment Banking Market Outlook: Powering the Nation’s Tech-Driven Financial Future

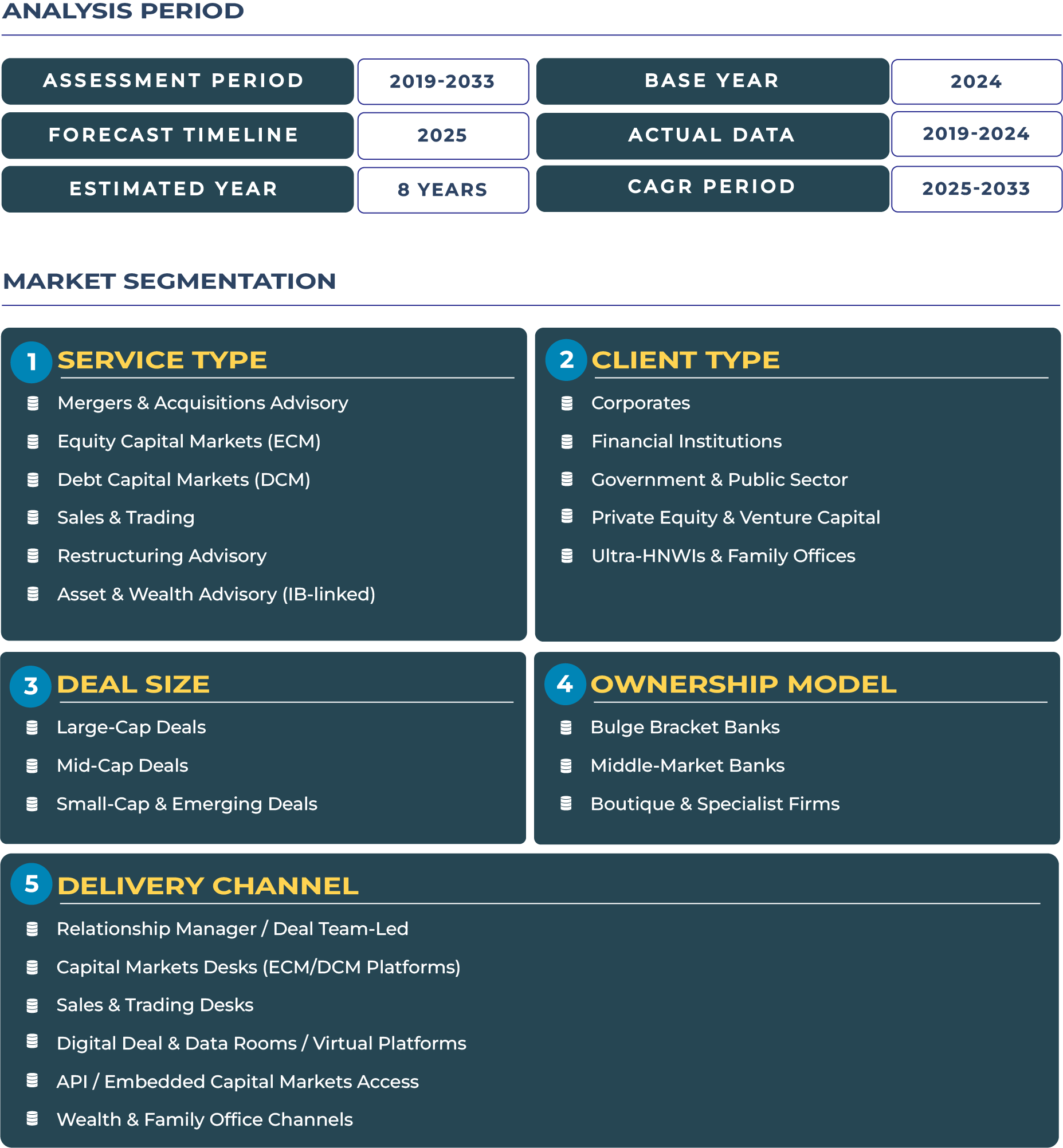

Israel, widely known as the “Startup Nation,” has cultivated a dynamic ecosystem of technological innovation and venture capital that now fuels its evolving investment banking industry. Positioned at the intersection of entrepreneurship, technology, and capital, Israel investment banking market has become increasingly focused on tech mergers and acquisitions, venture capital exits, and IPO advisory services. The market, valued at USD 355.6 million in 2025, is projected to reach USD 576.6 million by 2033, reflecting a CAGR of 6.2% during 2025–2033. This steady expansion is driven by a flourishing technology ecosystem, global investor interest, and regulatory modernization aimed at deepening capital markets in the country.

Note:* The market size refers to the total revenue generated by banks through various services.

Amid ongoing geopolitical challenges, including regional instability and security concerns, Israel’s financial sector has demonstrated remarkable resilience. The Bank of Israel continues to ensure macroeconomic stability, while the Ministry of Finance promotes initiatives to attract foreign investments and expand cross-border financing opportunities. Together, these efforts underscore a forward-looking approach where investment banking services play a central role in channeling innovation capital to sustain national growth.

Tech and Venture Capital Advisory Services Shaping the Future of Israeli Investment Banking

The Israeli investment banking landscape is undergoing a transformation led by its thriving technology and venture capital ecosystem. With over 6,000 startups and a highly active VC network, investment banks in Israel are increasingly focused on advisory services for technology-driven deals, including merger and acquisition transactions and IPO facilitation for tech firms. These services are vital for scaling startups into global players.

Technology merger and acquisition and VC advisory services have emerged as critical revenue drivers for leading institutions. Banks and financial advisory firms are aligning with global venture funds and tech investors to facilitate cross-border transactions, especially with partners in the United States and Europe. This cross-pollination of technology, finance, and innovation is shaping Israel’s new investment banking paradigm, one that thrives on agility, specialized advisory, and digital sophistication. Furthermore, regulatory modernization under the supervision of the Israel Securities Authority has enhanced transparency and investor confidence, reinforcing the attractiveness of Israel as a financial hub for technology-linked investments.

Key Drivers and Restraints: Innovation-Fueled Growth Meets Structural Challenges

Startup and Tech Financing Fuel Growth Momentum

Israel’s position as a global innovation hub is a significant catalyst for the expansion of its investment banking sector. The surge in venture capital activity, particularly within cybersecurity, fintech, artificial intelligence, and life sciences, continues to attract international capital inflows. Investment banks are now integral partners in structuring VC fundraising rounds and managing IPO pipelines for high-growth startups. Strategic collaborations with global investors have also enhanced deal sophistication, allowing Israeli firms to execute complex transactions that meet international standards.

Another growth enabler is the continued government support for private financing initiatives. Policies designed by the Israel Innovation Authority promote startup scalability and exit strategies, stimulating advisory demand in merger and acquisition and ECM segments. The strong pipeline of unicorns and technology-driven exits will continue to define the growth trajectory for the investment banking ecosystem over the coming decade.

Market Size Constraints and Competitive Pressures Remain Key Barriers

Despite its strengths, the Israeli investment banking industry faces limitations due to market scale and regional concentration. With a relatively small domestic corporate base, banks often depend on cross-border deal flow to sustain growth momentum. This reliance exposes them to external economic fluctuations and geopolitical uncertainty. Additionally, competition from global advisory firms and fintech-enabled platforms is compressing margins in the mid-market deal advisory space. Limited liquidity in local debt and equity capital markets further restricts the depth of DCM and ECM activities, compelling many issuers to seek overseas listings.

Moreover, persistent geopolitical instability and investor risk aversion can delay capital market transactions, especially during periods of regional tension. However, the country’s resilient economic fundamentals, high innovation index, and fiscal prudence provide a buffer against prolonged downturns in deal-making activities.

Trends and Opportunities: Cross-Border Advisory and Tech IPO Pipelines Define the Next Decade

Rising Cross-Border Tech Advisory Deals and Global Investor Interest

One of the most prominent trends in the Israeli investment banking market is the surge in cross-border technology advisory transactions. Global investors and multinational corporations are increasingly acquiring stakes in Israeli startups, prompting a rise in deal-making activities that require sophisticated advisory services. Investment banks are adapting by strengthening cross-border teams and leveraging technology to streamline due diligence and compliance processes. The increasing number of U.S. and European listings by Israeli tech companies further underscores the internationalization of the market.

Expanding Opportunities in VC and IPO Advisory Segments

The VC and IPO advisory space presents the most promising opportunities for investment banks in Israel. As the domestic market matures, a growing number of late-stage startups are seeking exits through public offerings or strategic acquisitions. Advisory firms are capitalizing on this by building specialized teams focused on technology IPOs and pre-IPO restructuring. Furthermore, the ongoing adoption of digital platforms and AI-driven analytics is enhancing the accuracy of valuations and deal execution, thereby increasing investor confidence and transaction speed.

Competitive Landscape: Specialized Investment Banking Firms and Strategic Innovation Partnerships

The competitive environment in the Israeli investment banking landscape is shaped by a blend of global financial institutions and local boutique advisory firms. Major international banks such as Goldman Sachs and Morgan Stanley maintain strong presences in the country, focusing on cross-border merger and acquisition and capital markets. Meanwhile, local players like Poalim IBI and Leumi Partners are leading domestic advisory activities, particularly in tech-driven transactions and private placements.

Recent developments include an increase in collaboration between investment banks and venture capital firms to facilitate early-stage financing and secondary share sales. For example, in 2024, Poalim IBI expanded its technology advisory unit to strengthen its VC and IPO capabilities, highlighting a strategic shift toward digital economy-focused services. International players are also investing in Israel’s financial infrastructure, establishing innovation partnerships that aim to integrate advanced analytics and ESG frameworks into deal processes.