Privatization and Infrastructure Advisory: Catalysts Transforming Argentina investment banking market

Argentina investment banking industry is entering a transformative phase, driven by government-led privatization initiatives and expanding infrastructure advisory opportunities. As Latin America’s third-largest economy, Argentina is witnessing renewed interest in its privatization agenda, where state-owned assets are gradually being opened to private investors to stabilize fiscal deficits and boost economic productivity. This transition is reshaping the dynamics of the investment banking market, as domestic and international institutions are increasingly involved in structuring mergers, acquisitions, and capital market transactions tied to these reforms. The Ministry of Economy continues to emphasize economic restructuring through private capital mobilization, fostering advisory demand across sectors such as transport, utilities, and energy.

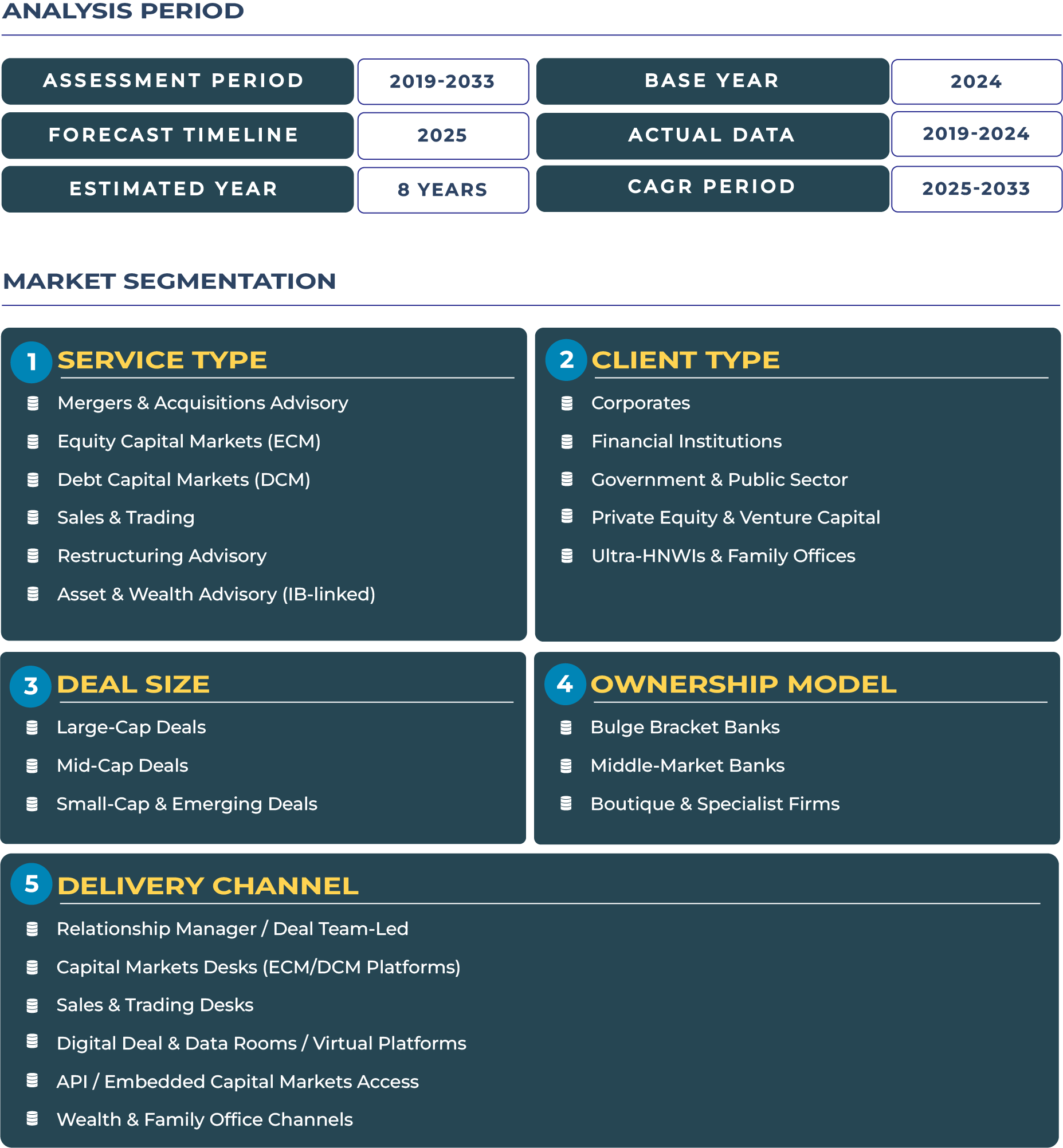

Note:* The market size refers to the total revenue generated by banks through various services.

The Argentina Investment Banking Market is projected to reach USD 2.5 billion in 2025 and expand to USD 2.9 billion by 2033, representing a steady CAGR of 1.6%. Although modest, this growth reflects a market adjusting to economic stabilization and regulatory reforms. The country’s fiscal recalibration, coupled with infrastructure investment programs and cross-border financing, provides structural support to the industry. Moreover, renewed relationships with multilateral institutions and the introduction of capital market modernization measures are fostering investor confidence. Despite challenges posed by inflation, currency volatility, and political uncertainty, Argentina investment banking ecosystem remains strategically positioned to benefit from selective privatization, public-private partnerships (PPPs), and infrastructure-linked financing mandates.

Argentina Investment Banking Market Outlook: Revitalizing Corporate Finance through Privatization and Infrastructure Momentum

The market outlook for Argentina investment banking sector is increasingly defined by its shift from public ownership to market-driven enterprise growth. As the government pursues fiscal reforms and asset divestments, investment banks are playing an instrumental role in bridging private capital with national infrastructure ambitions. The recent acceleration in privatization efforts across transport, telecommunications, and utilities has intensified the demand for advisory and capital markets expertise. The Central Bank of the Argentine Republic (BCRA) has been implementing monetary stabilization measures to strengthen liquidity, while the Ministry of Economy’s fiscal adjustments have opened new avenues for capital inflow and project financing.

In this context, infrastructure advisory has become one of the most dynamic sub-segments of Argentina investment banking landscape. Projects focusing on logistics modernization, renewable energy, and urban development are creating pipelines for structured financing and debt issuance. Furthermore, the growing interest of foreign investors, particularly from Europe and Asia, has boosted the scope of cross-border merger and acquisition and joint venture transactions. As Argentina’s corporate sector gradually stabilizes, investment banks are poised to leverage their expertise in restructuring and asset-based financing to support long-term economic recovery. The slow but steady CAGR of 1.6% reflects resilience amid macroeconomic adjustments and an evolving regulatory environment.

Drivers & Restraints: Balancing Privatization Gains with Economic Realities

Privatizations and Infrastructure Financing: The Key Growth Catalysts

Argentina’s privatization initiatives stand as the principal driver of its investment banking market. The government’s renewed commitment to transferring state-owned enterprises into private hands has attracted both domestic and international investors, generating significant advisory mandates. Infrastructure and energy financing have emerged as complementary growth pillars, with banks structuring syndicated loans, debt placements, and advisory for major projects. The National Gas Regulatory Authority (ENARGAS) and other infrastructure agencies are encouraging private sector participation to expand energy grids, logistics networks, and renewable capacity. These transactions demand sophisticated merger and acquisition and DCM capabilities, positioning investment banks as essential intermediaries between policymakers and institutional investors. This structural shift underscores the sector’s strategic relevance in Argentina’s path toward economic rebalancing and modernization.

High Political and Currency Risk: Persistent Challenges for Market Stability

Despite promising structural opportunities, Argentina investment banking ecosystem remains constrained by macroeconomic uncertainty and currency fluctuations. The Argentine peso’s chronic depreciation, coupled with high inflation rates, continues to erode investor confidence. Political transitions and divergent fiscal policies often create inconsistent regulatory conditions, affecting capital markets performance. The National Institute of Statistics and Census (INDEC) has highlighted persistent inflationary pressures that complicate debt pricing and capital allocation. Additionally, shifting government policies on capital controls and tax regimes hinder cross-border financing and corporate expansion. While these conditions pose risks, investment banks are responding through localized advisory frameworks, risk-hedging strategies, and diversification into resilient sectors such as export-driven industries and agribusiness finance.

Trends & Opportunities: Digitization, SME Financing, and Cross-Border Advisory Redefining Growth Pathways

Fintech-Driven Transformation in Capital Market Advisory

The digitization of Argentina’s financial services ecosystem is reshaping how investment banks deliver advisory and trading solutions. The growing presence of fintech platforms and online investment services has increased accessibility to capital markets for mid-sized enterprises. Supported by regulatory encouragement from the National Securities Commission (CNV), digital transformation is fostering new business models in capital markets advisory, enabling faster deal execution and broader investor participation. Digital trading infrastructure and automated compliance tools are also improving operational efficiency across merger and acquisition and equity market activities, laying the foundation for a more transparent and competitive financial ecosystem.

SME and Infrastructure Advisory: Emerging Opportunities for Inclusive Growth

While large corporates continue to dominate Argentina’s investment banking revenue streams, a growing opportunity lies in expanding advisory services to small and medium-sized enterprises (SMEs). SMEs represent the backbone of Argentina’s economic output and employment, yet remain underrepresented in structured finance and capital access. Investment banks are beginning to develop tailored advisory frameworks for SME financing, including mezzanine debt, working capital structuring, and cross-border collaborations. Additionally, infrastructure advisory linked to regional connectivity projects and renewable energy expansion is opening fresh deal opportunities. Cities such as Buenos Aires, Córdoba, and Rosario are emerging as focal points for regional capital deployment, strengthening the country’s long-term financial intermediation capacity.

Competitive Landscape: Strategic Positioning and Selective Privatization Advisory Defining Leadership

Argentina investment banking market features a blend of local players and global financial institutions. Leading domestic banks such as BBVA Argentina and Banco Galicia are enhancing their infrastructure and SME advisory portfolios, targeting privatization-linked mandates and energy sector transactions. On the international front, firms like JPMorgan Chase and HSBC continue to facilitate cross-border deal structuring, particularly in renewable energy and transport. In 2024, several institutions expanded their restructuring advisory operations to support corporates navigating debt refinancing amid macroeconomic pressures. The strategic focus across the industry is shifting toward infrastructure-linked PPP deals and SME financing, capturing the most resilient growth opportunities amid Argentina’s economic transitions.

Collaborations between domestic and international banks are deepening as Argentina’s market reopens to global investment flows. These partnerships not only bring technical expertise but also enhance the credibility of local capital markets in the eyes of foreign investors. As the market stabilizes, institutions that balance regulatory agility, infrastructure specialization, and cross-border execution capability will define Argentina’s next phase of investment banking competitiveness.