Italy Banking Market Outlook: Super-App Banking and CBDC Pilots as Catalysts of Digital Lifestyle Integration

The Italian banking sector is increasingly positioning itself as a digital lifestyle enabler, where the convergence of super-app banking models and central bank digital currency (CBDC) pilots is redefining the financial experience for SMEs and retail users alike. By embracing multi-functional platforms that combine payments, investments, insurance, and lifestyle services, Italian banks are building ecosystems that extend beyond traditional banking. This transformation addresses fragmented payment standards and integrates diverse customer needs into unified interfaces, enhancing loyalty while improving monetization.

Note:* The banking market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

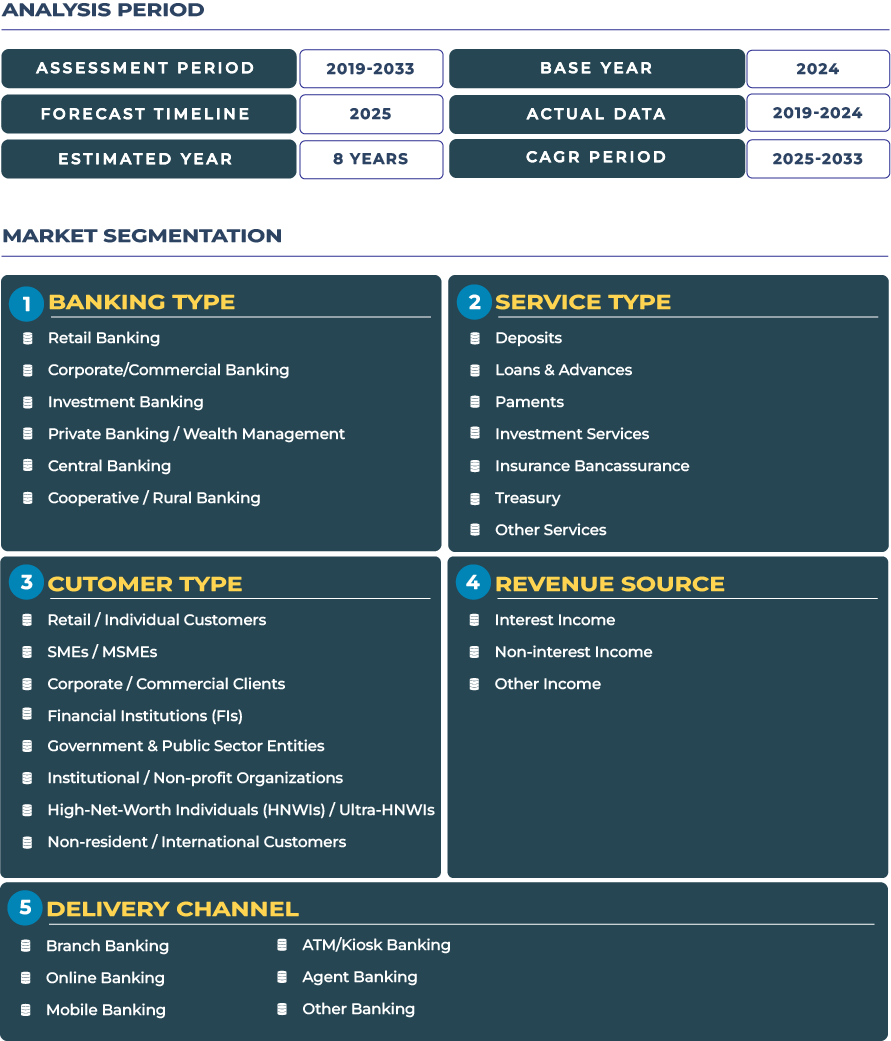

According to DataCube Research, the Italy banking market is expected to reach USD 161.7 billion in 2025 and further expand to USD 226.2 billion by 2033, growing at a CAGR of 4.3% during 2025–2033. This performance reflects Italy’s ability to capitalize on real-time payments, automation-driven efficiency, and regulatory support for digital transformation. The country’s economic resilience, despite challenges posed by European inflationary pressures, pandemic aftershocks, and geopolitical risks, underlines the adaptability of its banking ecosystem. Italy’s transition toward CBDC pilots also reflects its proactive approach in shaping Europe’s financial future, particularly in creating innovative solutions for SMEs that often struggle with liquidity and cross-border payments.

Why Automation, RPA, and Real-Time Infrastructure Drive Italy’s Banking Expansion

Automation and robotic process automation (RPA) are transforming cost structures across Italy’s banking sector. By digitizing repetitive processes such as loan underwriting, compliance checks, and transaction monitoring, banks are reducing operational costs while accelerating service delivery. This is particularly evident in corporate banking, where large enterprises demand streamlined treasury operations and faster settlement cycles. RPA adoption also strengthens fraud detection, ensuring compliance with tightening European regulatory frameworks.

Another critical growth driver is the rapid rollout of real-time payments infrastructure. Italy’s participation in the TARGET Instant Payment Settlement (TIPS) scheme is expanding faster settlements across retail and SME ecosystems. Real-time capabilities are increasingly demanded in regions such as Milan, Rome, and Turin, where e-commerce and digital-first retail are expanding. The fusion of instant payments with super-app platforms further accelerates customer adoption, ensuring that the Italian banking industry maintains competitiveness within the broader European financial market.

Challenges of Fragmented Standards and Legal Liabilities in Italy’s Banking Ecosystem

Despite its digital momentum, the Italian banking market continues to face headwinds from fragmented payment standards. Different banks and fintech providers have historically adopted varied frameworks, complicating interoperability and raising costs for SMEs seeking to expand regionally. Although regulatory harmonization under EU directives is reducing these gaps, the lack of uniform adoption slows the scalability of open banking services in Italy.

Another significant restraint is the increasing legal liability risk linked to product mis-selling. Italian banks have faced scrutiny for inadequate transparency in financial product distribution, particularly in insurance-linked savings and structured retail products. These risks have prompted regulators to demand higher disclosure and consumer protection standards, elevating compliance costs. For cooperative and rural banks, where trust and community service are central, these liabilities pose a reputational challenge alongside financial penalties.

Trends and Opportunities: Hyper-Personalization and CBDC Pilots Reshaping Italian Banking

Hyper-Personalization Through Big Data Insights Driving Retail Banking Growth

A defining trend in Italy’s banking landscape is the adoption of hyper-personalization through big data and analytics. Banks are leveraging transactional data, social media insights, and geolocation patterns to create highly tailored financial solutions. For example, retail customers in Milan are receiving personalized loan offerings tied to lifestyle events, such as education financing or homeownership planning. Similarly, private banking divisions are using predictive analytics to design investment portfolios based on ESG preferences, tax obligations, and generational wealth transfer needs.

CBDC Pilots Offering SMEs Access to Next-Generation Liquidity Solutions

Italy’s proactive stance on central bank digital currencies (CBDCs) offers a unique opportunity to transform SME financing. The Banca d’Italia is collaborating with the European Central Bank on the digital euro pilot, testing programmable payments and cross-border settlement tools. SMEs in Italy, particularly in the export-driven northern regions, stand to benefit from reduced transaction costs, faster settlement, and automated compliance with tax frameworks. This pilot positions Italy at the forefront of CBDC experimentation in Europe, with long-term implications for both liquidity access and trade competitiveness.

Tokenization of Real Estate and Alternative Asset Classes as Future Growth Channels

Opportunities also exist in the tokenization of real estate and other alternative assets, enabling fractional ownership models accessible via digital banking platforms. Italian investors, particularly younger demographics, are exploring these options to diversify beyond traditional savings accounts. Banks that integrate tokenized assets within their super-app frameworks will expand service offerings while capturing new revenue streams in wealth management. These opportunities align with Italy’s broader fintech growth, enabling banks to position themselves as leaders in next-generation asset management.

Government Regulation and Institutional Support for Digital Banking

The regulatory framework in Italy provides both structure and opportunity for the banking sector. The Ministry of Economy and Finance and Banca d’Italia play central roles in ensuring monetary stability, enforcing EU directives, and promoting innovation. Italy has aligned with the EU’s PSD2 directive, requiring banks to share data securely with authorized third parties. This move strengthens the foundation for open banking and super-app integration. Additionally, Italy is participating in EU-level sustainability regulations, encouraging banks to design ESG-focused financing tools. Government-backed digital sandboxes further allow banks and fintechs to co-create solutions under regulatory supervision, fostering an ecosystem conducive to innovation while ensuring consumer protection.

Macro-Economic and Social Factors Impacting Italy’s Banking Performance

The performance of the Italian banking industry is strongly tied to digital transaction growth and broader macroeconomic conditions. According to OECD estimates, digital transactions in Italy grew by more than 20% year-on-year in 2024, signaling increasing consumer adoption of online and mobile banking. However, the sector remains vulnerable to inflationary pressures and lingering pandemic effects on consumer confidence. Regional disparities are also notable—urban centers like Milan and Rome are driving fintech adoption, while rural areas remain dependent on cooperative banks. The war in Ukraine and associated energy cost fluctuations have also shaped lending priorities, with Italian banks allocating more resources toward renewable energy projects and trade financing to hedge against volatility.

Competitive Landscape: Super-App Strategies and AI Regulation Defining Italian Banking

The Italian banking ecosystem is highly competitive, featuring prominent players such as Intesa Sanpaolo, UniCredit, and Banco BPM. In 2024, Intesa Sanpaolo advanced its super-app initiative, integrating payments, insurance, and lifestyle services into a single platform. UniCredit invested in AI-driven personalization engines, delivering targeted retail and SME offerings across regional markets. Banco BPM enhanced its corporate banking portfolio by deploying blockchain-based trade finance solutions. Notably, Italy enacted a comprehensive AI law in 2024 to regulate AI applications across industries, including banking (Reuters). This legislation ensures responsible deployment of AI in areas such as credit scoring, fraud detection, and customer engagement, providing both challenges and opportunities for banks adapting to compliance requirements. These strategic moves underline the sector’s shift toward data-driven, digitally integrated, and regulation-aligned growth models.

Conclusion: Italy’s Banking Future Anchored in Super-App Innovation and Digital Currency Integration

The Italian banking market is entering a new era of transformation, where super-app platforms and CBDC pilots serve as anchors for long-term growth. By integrating lifestyle services with financial offerings, banks are enhancing customer stickiness and unlocking new revenue streams. The push toward hyper-personalization ensures that Italian consumers and SMEs experience banking as an embedded part of their daily lives rather than a standalone service. At the same time, CBDC initiatives and tokenization of assets are reshaping liquidity management and investment opportunities. While challenges such as fragmented standards and liability risks persist, regulatory oversight and innovation-friendly policies are providing a balanced framework for growth. The Italian banking landscape is thus evolving into a digitally integrated ecosystem that balances compliance, innovation, and customer value creation. Looking toward 2033, the ability of banks to operationalize these innovations at scale will define Italy’s competitive position in Europe’s financial future.