Corporate Financing Solutions in Russia: Supporting Domestic Enterprises Amid Geopolitical and Financial Challenges

The Russia Corporate Banking Market stands at a critical juncture where domestic financing solutions are reshaping the country’s economic trajectory amid shifting geopolitical realities. In recent years, Russian banks have intensified efforts to strengthen corporate lending frameworks, enhance ruble-based financing, and introduce risk-hedging mechanisms to support domestic enterprises facing limited access to global financial markets. The Central Bank of Russia (CBR) continues to guide the transformation by promoting ruble liquidity stability and expanding local interbank settlements.

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

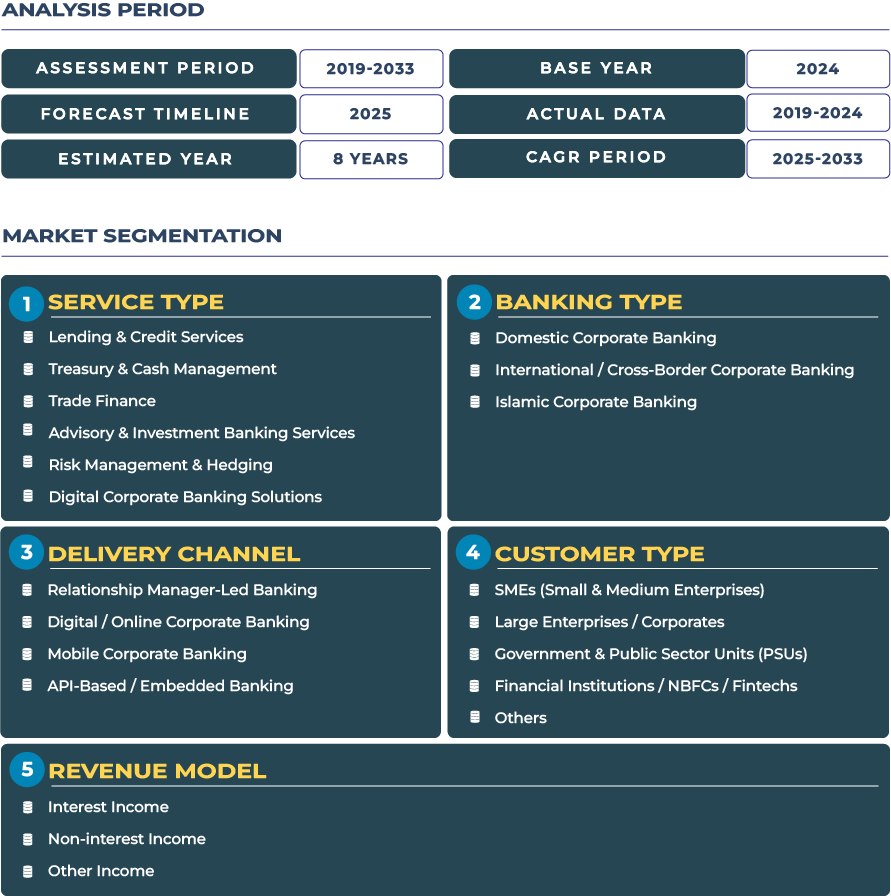

According to DataCube Research, the market was valued at USD 33.0 billion in 2025 and is projected to reach USD 35.7 billion by 2033, growing at a modest CAGR of 1.0% from 2025 to 2033. This restrained yet steady performance underscores the resilience of Russian financial institutions despite international sanctions and reduced access to Western capital. Corporate banks are pivoting towards domestic credit expansion, localized trade finance, and tailored treasury and cash management solutions for large corporates in key sectors such as energy, agriculture, and manufacturing.

Russia Corporate Banking Market Outlook: Reinforcing Corporate Liquidity and Stability Through Domestic Financial Innovation

The near-term outlook for the Russian corporate banking industry is characterized by controlled adaptation and innovation in financial intermediation. With external restrictions on cross-border lending, Russian banks are prioritizing onshore financing tools, ruble-denominated corporate bonds, and targeted credit programs to ensure capital flow continuity for domestic enterprises. The financial ecosystem is evolving under regulatory guidance from the CBR to sustain liquidity amid constrained international operations.

Banks such as Sberbank and VTB are implementing digital treasury and cash management platforms for Russian corporates to optimize capital allocation and minimize FX exposure. Moreover, the increased adoption of national payment systems, such as the SPFS (System for Transfer of Financial Messages), allows for more secure domestic transaction settlements. Despite economic headwinds, government-backed stimulus and localized financial infrastructure are positioning the market to gradually recover corporate lending volumes through 2033.

Drivers & Restraints: Forces Shaping Russia Corporate Banking Ecosystem

Commodity Sector Financing and Domestic Credit Expansion Sustaining Market Growth

Russia corporate banking sector is strongly supported by high-value industries such as oil, gas, and metals, which continue to generate substantial financing needs. Export-oriented corporates rely on structured loans, risk management products, and trade financing to manage cyclical revenue flows. The robust demand for ruble-dollar hedging and liquidity management tools has further stimulated innovation in derivative-linked products tailored for large clients. Additionally, government programs offering subsidized interest rates for SMEs and manufacturers have contributed to sustained lending activity, driving stability across the broader corporate banking landscape.

Geopolitical Constraints and Sanctions Restricting Global Financial Integration

The most significant restraint for the Russian corporate banking market lies in ongoing geopolitical and financial isolation. International sanctions have restricted correspondent banking relationships, limiting cross-border settlements and trade finance capacity. Furthermore, FX liquidity constraints and capital control measures have complicated foreign currency financing for corporates. These factors collectively impose barriers to scaling international treasury operations, forcing banks to deepen domestic linkages. The market’s long-term resilience will depend on its capacity to replace external capital with locally sourced and government-backed instruments.

Trends & Opportunities: Transitioning to Localized Financial Ecosystems and New Trade Corridors

Localization of Payment Systems and Corporate Treasury Transformation

A key trend shaping the Russia corporate banking sector is the structural pivot toward domestic payment infrastructures and local currency transactions. Banks are increasingly using SPFS and the MIR card network to facilitate seamless domestic transfers while bypassing global SWIFT dependencies. This trend has accelerated corporate treasury centralization, enabling enterprises to manage liquidity across subsidiaries through local platforms. In addition, corporates are increasingly adopting advanced digital corporate banking solutions to enhance real-time reporting, compliance, and operational agility within Russia’s evolving regulatory environment.

Emerging Opportunities in Eurasian Trade Finance and Domestic Liquidity Management

Amid external constraints, new growth avenues are emerging in Eurasian trade finance corridors. Russian banks are partnering with financial institutions from China, India, and Central Asia to expand trade settlement channels denominated in rubles, yuan, and other non-USD currencies. This trend has created fresh opportunities in onshore liquidity management and localized corporate hedging strategies. Additionally, as domestic corporates diversify their export routes through the Northern Sea Corridor and Central Asian logistics hubs, banks are expected to introduce new financing products to facilitate trade expansion and supply-chain resilience.

Competitive Landscape: Local Champions Leading Transformation in Corporate Banking

The competitive environment of Russia corporate banking market is dominated by domestic financial institutions that have effectively localized services amid sanctions. Major players such as Sberbank, VTB, Gazprombank, and Alfa-Bank have reoriented their strategies toward onshore-focused liquidity management and ruble-centric financing. Sberbank has notably launched sectoral lending programs for agriculture and energy companies, offering flexible repayment structures aligned with commodity price cycles.

VTB has expanded its treasury management offerings for large corporates by integrating digital FX solutions that enhance transparency in multi-currency settlements. Simultaneously, Gazprombank’s focus on trade finance across Eurasian corridors demonstrates a strategic shift toward building cross-border financing pools that complement Russia’s energy export routes. These initiatives collectively strengthen the country’s financial autonomy while ensuring corporate clients retain access to reliable credit and liquidity facilities.