US Fintech Market Outlook: FedNow as the Catalyst for Real-Time Financial Innovation in the U.S. Fintech Market

The U.S. fintech market is entering a transformative phase, shaped by the nationwide rollout of the FedNow Service. As the country’s first instant payments infrastructure operated by the Federal Reserve, FedNow is enabling fintechs, banks, and payment service providers to deliver faster, safer, and always-available transactions. This backbone is particularly critical for small and medium-sized enterprises (SMEs) that depend on efficient cash flow, while also redefining consumer expectations for immediacy in financial services. The ecosystem is also witnessing a wave of mergers and acquisitions designed to accelerate the deployment of FedNow-enabled solutions, especially across digital lending and merchant payments.

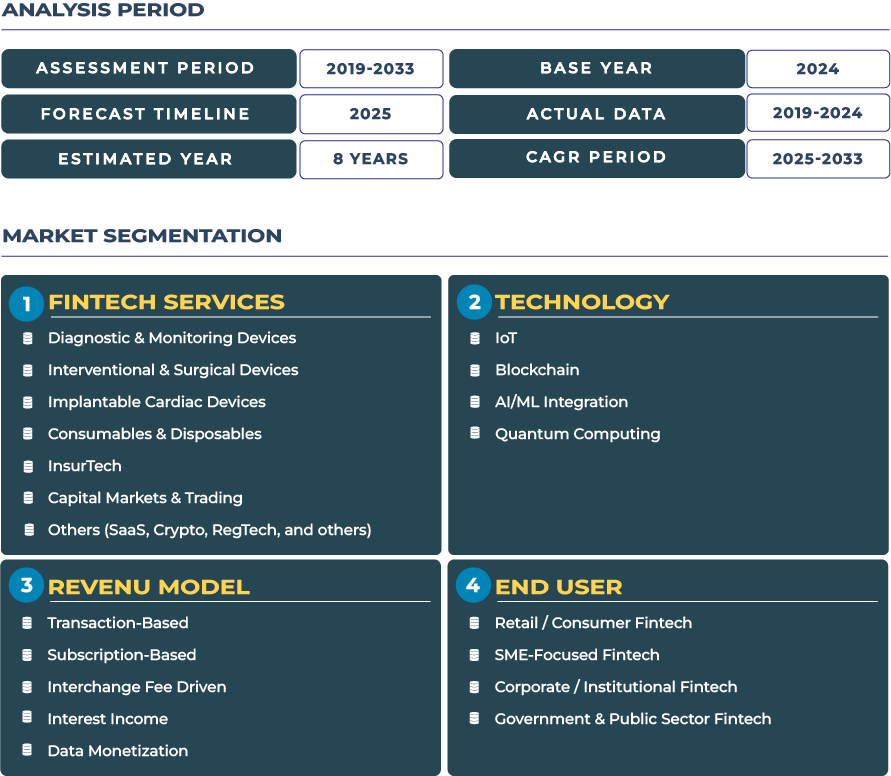

Based on DataCube Research estimates, the U.S. fintech market is valued at USD 106.3 billion in 2025 and projected to reach USD 223.7 billion by 2033, reflecting a healthy CAGR of 9.8% from 2025 to 2033. This trajectory underscores how the combination of regulatory innovation, market demand, and private-sector capital is powering growth across payments, digital lending, insurtech, and wealthtech verticals. The adoption of instant payments is not only improving transaction efficiency but also serving as the gateway for embedded finance, decentralized trading, and tokenization initiatives.

U.S. Fintech Market Driven by Digital Transformation and Instant Payments

The U.S. fintech market is advancing toward an innovation-centric era in which the focus has shifted from digitizing banking functions to delivering real-time, data-driven services. The introduction of FedNow in 2023 represents a structural change, enabling 24/7 real-time payments, and it is rapidly being integrated by fintech players to roll out new consumer and business products. The broader ecosystem is capitalizing on opportunities in digital lending, where AI-driven credit assessment tools are accelerating SME financing approvals and reducing reliance on legacy banking infrastructure. Similarly, insurtech platforms are modernizing claims processing by integrating instant settlement capabilities tied to the FedNow rail.

The steady double-digit expansion expected through 2033 is supported by four major enablers: a large digitally active population, an advanced startup ecosystem, robust capital markets, and a favorable regulatory environment. Moreover, the U.S. retains its competitive edge by fostering innovation hubs in regions such as California, New York, and Texas, where collaboration between banks and fintech startups accelerates commercialization. Collectively, these factors position the U.S. fintech sector as a global leader, increasingly influencing international payment standards and capital markets digitization.

Key Drivers and Restraints Defining the Growth Trajectory of the U.S. Fintech Sector

Large digital consumer base and deep capital markets drive momentum

With over 85% of U.S. adults owning smartphones and actively engaging in digital banking, the consumer base for fintech is unmatched. Venture capital and private equity inflows remain substantial, with fintech investments ranking among the top five technology verticals in U.S. startup funding. Companies like PayPal continue to strengthen their positions by leveraging open banking APIs and embedded finance opportunities. These dynamics are complemented by a regulatory ecosystem that encourages competition and financial inclusion.

Strict consumer protection and litigation risk temper acceleration

However, the sector faces challenges from stringent enforcement by the Consumer Financial Protection Bureau (CFPB). Enhanced scrutiny on lending practices, credit reporting, and consumer rights increases compliance costs and exposes fintechs to higher litigation risks. For example, regulatory pushback on high-interest digital lending models has delayed product rollouts. The costs of maintaining compliance-ready frameworks, combined with growing cyber-risk liabilities, act as brakes on otherwise strong growth momentum. Nevertheless, fintechs that effectively balance innovation with compliance will remain resilient in this regulatory climate.

Major Trends and Untapped Opportunities in the Evolving U.S. Fintech Landscape

Robo-advisors and AI-led digital investments mainstreaming

The adoption of robo-advisors is steadily entering the mainstream as consumers demand low-cost, algorithm-driven wealth management. Platforms integrating tax optimization and ESG-linked investment portfolios are gaining momentum, especially among younger demographics. This transformation is further fueled by the democratization of wealthtech applications that provide retail investors with access to once-exclusive capital markets instruments.

SME lending digitalization and tokenization pilots create new avenues

Fintechs are increasingly addressing gaps in SME credit access by using real-time transaction data and alternative scoring models. Digital lenders are building on FedNow’s infrastructure to offer same-day working capital disbursements, creating a competitive edge over traditional banks. Parallelly, tokenization pilots in U.S. capital markets are redefining securities settlement and expanding the scope of insurance-linked securities. These pilots, backed by strong interest from institutional investors, open doors for fintech players to bridge traditional finance with decentralized solutions.

Government Regulations and National Initiatives Reshaping the Fintech Industry

The U.S. fintech industry is deeply shaped by government initiatives and oversight. Apart from the CFPB, agencies such as the U.S. Securities and Exchange Commission (SEC) and the Federal Reserve play vital roles in ensuring systemic stability and consumer safety. The launch of FedNow exemplifies proactive policymaking aimed at modernizing the national payments ecosystem. Regulations around open banking, digital lending transparency, and insurtech product approvals are aligning with the broader goal of enhancing financial inclusion while preventing systemic risks. Furthermore, the SEC’s experimentation with tokenized assets demonstrates the government’s readiness to cautiously explore frontier technologies without undermining investor protection.

Economic and Structural Factors Shaping the Performance of the U.S. Fintech Market

Venture capital flows, rising interest rates, and consumer demand for instant payments are among the most significant economic drivers impacting fintech growth. According to the U.S. Department of the Treasury, venture capital investment into financial technology exceeded USD 25 billion in 2023, underlining continued investor confidence despite macroeconomic headwinds. Additionally, adoption of real-time payments is accelerating by 2025, it is expected that over 30% of U.S. retail payments could be routed through instant settlement systems. Meanwhile, geopolitical tensions and inflationary pressures have spurred fintechs to focus on efficiency-driven solutions such as digital lending automation, while also increasing demand for embedded insurance and cross-border payment services. These structural factors collectively underscore the resilience of the U.S. fintech ecosystem.

Competitive Landscape and Strategic Moves Reshaping the U.S. Fintech Ecosystem

The U.S. fintech sector is experiencing rapid competitive realignment as firms launch FedNow-enabled products and engage in acquisitions to accelerate adoption. The Federal Reserve officially launched FedNow on July 20, 2023, establishing a transformative payments rail that fintech companies and banks are racing to integrate. For instance, regional banks have already announced partnerships with fintech providers to deploy instant payment solutions tailored for SMEs and healthcare claims processing. Product launches are focused on embedding real-time payments in merchant checkout systems, while acquisitions are concentrated on securing digital lending and risk analytics capabilities.

Leading companies such as PayPal, Square (Block), and SoFi are strategically expanding their portfolios to capture growth across multiple fintech verticals. In 2024, SoFi enhanced its digital lending capabilities through the acquisition of a credit decisioning platform, while PayPal advanced its open banking strategy by integrating instant cross-border remittance services. The competitive landscape is also enriched by niche insurtech startups that leverage AI-powered claims automation tied to real-time disbursements. The interplay between incumbents, startups, and regulators creates a dynamic environment where competitive advantage hinges on agility, compliance, and technology integration.

Conclusion: Building the Future of U.S. Fintech Through Real-Time Payments and Strategic Collaboration

The U.S. fintech industry stands at a critical juncture where FedNow’s launch, combined with strong consumer demand for digital-first services, is setting the stage for sustainable expansion. Instant payments are no longer a convenience but a baseline expectation, and fintech players that fail to adapt will risk marginalization. The convergence of payments, lending, insurtech, and wealthtech under a unified innovation agenda highlights the sector’s ability to reshape both consumer and institutional finance. While regulatory scrutiny remains a persistent challenge, it simultaneously strengthens the industry by ensuring transparency and consumer trust.

Going forward, the U.S. fintech landscape will increasingly be defined by its ability to balance rapid innovation with compliance, expand inclusion through digital lending, and harness tokenization to transform capital markets. Strategic acquisitions, alliances, and product launches tailored to FedNow capabilities will further cement the sector’s position as a global leader. Ultimately, the U.S. fintech market’s trajectory reflects not just technological advancement, but also a profound restructuring of financial intermediation that aligns with the digital economy of the future.