South Korea Banking Market Outlook: Digital Wealth and Lifestyle Banking Expansion Defining the Future

Unlike many other Asian economies, South Korea banking sector has been quick to adopt API-driven open banking, enabling third-party fintech integration and accelerating financial inclusion across urban and rural communities. At the same time, consumer behavior—especially among younger demographics—has shifted toward lifestyle-driven banking, where mobile-first platforms provide not only transactions but also tools for budgeting, investing, and savings through gamified features. This evolution reflects the broader modernization of the country’s banking ecosystem, where customer experience is as critical as regulatory compliance and capital adequacy.

Note:* The banking market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

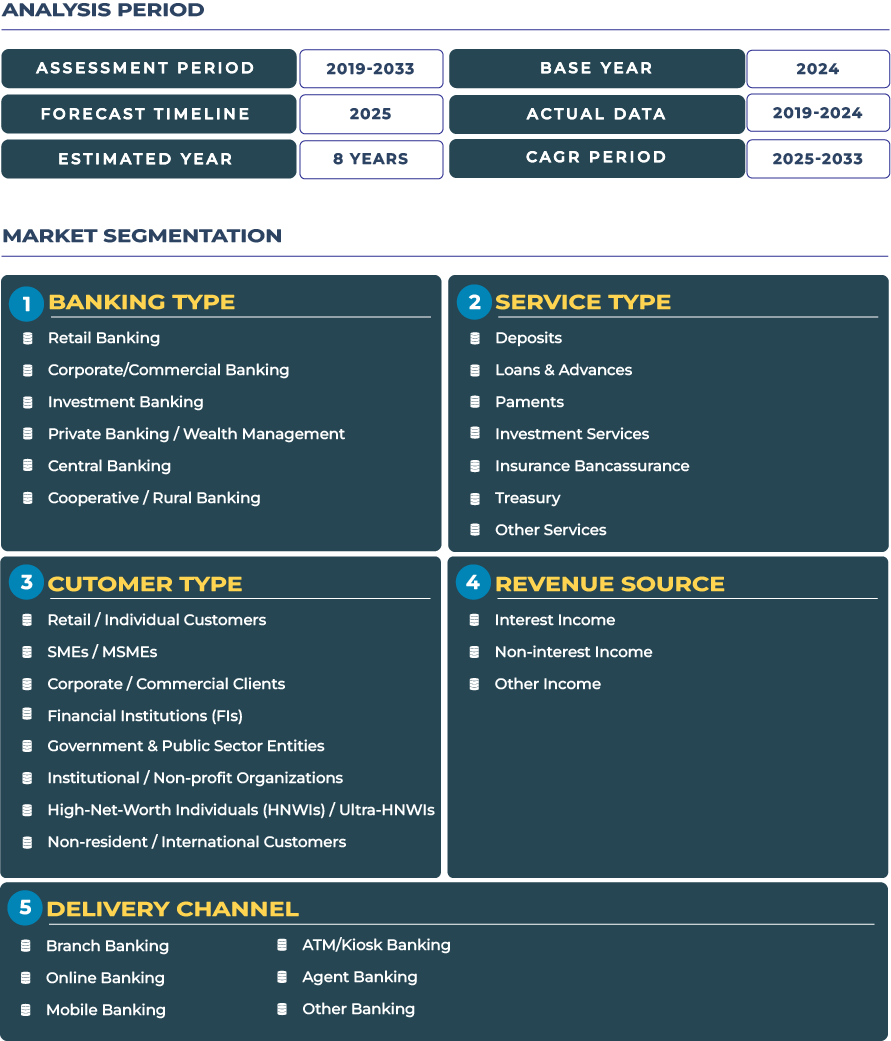

The South Korea banking market is estimated at USD 145.6 billion in 2025 and is expected to reach USD 205.1 billion by 2033, growing at a steady CAGR of 4.4% from 2025 to 2033. Market expansion is supported by rising disposable incomes, widespread adoption of open banking APIs, and increasing demand for digital wealth management solutions. Additionally, lifestyle banking applications targeting Gen Z and millennial customers are strengthening revenue streams for retail and private banking segments. Despite headwinds such as a talent shortage in digital skills and fragmented regulatory frameworks, South Korea’s banking industry continues to build resilience, positioning itself as one of the most digitally progressive banking markets in Asia. The momentum is especially visible in Seoul, Busan, and Incheon, where technology-driven services dominate the financial landscape.

Growth Drivers and Challenges: Understanding What Fuels and Constrains South Korea Banking Industry

Open Banking Ecosystem and Rising Consumer Incomes Accelerating Growth

One of the most significant growth drivers in South Korea’s banking market is the adoption of API-led open banking ecosystems. The government’s push for interoperability across banks and fintech providers has created an ecosystem where customers can seamlessly access services across multiple financial platforms. This has transformed retail banking, enabling customers to consolidate accounts, streamline payments, and access tailored credit services. In parallel, rising consumer disposable incomes have spurred demand for premium financial products, particularly in wealth management. With higher savings rates and increasing interest in investment diversification, South Koreans are turning to banks that provide sophisticated digital advisory and automated portfolio management solutions. This dual combination—an open API infrastructure and wealth-driven consumer behavior—is reshaping the growth trajectory of the sector.

Talent Gaps and Regulatory Fragmentation Slowing the Pace of Transformation

Despite its strengths, South Korea’s banking industry faces critical challenges. A persistent shortage of digital talent, particularly in advanced fields like cybersecurity, data science, and financial engineering, has slowed the pace of innovation for certain institutions. Smaller cooperative banks and rural financial institutions, in particular, struggle to recruit and retain skilled professionals capable of implementing next-generation digital solutions. Furthermore, regulatory fragmentation adds another layer of complexity. While the Financial Services Commission (FSC) has made strides in harmonizing banking regulations, inconsistencies across fintech licensing, consumer data privacy, and cross-border digital payments continue to create friction. These challenges underline the need for stronger collaboration between regulators, industry associations, and financial institutions to build an agile yet secure regulatory ecosystem.

Trends and Opportunities: Digital-First Banking and Gamified Financial Solutions Reshaping Consumer Behavior

Mobile-First Banking Adoption Accelerating Financial Access

South Korea’s banking landscape is increasingly dominated by mobile-first platforms, with customers favoring smartphone-based banking for transactions, investments, and credit applications. The surge in mobile app usage has been particularly strong in metropolitan regions like Seoul, where over 80% of banking transactions are completed digitally. Investment banking services are also being partially integrated into mobile applications, giving retail investors access to markets once limited to institutional clients. This mobile-first trend has amplified financial access, with younger generations leading adoption of instant credit scoring and micro-investment tools.

Gamification and Lifestyle Banking Creating New Growth Pathways

Gamification has emerged as one of the most transformative tools in engaging Gen Z and millennial customers. Banks in South Korea are embedding gamified savings challenges, interactive financial literacy tools, and reward-based investment programs into their digital platforms. These initiatives go beyond traditional banking, transforming customer relationships into lifestyle partnerships. For example, gamified financial apps in Seoul and Busan have shown higher retention rates among younger users, while also promoting savings discipline. Lifestyle banking, driven by these gamified features, is expected to create long-term loyalty and strengthen the competitive advantage of banks that prioritize customer-centric innovation.

Government Regulation: Policy Initiatives Strengthening Consumer Trust and Innovation

South Korea’s regulatory landscape plays a critical role in balancing innovation with consumer protection. The Financial Services Commission (FSC) has been at the forefront of implementing policies that promote open banking, financial innovation, and digital security. Regulatory frameworks have enabled fintechs and traditional banks to collaborate while ensuring consumer data protection under stringent privacy laws. The Bank of Korea has also maintained a proactive role in monitoring systemic risks, particularly as digital lending expands rapidly. Furthermore, government-led financial inclusion initiatives, including support for rural banking cooperatives, ensure that modernization does not come at the expense of marginalized communities. These regulatory efforts are crucial for sustaining trust in South Korea’s banking ecosystem.

Key Impacting Factors: Structural and Economic Elements Influencing Banking Performance

Multiple macro and micro-level factors are influencing the performance of South Korea’s banking market. Financial inclusion programs, supported by government initiatives, have ensured widespread access to banking services across both urban and rural populations. Deposit insurance schemes overseen by the Korea Deposit Insurance Corporation (KDIC) continue to safeguard customer confidence in the financial system. However, the market is also affected by global uncertainties, including regional geopolitical tensions that can impact foreign investment flows and consumer confidence. Additionally, the nation’s strong push toward digital transformation creates an environment where banks must balance innovation with cybersecurity risks. Together, these factors create a complex but forward-looking landscape for South Korea’s banking industry.

Competitive Landscape: Strategic Shifts by Leading Banks and International Players

South Korea’s banking sector is dominated by leading institutions such as KB Financial Group, Shinhan Financial Group, Hana Bank, and Woori Bank, each of which is actively expanding digital wealth management services. In 2024, KB Financial Group launched a new mobile wealth management platform aimed at retail investors, integrating robo-advisory services with gamified savings features. Shinhan Bank has expanded its API ecosystem, enabling third-party fintech providers to deliver personalized financial tools directly to its customers. Meanwhile, Hana Bank is focusing on digital lending solutions tailored to small businesses, while Woori Bank is piloting gamified credit score management tools for young customers. International players, including global investment banks, are also leveraging South Korea’s open banking infrastructure to expand cross-border wealth management and investment offerings. These competitive strategies demonstrate how the market is being redefined by digital-first innovation, customer-centric design, and collaborative ecosystems.

Conclusion: Building a Lifestyle-Centric and Digitally Empowered Banking Future in South Korea

South Korea’s banking market is evolving into a digitally empowered ecosystem defined by wealth-driven innovation, gamification, and customer-centricity. The rise of mobile-first platforms and open banking APIs has created an integrated financial environment where consumers can seamlessly manage their wealth, lifestyle, and transactions through a single interface. Gen Z and millennial customers, who increasingly prioritize gamified and lifestyle-driven financial services, are reshaping demand for banks to go beyond traditional offerings. Meanwhile, regulatory authorities are carefully balancing innovation with systemic stability, ensuring that modernization does not compromise consumer trust. Although challenges such as digital talent shortages and fragmented regulations persist, the overall market direction is positive, with institutions investing heavily in wealth management, lifestyle banking, and digital infrastructure. Ultimately, South Korea’s banking industry is poised to become a regional leader in embedding financial services into the daily lives of consumers, creating long-term value and resilience in an increasingly competitive global market.