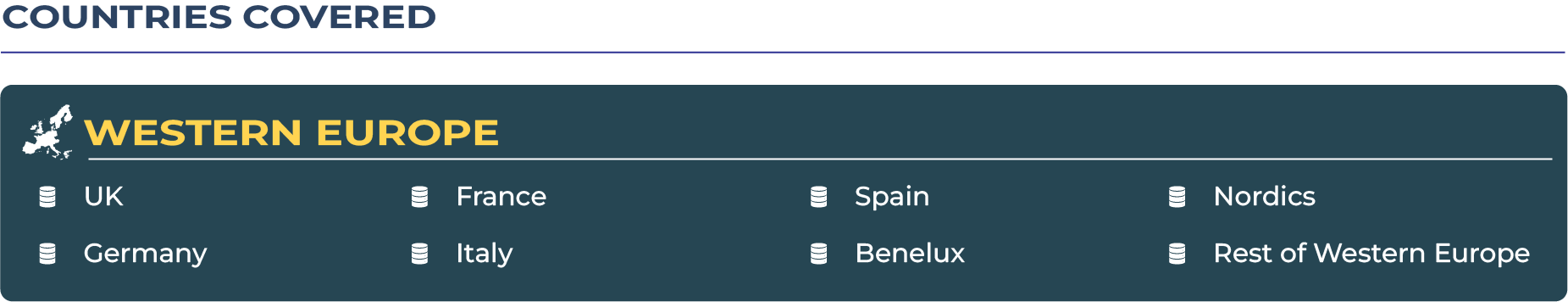

Western Europe Diagnostic Imaging Devices Market Outlook: Evidence-Based Imaging Transformation Shapes the Future of Clinical Diagnostics

Western Europe is redefining its healthcare diagnostics through evidence-based, data-validated, and efficiency-driven imaging innovation. The Western Europe Diagnostic Imaging Devices Market is transitioning toward clinically validated, AI-enhanced imaging solutions that strengthen diagnostic accuracy and streamline hospital workflows. Backed by government-led modernization programs and high public healthcare expenditure, Western Europe diagnostic imaging devices market is poised for consistent growth from USD 9.1 billion in 2025 to USD 12.1 billion by 2033, growing at a CAGR of 3.6%. The transformation is driven by an increasing focus on clinical efficacy, operational optimization, and the integration of intelligent imaging platforms in major hospitals across Germany, France, and the UK.

Modern imaging solutions such as hybrid PET/CT scanners, digital radiography, and advanced ultrasound systems are being deployed to reduce diagnostic turnaround time and enhance early disease detection. The region’s commitment to evidence-based medicine ensures that every imaging advancement, whether a low-dose CT innovation or AI-assisted MRI workflow, is backed by robust clinical validation. As Western Europe continues to merge regulatory discipline with digital innovation, it is positioning itself as a leader in precision imaging and healthcare quality assurance.

Western Europe’s Imaging Revolution Anchored in Clinical Evidence and Efficiency

The Diagnostic Imaging Devices Market in Western Europe stands as a benchmark for integrating scientific rigor with cutting-edge technology. The region’s healthcare systems are leveraging extensive datasets, clinical trials, and radiology informatics to improve diagnostic reliability. Investments from public health authorities and research organizations are fueling the digitization of imaging archives and enhancing interoperability across hospitals. The European Health Data Space initiative continues to provide a structured framework for data sharing and validation, making clinical imaging more collaborative and data-driven.

Despite inflationary pressures and post-pandemic fiscal adjustments, countries such as Germany and France continue to prioritize imaging modernization in public hospitals. The push toward green healthcare and sustainability also influences equipment design, encouraging vendors to develop low-energy systems and recyclable imaging components. As hospitals emphasize measurable outcomes, procurement models are shifting from hardware-centric purchasing to outcome-based service contracts. This paradigm emphasizes uptime, workflow optimization, and diagnostic precision, hallmarks of Western Europe’s data-backed healthcare evolution.

Drivers & Restraints: Financial Commitment Meets Procurement Challenges in Imaging Innovation

Robust Healthcare Investments and Academic Collaborations Accelerate Imaging Modernization

High public healthcare spending remains the primary engine behind the region’s imaging transformation. Germany’s federal healthcare modernization initiatives and France’s digital hospital programs are enabling broad-based replacement of outdated imaging systems. Large academic hospitals across the Nordics and Benelux are deploying enterprise radiology IT and piloting AI-assisted image interpretation systems that increase diagnostic throughput while maintaining clinical quality. These efforts are complemented by strong partnerships between medical universities and technology companies, leading to faster validation cycles for new imaging modalities and cross-border collaboration in clinical research.

Austerity Measures and Bureaucratic Procurement Processes Limit Market Agility

Despite these growth levers, fiscal constraints and prolonged procurement cycles pose challenges. Tight hospital budgets in countries undergoing healthcare austerity measures often delay equipment upgrades and reduce capital-intensive purchases. The tender-based procurement system in public hospitals, though designed to ensure transparency, frequently results in long lead times that can slow down technology adoption. Moreover, high energy costs and inflationary trends add further strain to hospitals’ capital allocation for new imaging infrastructure. These factors create a cautious but evolving investment climate, requiring vendors to align with value-based pricing models and flexible service-level agreements.

Trends & Opportunities: Collaborative Networks and Value-Centric Imaging Set the Direction

Cross-Hospital Imaging Networks Drive Regional Diagnostic Standardization

One of the most transformative trends in Western Europe diagnostic imaging devices sector is the development of cross-hospital imaging networks and centralized reading centers. These systems enhance collaboration between tertiary hospitals and local clinics, enabling efficient use of resources and faster image review. The UK and France are leading in implementing nationwide teleradiology programs that link regional imaging centers through secure cloud-based PACS infrastructure. This interconnected approach promotes equitable access to expert radiology, reduces diagnostic delays, and helps mitigate workforce shortages in specialized imaging roles.

Patient-Centric Imaging and Service-Level Differentiation Create New Growth Avenues

Healthcare systems across Western Europe are pivoting toward patient-centric imaging pathways that emphasize convenience, safety, and continuity of care. The rise of outpatient diagnostics centers equipped with compact MRI and ultrasound systems is reshaping the accessibility of imaging services. Meanwhile, device manufacturers are capitalizing on this trend by offering differentiated service models, such as uptime guarantees and remote technical assistance, that appeal to hospitals with tight operational schedules. Vendors adopting such SLA-driven engagement models are witnessing higher retention rates and greater market penetration in competitive urban regions.

Regional Analysis by Country

United Kingdom

- The UK market is advancing through the National Health Service’s (NHS) digital diagnostic transformation strategy, focusing on reducing imaging backlogs and improving regional accessibility. Increasing partnerships with private diagnostic centers are driving upgrades in MRI and CT infrastructure.

Germany

- Germany remains Western Europe’s largest market, driven by significant federal healthcare investments and a strong industrial ecosystem. Hospitals are actively integrating AI-validated MRI and PET/CT technologies to enhance early disease detection.

France

- France diagnostic imaging sector is benefitting from public funding for hospital modernization and the rollout of interoperable digital platforms. French hospitals are early adopters of cloud-based imaging and radiation dose optimization solutions.

Italy

- Italy is focusing on improving imaging infrastructure in regional hospitals through government-supported healthcare initiatives. The emphasis on cost-efficient ultrasound and X-ray systems is addressing diagnostic gaps in secondary care facilities.

Spain

- Spain’s market is driven by growing adoption of mobile and portable diagnostic units to improve accessibility in remote regions. The nation’s healthcare reforms support public-private partnerships for diagnostic equipment renewal.

Benelux

- Countries in the Benelux region, including Belgium and the Netherlands, are prioritizing digital imaging integration and PACS interoperability. Hospitals are also investing in advanced CT systems for cardiovascular and oncology diagnostics.

Nordics

- Nordic nations are among the earliest adopters of AI-enhanced imaging, emphasizing precision medicine and sustainability. Public healthcare systems prioritize low-dose imaging and eco-friendly equipment procurement practices.

Competitive Landscape: Evidence-Led Innovation and Intelligent Imaging Define Market Leadership

The competitive environment in Western Europe Diagnostic Imaging Devices Market is characterized by evidence-based innovation and collaboration between technology providers and clinical institutions. Companies like Philips and United Imaging are actively deploying next-generation imaging solutions tailored for European hospitals. In June 2025, Philips launched its SmartCT platform across Europe, enhancing stroke diagnosis through intelligent 3D imaging and optimized workflow automation. Similarly, United Imaging expanded its European footprint by showcasing molecular imaging and PET advancements at EANM/ECR events in 2024–2025, highlighting its strategic focus on molecular diagnostics and precision imaging.

Vendors are targeting university hospitals with evidence-led imaging portfolios that act as reference sites for clinical adoption. This localization strategy emphasizes regional compliance, clinical validation, and operational support. By embedding intelligent imaging analytics, predictive maintenance, and digital service bundles, manufacturers are strengthening their competitive positioning in a market where quality assurance and efficiency drive procurement decisions.