Market Outlook: Navigating the Horizon for Spain Private Banking Ecosystem Through 2033

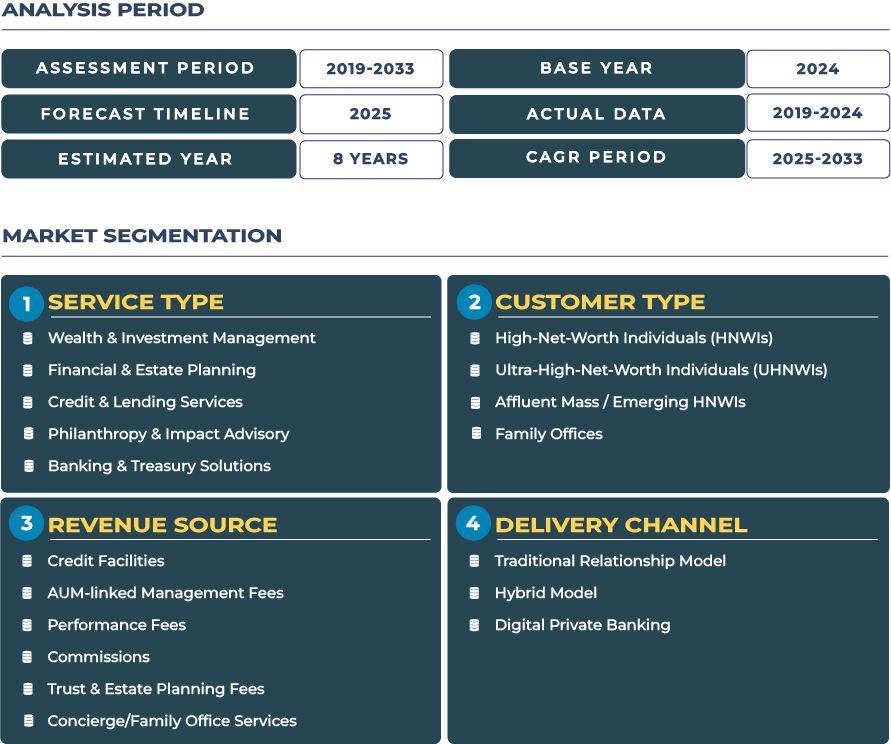

The outlook for the Spanish private banking market suggests a measured but strategic trajectory. With a forecast increase from USD 14.3 billion in 2025 to USD 16.3 billion in 2033-implying a CAGR of circa 1.6%-the market’s growth is modest yet significant in the context of digital-affluent generation and inbound wealth flows. Wealth & investment management demand grows in Spain as wealthy individuals seek integrated credit and lending services, estate and legacy planning, philanthropy & impact advisory and banking & treasury solutions tailored for global mobility.

Note:* The market size refers to the total revenue generated by banks through various services.

However, capturing this growth will require Spanish private banks to focus on service depth, client segmentation and digital engagement more than broad expansion. Spain economy continues to adjust to global headwinds-post-pandemic recovery, inflationary pressures, real-estate market shifts and geopolitical uncertainty (especially energy-related) all influence HNWI behaviour. Against this backdrop, institutions that embed digital onboarding, streamlined advisory platforms, cross‐border liquidity solutions and next-gen wealth services will be positioned to maximise growth in a low-growth but evolving private banking environment.

Driving Forces & Growth Barriers: Core Catalysts and Impediments in Spain Private Banking Sector

Spain private banking sector is propelled by several compelling drivers. First, the tourism and residency-incentive economy have created new affluent entrants with global wealth profiles, increasing demand for wealth & investment management and banking & treasury solutions. Second, family business wealth and property ownership (especially in coastal and resort regions) underpin demand for estate and legacy planning, credit & lending services and philanthropic advisory. Third, the digital-native affluent generation is pushing private banks to redesign their service models around mobile and real-time engagement, thereby increasing wallet share per client and raising margin opportunity for banks that respond.

On the flip side, the growth of Spain private banking market is constrained by factors such as franchise fragmentation, margin pressure and political volatility. According to the Banco de España analysis, the banking-sector concentration in Spain rose significantly-five largest banks increased their market share from ~40% in 2007 to around ~70% in 2023, reflecting structural banking ecosystem pressures. This concentration limits competitive manoeuvrability for private banks. Additionally, fee compression in wealth management, regulatory burden, high cost-to-serve for boutique models and fluctuations in the real‐estate cycle temper growth expectations. The modest 1.6% CAGR thus reflects a market that must rely on strategic segmentation and service enhancement rather than volume expansion.

Evolving Patterns & Opportunity Zones: Digital Onboarding, ESG-Tourism Funds and the Iberian Wealth Corridor in Spain Private Banking Market

In Spain private banking sector, three trend vectors dominate: digital onboarding and hybrid advisory models, ESG-linked tourism and hospitality wealth vehicles, and cross-border Iberian wealth mobility. Private banks are increasingly offering app-based advisory, integrated payments/treasury access and tailored credit solutions for wealthy clients. ESG tourism funds-linking real estate, hospitality and sustainability-are becoming investor preferences among wealthy individuals in Spain. Meanwhile, the Portugal-Spain UHNW corridor is gaining traction as wealthy families seek residency, tax optimisation and cross-border wealth structuring, creating demand for private banks with multi-jurisdictional advisory capabilities.

Spanish private banking firms can capitalise on several high-value opportunities. They include family-office consolidation services-providing full-service wealth platforms for multi-generational families, integrating estate planning, philanthropy, investment and treasury workflows. ESG hospitality funds present a niche where wealth preservation, impact investing and real-asset exposure coalesce-a compelling proposition for affluent clients in Spain coastal luxury zones. Digital onboarding and fintech alliances offer scalable ways to access next-gen affluent clients and deliver personalized experiences with lower cost-to-serve. Coastal hubs such as Barcelona, Madrid (residential north) and Marbella are geographic opportunity zones for private banks focused on digital, international and lifestyle-wealth clients.

Competitive Landscape: Strategic Realignment in Spain Private Banking Industry

The Spanish private banking market is witnessing strategic repositioning and intensified competition. A leading player, CaixaBank, garnered national recognition as “Best Private Bank in Spain 2025” and surpassed €50 billion in assets under independent advisory by mid-2025, reinforcing its leadership in digital advisory and family-office service offerings. This reflects a broader shift toward advisory transparency, client segmentation and digital-first service models among Spanish private banks.