Offshore Wealth Protection and Digital Adaptation: Navigating Zimbabwe Private Banking Market

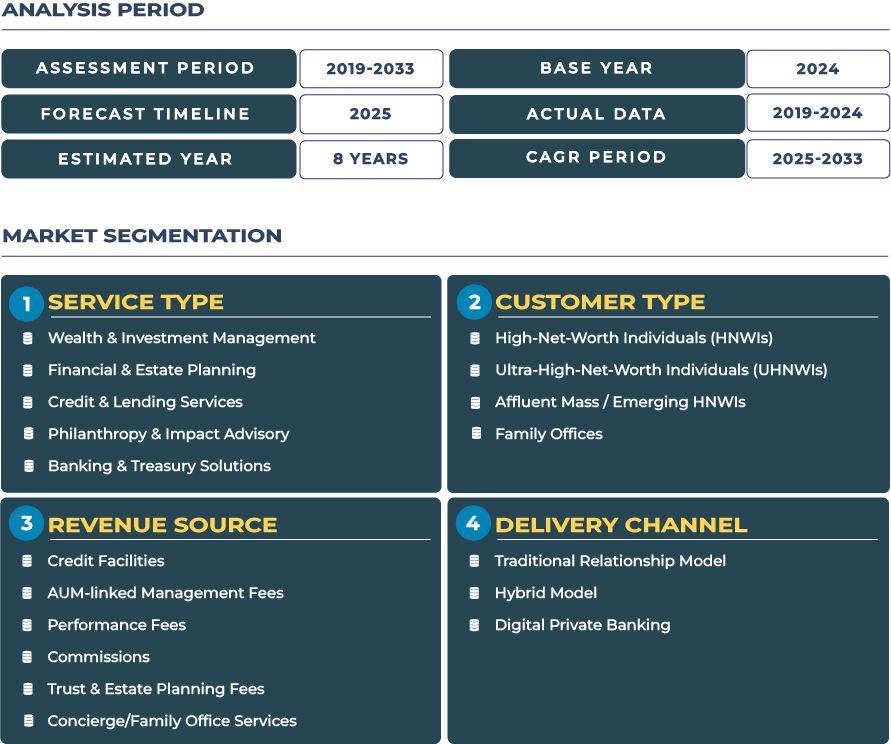

In Zimbabwe private banking ecosystem, affluent individuals and business owners increasingly focus on wealth preservation through offshore channels and digital platforms. With an estimated market size of around USD 838.6 million in 2025 and forecast to reach approximately USD 1.7 billion by 2033-indicating a compound annual growth rate (CAGR) of circa 9.6% -the growth reflects rising demand for personalized wealth & investment management, credit & lending linked to commodity and business wealth, and digital banking & treasury services capable of cross-border structuring. Against a backdrop of volatile currency regimes and macroeconomic uncertainty, Zimbabwe’s private banking sector is evolving towards digital‐first models and offshore wealth steering strategies.

Market Outlook – Unlocking Wealth-Preservation & Digital-Onboarding in Zimbabwe’s Private Banking Landscape

The outlook for Zimbabwe private banking market is built on three interrelated pillars. First, growing resource-based wealth-particularly in mining, agriculture, and diaspora remittances-is generating demand for private banking services offering tailored wealth & investment management, estate planning and treasury solutions. Private banks are increasingly offering credit & lending structures tied to commodity holdings, real estate and business assets to wealthy clients seeking liquidity. Second, digital adaptation is a key enabler: the fintech ecosystem in Zimbabwe is expanding, enabling mobile banking, digital onboarding and offshore access for high‐net-worth individuals who are seeking capital preservation and global investment exposure. For example, platforms such as EcoCash pioneered mobile financial inclusion and now signal the broader shift toward digital private-wealth access.

Note:* The market size refers to the total revenue generated by banks through various services.

Thirdly, given the macroeconomic challenges-currency de-valuation, inflation, regulatory change-private-banking providers must emphasise cross‐border structuring, multi-currency treasury, and trusted advisory relationships. The rising trend of affluent Zimbabweans placing wealth offshore and the growing call for international asset diversification highlight the significance of this shift. Yet the market faces headwinds: political and economic uncertainty, limited global product depth, and regulatory complexity. Providers that deliver robust advisory frameworks, digital accessibility and offshore connectivity will gain competitive advantage in Zimbabwe’s private banking sector.

Drivers & Restraints – Forces Determining Zimbabwe’s Private Banking Industry Trajectory

Growth Drivers: Resource Wealth, Diaspora Inflows and Fintech Expansion

Zimbabwe’s private banking market is supported by a set of powerful growth drivers. The country’s substantial resource base-mining of gold, platinum and diamonds-has led to concentrated wealth creation, thereby creating demand for wealth & investment management tailored to business owners and natural resource stakeholders. At the same time, diaspora remittances and foreign currency inflows provide both asset diversification and wealth-preservation demand, increasing the addressable private-banking client base. Moreover, fintech expansion is playing a critical role: digital remittance platforms, mobile banking adoption and evolving regulatory frameworks enable private banks to onboard clients more efficiently and extend advisory services beyond traditional urban wealth centres.

Growth Restraints: Hyperinflation, Currency Instability and Political Risk

However, the Zimbabwe private banking industry confronts significant restraints. Persistently high inflation and currency instability undermine domestic asset values and client confidence in local treasury solutions-many clients continue to prefer USD or offshore structures. Zimbabwe’s newly introduced ZiG gold-backed currency continues to face significant market scepticism, evidenced by a persistent 20% disparity between the official exchange rate and the parallel market. Political risk and regulatory unpredictability further complicate long-term wealth-planning strategies. The market’s small size, limited presence of global private-wealth firms and relatively under-developed trust & estate advisory infrastructure also restrict scale and sophistication. In this environment, private-banking providers must balance growth ambitions with risk mitigation, product innovation and digital cost efficiency.

Trends & Opportunities – Emerging Dynamics and Strategic Pathways in Zimbabwe’s Private Banking Ecosystem

Key Trends: Digital Currency Adoption, Offshore Wealth Channels and Remittance-Linked Products

Several compelling trends are shaping Zimbabwe’s private banking landscape. Digital-currency adoption and mobile wealth platforms are becoming prominent as affluent clients seek secure, accessible treasury and investment tools despite local macro constraints. Offshore wealth channels are also gaining traction, with private-banking clients increasingly deploying assets in neighbouring jurisdictions or offshore vehicles to hedge domestic risk. Meanwhile, remittance-linked wealth products-tailored for diaspora clients or local business owners receiving foreign-currency inflows-are emerging as a niche service line within the private-banking ecosystem. Banks are designing advisory, credit and treasury solutions specifically for this cohort.

Strategic Opportunities: Diaspora-Wealth Banking, Fintech Private-Wealth Services and Digital Remittances Focus

The strategic opportunity set in Zimbabwe’s private banking market is notable. One area is diaspora-wealth banking: private banks can offer comprehensive wealth & investment management, estate/family-office advisory and offshore treasury services targeted to clients abroad or returning to Zimbabwe. Another opportunity lies in fintech private-wealth services-banks partnering with digital-platform providers to deliver mobile onboarding, portfolio access and cross-border advisory at scale, thereby lowering cost-to-serve. A third promising avenue is digital remittance-linked wealth products-designing investment solutions, treasury services and credit facilities tied to incoming foreign-currency flows, enabling affluent clients to convert remittances into structured wealth accumulation strategies. These opportunities offer private-banking firms pathways to differentiate and grow off a challenging domestic base.

Competitive Landscape – How Providers Are Positioning in Zimbabwe’s Private Banking Sector

The competitive landscape in Zimbabwe’s private banking market is defined by local players developing niche wealth-services and digital interfaces. A prominent provider is CBZ Bank Limited, which publicly promotes a private banking unit offering personalized financial solutions, portfolio management and safe custody services tailored to affluent clients. Other banks, such as Nedbank Zimbabwe, feature private banking desks oriented toward high-net-worth clients, wealth advisory and integrated banking services. Domestic institutions are focused on digital-wealth delivery, offshore-asset access partnerships, and diaspora banking services. International entrants and wealth managers looking at Zimbabwe must navigate the macro environment and client-acquisition costs carefully. Differentiation in this market stems from digital infrastructure, cross-border advisory capacity and trusted local relationship-management-a combination that will define leadership in the private banking ecosystem.

Strategic Imperatives for Stakeholders in Zimbabwe’s Private Banking Market

To succeed in Zimbabwe’s private banking sector, institutions must adopt clear strategic priorities. First, develop advisory depth across wealth & investment management, estate/family-office planning, credit & lending tied to commodity/business holdings, and philanthropy & impact advisory-given the nature of local wealth generation. Second, invest in digital-first platforms: mobile wealth apps, digital onboarding, remote advisory and offshore treasury interfaces will be essential to engage both local affluent clients and the diaspora. Third, build cross-border capability: multi-currency treasury, offshore structuring, and partnerships with global private-wealth firms will enhance value for clients seeking diversification. Fourth, emphasise risk-management and governance: given Zimbabwe’s currency instability, inflation environment and regulatory uncertainty, strong advisory, compliance frameworks and transparent pricing will be core to client trust and retention. Institutions that execute these imperatives effectively will be positioned to lead in Zimbabwe’s evolving private banking landscape.