Open Banking Integration Reshaping Corporate Banking Efficiency in Western Europe

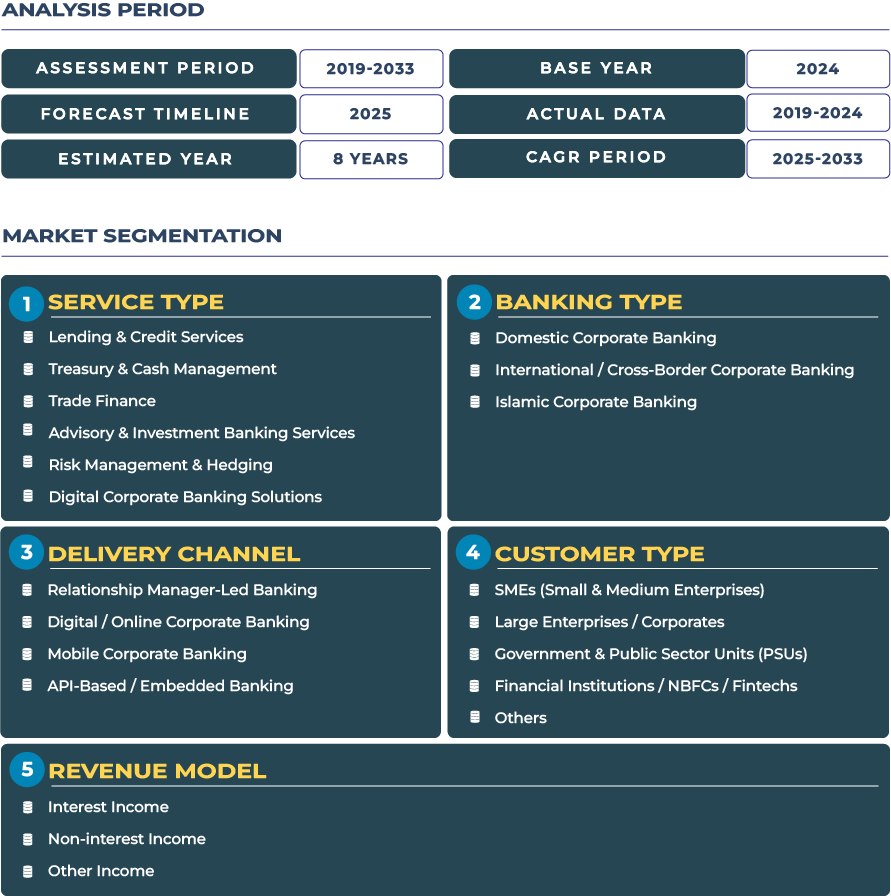

Western Europe corporate banking market is undergoing a structural transformation driven by open banking APIs and the continued evolution of the Payment Services Directive 2 (PSD2) framework. Corporate banks across the region, from BBVA and Santander to Deutsche Bank and BNP Paribas, are leveraging API-based connectivity to enable real-time liquidity, multi-entity cash visibility, and seamless treasury management. The Western Europe Corporate Banking Market, valued at USD 463.1 billion in 2025, is projected to reach USD 580.6 billion by 2033, growing at a CAGR of 2.9% from 2025 to 2033. This evolution is shaped by expanding fintech integrations, cross-border trade finance digitalization, and heightened corporate demand for flexible credit and treasury ecosystems.

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

Western Europe Corporate Banking Market Outlook: API-Driven Treasury and Liquidity, The Next Corporate Advantage

Open banking has matured in Western Europe beyond retail applications, extending deeply into the corporate banking ecosystem. Financial institutions are now prioritizing real-time data exchange for treasury, cash flow forecasting, and working capital optimization. The rise of API-driven liquidity platforms is enabling corporations to consolidate multicurrency accounts across subsidiaries, a critical advantage for exporters and multinational groups managing euro, pound, and franc flows. This integration is reshaping the corporate cash management landscape, allowing CFOs to shift from reactive liquidity management to predictive decision-making.

The market’s sustained expansion is supported by the European Central Bank’s (ECB) emphasis on fostering interoperable financial infrastructures through the TARGET Instant Payment Settlement (TIPS) system, ensuring corporate treasuries benefit from instant settlements across borders. Despite economic headwinds caused by the Russia-Ukraine conflict and persistent inflationary pressures, Western Europe corporate banking sector remains resilient, underpinned by robust digital adoption, regulatory modernization, and the increasing demand for green transition financing.

Growth Catalysts: Green Financing, Fintech Synergies, and Multi-Currency Management

The Western European corporate banking industry’s growth is anchored in structural drivers, most notably the green transition financing push. Corporate banks are increasingly aligning their lending portfolios with sustainability objectives, offering transition loans and sustainability-linked credit lines to support Europe’s decarbonization targets. For example, major lenders like BNP Paribas and HSBC have expanded their sustainability desks to cater to renewable project finance and carbon-neutral industrial expansion.

In parallel, corporate-fintech partnerships are redefining operational efficiency. These collaborations are particularly visible in cash pooling automation, predictive risk analytics, and API-enabled reconciliation. Companies leveraging real-time treasury dashboards have gained improved intraday cash visibility, enhancing their liquidity management posture across jurisdictions. Furthermore, large export corporations in Germany and the Netherlands are demanding multicurrency cash management solutions that integrate seamlessly with ERP systems, further catalyzing digital adoption across trade finance and treasury segments.

Restraints: Compliance Complexity and Legacy Integration Challenges

Despite strong growth indicators, the Western Europe corporate banking landscape faces notable headwinds. Regulatory fragmentation across jurisdictions imposes a high cost of compliance, particularly for institutions operating across the EU, UK, and EFTA. Divergent interpretations of anti-money laundering (AML) and know-your-customer (KYC) rules across national regulators amplify operational burden and technology integration challenges.

Moreover, legacy enterprise resource planning (ERP) systems within large corporations remain slow to adapt to the API-first banking model. This limits the pace at which digital treasury and payment innovations can scale. Smaller banks and mid-tier institutions also struggle with resource-intensive PSD2 compliance upgrades, hindering competitive parity with large global incumbents. Collectively, these factors temper the pace of transformation, though they simultaneously create opportunities for RegTech and middleware providers to bridge integration gaps.

Trends and Opportunities: ISO 20022 Standardization and Embedded Corporate Banking

One of the most significant ongoing shifts in Western Europe corporate banking industry is the adoption of the ISO 20022 messaging standard. This standard enables richer payment data, enhancing automation in reconciliation, fraud monitoring, and liquidity management. Banks such as UniCredit and Deutsche Bank are already implementing ISO 20022-compliant platforms to improve efficiency and transparency across corporate payment channels.

Simultaneously, corporate demand for embedded banking, integrating financial services directly into ERP or supply chain management tools, is growing rapidly. Manufacturers and logistics companies are adopting embedded financing for supplier payments, while automakers and energy firms are exploring captive green loan facilities to meet sustainability targets. This integration of financial services into corporate workflows marks a fundamental shift from transactional to relationship-based banking, positioning Western Europe at the forefront of the next phase of corporate digital transformation.

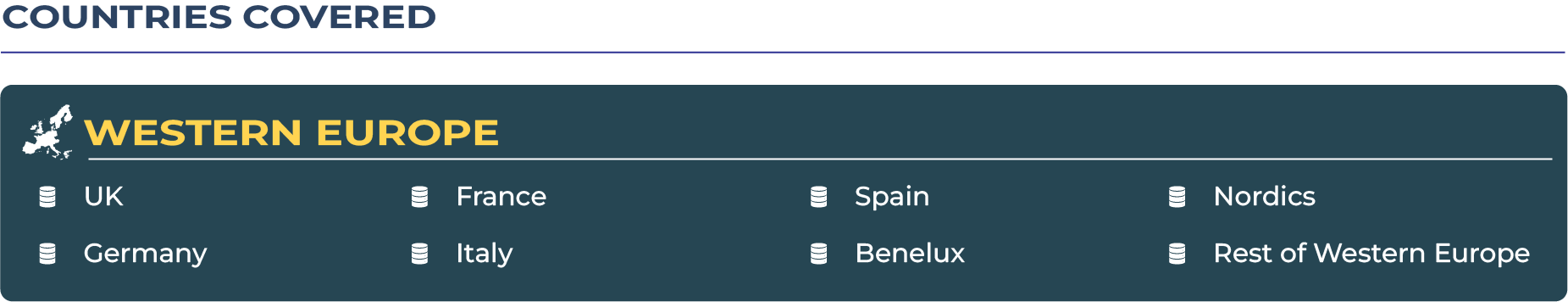

Regional Analysis by Country

United Kingdom

The UK corporate banking sector remains an innovation hub, leveraging Bank of England’s digital payment policies and open banking frameworks to enhance multicurrency treasury systems. Fintech-bank collaborations remain strong, with London continuing to be Europe’s fintech capital.

Germany

German banks emphasize export-oriented financing and structured trade support. Deutsche Bank and Commerzbank are leading in ESG-linked lending, with API-based treasury automation gaining traction among industrial manufacturers.

France

France corporate banking ecosystem benefits from strong government support for sustainability-linked loans. BNP Paribas is spearheading ESG innovation, integrating green finance into its corporate lending portfolio.

Italy

Italian institutions are modernizing trade finance operations through blockchain pilots and multicurrency pooling. UniCredit continues to expand its digital treasury platform capabilities across European subsidiaries.

Spain

Spanish banks like Santander and BBVA are advancing cross-border corporate payment services and embedded finance solutions. Treasury automation for exporters is becoming a major differentiator.

Benelux

Benelux countries are leading in fintech-bank co-innovation. Dutch banks are strong in green bond underwriting, while Luxembourg continues to grow as a hub for digital treasury management centers.

Nordics

Nordic banks are leveraging ISO 20022 and AI-based liquidity analytics to streamline trade finance and supply chain payments, with strong regulatory alignment through the Nordea group.

Competitive Landscape: Strategic Innovation Among Western European Banking Leaders

The Western Europe corporate banking landscape is dominated by key players including Santander, BNP Paribas, HSBC, BBVA, UniCredit, and Deutsche Bank. These institutions are adopting multi-pronged strategies to maintain competitiveness. In 2024, Deutsche Bank announced an ISO20022-ready multicurrency pooling service to facilitate liquidity visibility for multinational corporations. BNP Paribas expanded its Green Transition Loan Desk to align with EU sustainability frameworks, while Santander introduced embedded payroll and supplier finance solutions for manufacturing clients.

The competitive environment emphasizes innovation-driven differentiation. Banks that can seamlessly combine compliance readiness with digital agility, especially through API ecosystems, will capture growing demand from Europe’s multinational corporates seeking unified treasury and trade solutions.