Oman Dental Devices Market Outlook: Healthcare Modernization and Private Growth Driving Expansion

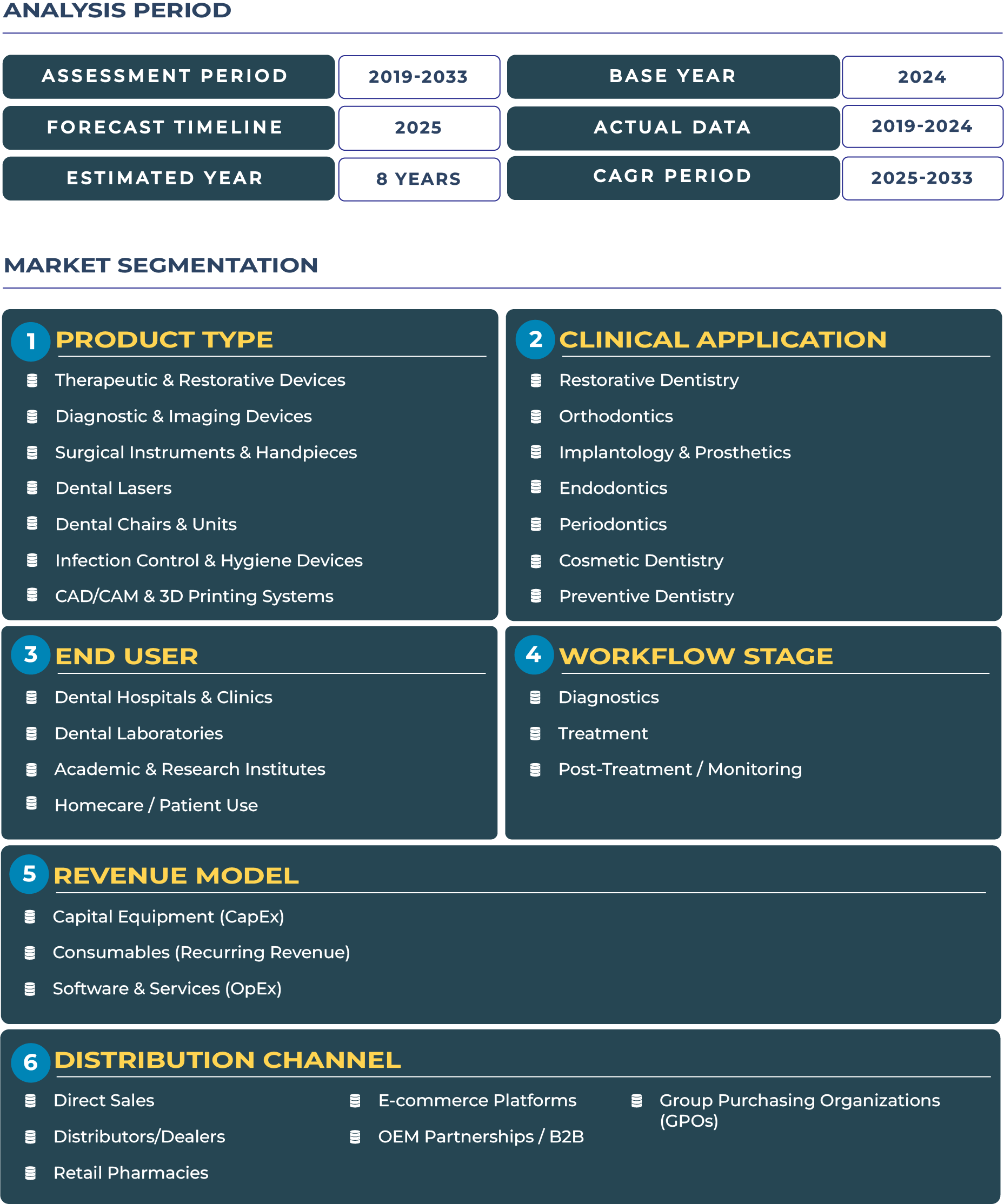

The Oman dental devices market is entering a pivotal phase, defined by healthcare modernization, private sector growth, and expanding access to advanced technologies. While Oman’s healthcare ecosystem historically leaned on public health infrastructure, recent years have seen a surge in private dental clinics investing in modern technologies such as CAD/CAM systems, restorative devices, and diagnostic imaging equipment. This modernization reflects the government’s commitment to healthcare quality upgrades under the Ministry of Health Oman, coupled with the private sector’s ambition to match GCC standards. In value terms, the market is expected to reach USD 140.5 million in 2025 and further expand to USD 317.1 million by 2033, growing at a robust CAGR of 10.7%. These figures underscore Oman’s increasing reliance on imports, coupled with rising patient awareness, as the nation strengthens its dental devices industry to meet both urban and regional demands.

How Modernization of Private Clinics is Shaping Oman Dental Devices Sector

Oman dental devices ecosystem is becoming a critical component of the country’s healthcare modernization agenda. Modern private clinics are central to this evolution, particularly in Muscat and other urban centers, where patients are demanding advanced care supported by surgical instruments, dental lasers, and premium hygiene devices. Public health upgrades, supported by government policies, are creating a foundation for broader dental adoption in smaller districts. However, the private sector remains the main engine of growth, focusing on restorative and cosmetic dentistry, areas that attract high-value patients. This dual momentum—public sector infrastructure upgrades and private clinic modernization—positions Oman as an attractive but niche player within the GCC dental devices landscape, offering manufacturers opportunities to capture incremental demand through distributor-led market entry.

Drivers & Restraints: Navigating Growth Accelerators and Market Limitations in Oman

Drivers: Growth in the Oman dental devices market is primarily supported by the steady expansion of private dental clinics, which increasingly invest in diagnostic imaging, restorative devices, and CAD/CAM technology to improve treatment outcomes. Government-led healthcare modernization projects add another layer of opportunity, particularly through upgrades in public hospitals and district-level facilities. Stable but small-scale demand from the local population ensures that device utilization is consistent, even if not as large as in regional peers. Together, these drivers create a gradual but reliable base for market expansion.

Restraints: On the other hand, the Oman dental devices sector faces distinct challenges. The limited size of the market restricts scalability for manufacturers, who must rely heavily on GCC distribution hubs for imports and servicing. Moreover, Oman does not benefit from strong dental tourism, unlike the UAE, which caps elective care demand for premium products. Regulatory processes are transparent but sometimes lengthen product registration timelines, delaying device introduction. These limitations shape Oman as a market that favors focused strategies rather than broad-scale deployments.

Trends & Opportunities: Localized Modernization and GCC Network Integration

Trends: The modernization of private dental clinics remains one of the most prominent trends in Oman dental devices landscape. Selective procurement for public hospitals is ensuring that only high-quality diagnostic and imaging devices are adopted, aligning with budgetary priorities. At the same time, emerging private dental chains are consolidating urban markets, offering bundled dental care services that increasingly rely on advanced tools such as 3D printing and digital workflows. This evolution signals a transition from traditional care models to tech-integrated practices.

Opportunities: For global and regional manufacturers, Oman offers targeted opportunities. Leveraging GCC distributor networks remains the most efficient way to penetrate the market, reducing logistical costs and improving response times. Offering financing solutions and structured service plans can further attract private clinics hesitant to invest upfront in high-cost equipment. Additionally, companies can set up periodic service and demonstration visits from UAE hubs, ensuring local clinics remain engaged with cutting-edge technologies without requiring permanent infrastructure in Oman.

Competitive Landscape: Strategies and Market-Specific Developments

The dental devices sector in Oman is shaped by international players such as Straumann, alongside GCC distributors that dominate supply and service. Strategies revolve around efficient distribution, financing, and after-sales service, as Oman’s modest scale does not justify large direct operations. Between 2022 and 2025, Oman’s Ministry of Health emphasized upgrades in public hospitals and health centers, including dental units, signaling opportunities for suppliers of infection control systems, dental chairs, and restorative instruments. Private clinic expansions in Muscat also reflect a growing willingness to procure premium dental lasers and CAD/CAM technologies, with financing and distributor support being critical enablers. This unique combination of public investment and private modernization makes Oman a specialized but steadily growing market within the Middle East dental devices ecosystem.