Peru Connector Market Outlook

Powering Peru’s Infrastructure Revolution with Rugged Hybrid Connectors

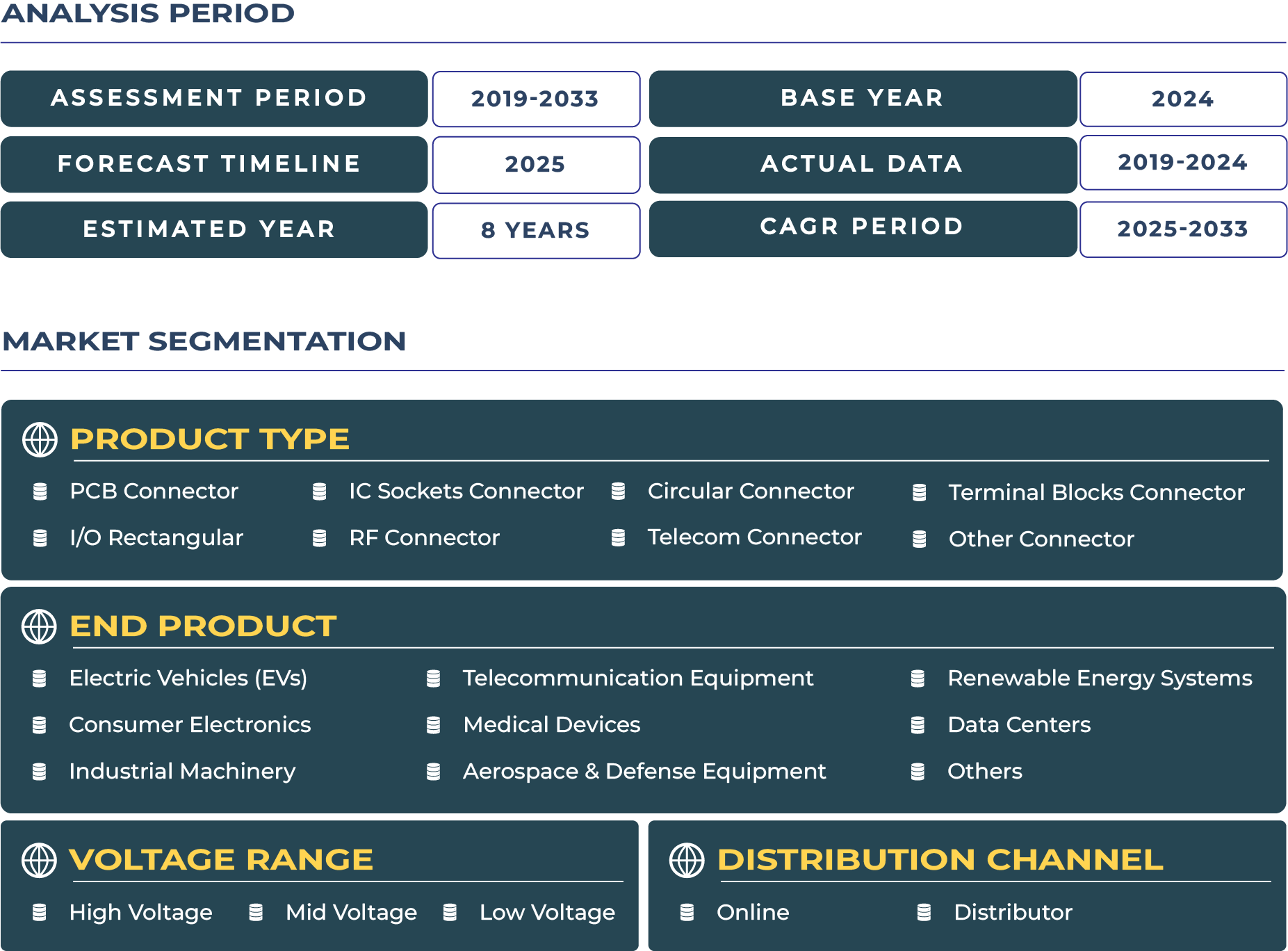

Peru is currently undergoing a significant transformation of its foundational infrastructure. The government’s aggressive drive to modernize maritime ports, expand railway networks, and integrate digital systems into remote mining sites is creating fertile ground for specialized connector solutions. Rugged hybrid connectors—blending wired and wireless functionality with robust protection—have emerged as critical enablers in this landscape. The Peruvian connector market is projected to climb to USD 245 million by 2033, reflecting a CAGR of approximately 6.5%. This growth is driven by expanding infrastructure projects in mining and transportation, alongside increased adoption of rugged hybrid connectors suited for challenging environments.

Harnessing Peru’s Remote Infrastructure with Weather‑Tough Hybrid Connectivity

Enhanced port automation in Callao, remote railway electrification across the Andean corridor, and smart controls in mining camps drive demand for connectors proven to withstand extreme humidity, vibration, and dust exposure. Hybrid connectors combining power transmission, sensor interfaces, and wireless modules in single units reduce installation complexity and failure points in remote sites. By enabling modular connectivity, these solutions allow quick maintenance swaps at remote locations, significantly reducing downtime and improving transmission reliability across supply routes.

Catalysts and Headwinds in Peru Connector Industry Evolution

Peru connector ecosystem expansion is powered by two key growth drivers. First, the proliferation of maritime electronics—such as automated gantry cranes and remote port sensors—requires robust telecom and circular connectors that resist saltwater corrosion and heavy mechanical loads. The Callao consortium, for instance, initiated a phased port modernization project in 2024 and deployed I/O rectangular and RF connectors across automated gate systems.

However, the market also converges on several restraints. Major global OEMs are increasingly integrating connector production into their own factories, reducing dependence on local suppliers and compressing margins. Similarly, complexity in testing—especially for high-frequency telecom and hybrid connectors—poses a challenge. High-altitude and submersible deployments require specialized test chambers that only a handful of Peruvian labs currently possess, prolonging validation and certification timelines and escalating costs by an estimated 15%.

Industrial Trends Driving Ruggedization and Hybrid Adoption

Peruvian connector manufacturers are aligning with global trends by offering increasingly ruggedized hybrid connectors for industrial and remote applications. Concurrently, a shift toward hybrid wireless-wired connectivity is taking hold—providing sensor modules with LTE fallback wired to power and sync.

Lucrative Pathways Unlocking Peru’s Connector Growth Potential

Peru’s connector landscape offers compelling opportunities for firms specializing in ruggedized hybrid solutions and system integration. Targeting heavy-duty machinery platforms used in mining and transport provides a growth avenue

Total Cost Drivers: Logistics, Semiconductor Imports and Thermal Efficiency

Peru’s connector market is influenced heavily by external economic factors. Semiconductors import dependency remains high, with import volumes reaching approximately USD 300 million in 2023. This reliance translates into extended lead times and currency-driven price volatility. Moreover, logistical challenges traversing the Andes elevate transport costs by 18% relative to coastal shipments. These constraints are encouraging demand for lifecycle-optimized connectors featuring thermal performance, high cycle durability, and service modularity.