Market Outlook: Uncovering Strategic Pathways in Italy Private Banking Ecosystem Through 2033

The market outlook for Italy private banking sector reflects measured growth but strategic substance. At USD 19.6 billion in 2025 rising to USD 22.6 billion by 2033, the implied CAGR of 1.8% indicates limited volumetric expansion but underscores the imperative for value-creation rather than scale alone. The modest forecast challenges firms to deepen service packaging, improve advisory outcomes, and capture incremental wallet share rather than rely on broader market expansion in a mature and saturated affluent segment.

Note:* The market size refers to the total revenue generated by banks through various services.

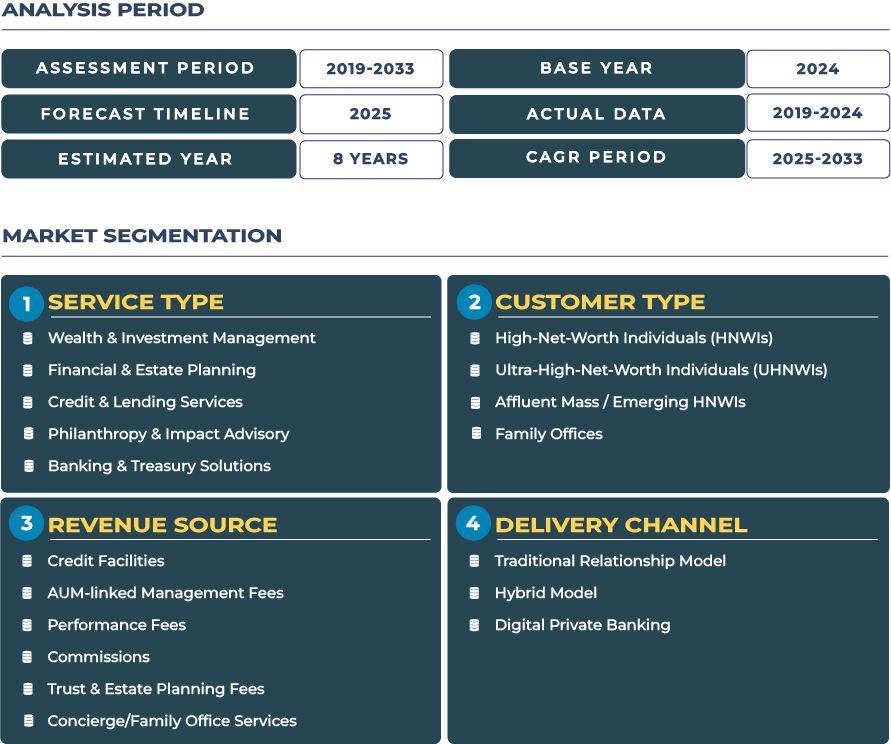

Several factors support this outlook. Italy net wealth of households reached €11,286 billion at end-2023-a 4.5% nominal increase from prior year. This significant asset base, coupled with the growing interest in real-estate and art-linked investment, underpins demand for private banking services beyond traditional investment advice. Yet the macro-environment remains challenging: slow economic growth, tight margins in banking, regulatory and tax complexity, and regional fragmentation temper growth potential. Hence, private banks in Italy must focus on boutique differentiation, integrated offerings (e.g., wealth & investment management, credit & lending services, philanthropy & impact advisory, banking & treasury solutions) and regional client-experience excellence to capture the available growth.

Drivers of Growth & Structural Constraints: Why Italy Private Banking Market Moves Slowly but Deliberately

Driving factors: Italy private banking sector benefits from several meaningful catalysts. First, the wealth accumulation among small- and medium-sized enterprise (SME) owners and family firms in regions such as Lombardy, Veneto and Emilia-Romagna provides a robust pool of HNWIs seeking tailored wealth-management platforms. Second, real-estate-driven affluence-residential, commercial and heritage sectors-fuels demand for advisory services linked to value preservation, cross-border exposure and estate planning. Recent data shows Italian private investors increased commercial-real-estate allocations significantly in 2024 (+68% YoY) and early 2025. Third, Italy tourist-linked investment flows (from luxury residency, lifestyle migration and second-home acquisitions) create wealth-management needs tied to portfolio diversification, credit structuring and legacy planning.

Restraining factors: On the flip side, Italy private banking industry faces structural impediments. Political instability and banking-sector concentration continue to weigh on market confidence. The banking system still carries elevated levels of non-performing loans (NPLs) and regulatory overheads greater than in some peer markets, raising cost-to-serve and limiting agility. In addition, the comparatively slow pace of digital-wealth transformation, alongside fragmented regional banking models and heavy reliance on traditional advisory frameworks, hampers scalability and margin improvement. Given the modest CAGR of 1.8%, Italian private banks must focus on efficiency, client-segmentation and high-value propositions to offset structural growth constraints.

Trend-vectors & Opportunity Windows: Real-Asset Diversification, Offshore Regularisation and Fintech Alliances in Italy Private Banking Landscape

Major trends: One critical trend in Italy private banking market is the surge of real-asset diversification among wealthy clients. The shift toward Italy commercial-real-estate market-especially from private investors-demonstrates a move beyond traditional portfolios. Another trend is offshore-wealth regularisation and mobility: Italy favourable tax regime for new residents and inbound wealth is attracting high-net-worth individuals from Northern Europe post-2025. Finally, digital transformation is gaining momentum as boutique private banks seek to deliver hybrid advisory, mobile dashboards, integrated treasury platforms and lifestyle-wealth services tailored to affluent clients.

Opportunity leverages: For Italian private banking firms, key opportunity zones emerge. First, real-estate wealth structuring advisory-helping clients navigate Italian property, legacy estates, cross-border holdings and tax-optimization-is a distinct value-book. Second, succession planning for family-business and multi-generational wealth is under-served; private banks that offer full-life-cycle multigenerational wealth planning-including family governance, philanthropy, art/heritage advisory-will differentiate. Third, fintech partnerships-joining boutique private banks with digital-wealth platforms, payments/treasury innovations and alternative-asset access-offer scalable growth paths without excessive infrastructure investment. Northern regions such as Milan and Lombardy remain growth hubs for these packaged advisory models.

Competitive Landscape: Strategic Manoeuvres Reshaping Italy Private Banking Industry

The competitive framework in Italy private banking market is dynamic, with firms repositioning toward ecosystem models. A leading institution, Banca Generali, a specialist private bank listed in Milan, remains a benchmark-focusing on advisory excellence, alternative-asset access and segment differentiation. Reports from April 2025 indicated a strategic bid from