Germany Insurance Brokerage Market Outlook

Modular Precision Anchors Germany’s Risk-Averse Insurance Brokerage Evolution

Germany insurance brokerage market thrives on a foundation of financial prudence and customization. In a nation characterized by its measured approach to risk and fiscal responsibility, brokers have cultivated a reputation for delivering modular, personalized coverage—particularly appealing to freelancers, SMEs, and cautious consumers. These clients seek flexibility in product design, such as tailored professional liability or hybrid life-health modules delivered via brokers rather than prepackaged by insurers. As a result, the insurance brokerage landscape in Germany has matured into an advisory-led ecosystem where brokers support buyer confidence through structured, fit-for-need solutions.

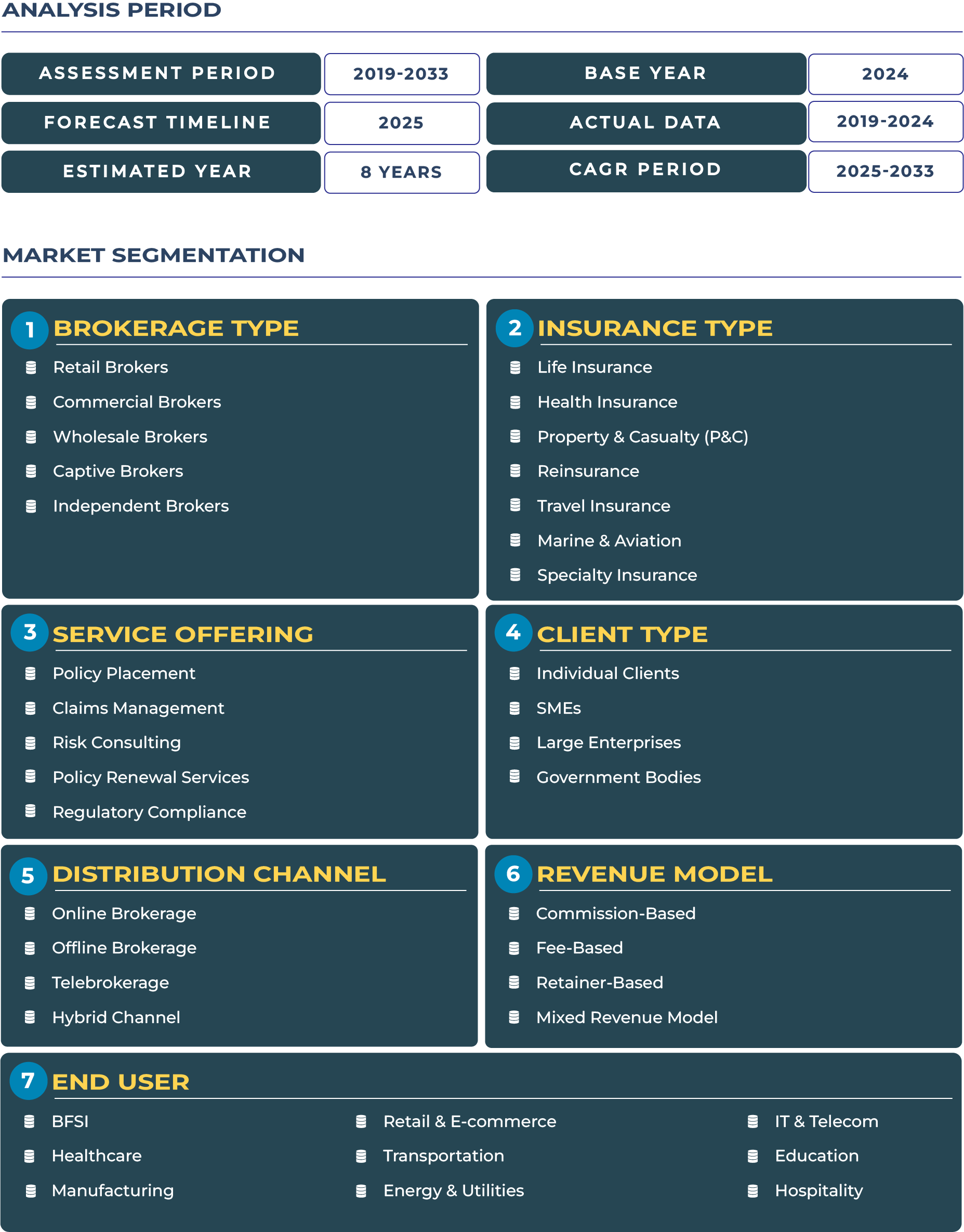

Market projections indicate the German insurance brokerage market will reach approximately USD 34.6 billion in 2025, growing to USD 55.8 billion by 2033, registering a compound annual growth rate (CAGR) of 5.5% from 2025 to 2033. This growth is attributed to increasing demand for specialty and P&C brokerage, elevated penetration of modular and ESG-aligned products, and sustained consolidation activity that strengthens market capabilities. Moreover, Germany’s resilience amid geopolitical shifts and elevated interest rates supports investment in brokerage channels for risk transfer and asset protection.

Corporate Schemes and Specialty Insurance Propel Strategic Expansion

Germany insurance brokerage sector is witnessing accelerating momentum powered by corporate group schemes and niche specialty lines. Large commercial brokers are orchestrating group-level negotiations for employee benefits, cyber protection, and directors' liability—leveraging scale to access preferential terms and pricing. Germany remains one of the strongest non-life commercial markets in Europe, accounting for €37 billion in non-life premiums in 2023 with a 2.6% CAGR. Brokers are leveraging this to expand their footprint across multinational and SME networks, breaking the historical dominance of captive agents.

Marine, environmental liability, and specialty P&C lines have emerged as growth drivers. Wholesale brokers are addressing the evolving needs of Germany’s export-driven economy—delivering modular solutions for supply chain resilience, logistics, and cyber exposures. Tailored coverage and deeper underwriting insight differentiate brokers in these high-value, technical segments, strengthening client partnerships and expanding advisory share of wallet.

Commoditization and Customer Complexity Challenge Advisory Value

Despite its strengths, the German brokerage ecosystem faces constraints driven by commoditization and client fatigue over complexity. Basic motor and homeowners insurance are increasingly standardized, eroding the value proposition of generic broker offerings. Price-comparison platforms further accelerate this trend by increasing transparency and pushing premiums downward.

Clients, while risk-averse, now confront a labyrinth of policy options—ranging from modular health riders to ESG-linked underwriting metrics—demanding high advisory effort. Conveying the nuances of layered products to cautious, often older, policyholders can be resource-intensive. This complexity raises advisory costs and erodes margins, challenging brokers to balance custom solutions with scalable engagement. Only those with streamlined, client-centric consultation models will maintain profitability.

NLP, ESG Metrics, and Digital Asset Coverage Define the Next Frontier

Advancements in digital underwriting and broker-service automation are reshaping the German market. Natural language processing (NLP) tools enable instant policy summarization and gap analysis—a valuable efficiency for brokers managing intricate modular packages. This technology enhances advisory effectiveness across commercial and independent broker networks.

Underwriting is also evolving through ESG integration. Brokers now incorporate environmental, social, and governance parameters across risk models, appealing to Germany’s increasingly sustainability-focused market. Clients aligned with green financing strategies are actively seeking ESG-aligned policies, and brokers who can quantify this value hold competitive advantage.

Additionally, digital asset and crypto insurance are emerging as niche growth areas. With blockchain platforms and tokenized assets gaining traction, brokers are stepping into advisory roles for digital custody, operational risk, and fraud coverage. Pandemic-related parametric insurance—contingent on defined loss triggers—is also gaining attention as businesses reassess continuity planning.

BaFin Oversight and ESG Mandates Shape Market Practices

Germany’s insurance brokerage is regulated under the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin), whose supervisory frameworks emphasize professionalism, transparency, and solvency. Recent mandates have strengthened ESG disclosure requirements, compelling brokers to include sustainability criteria in advisory and underwriting.

BaFin also supports digitalization through sandbox environments for fintech-insurtech solutions and national distribution mandates that ensure policy clarity and non-commission bias. These frameworks enhance trust in broker services—particularly important when marketing modular or complex products. Clear standards for customer advice, documentation, and complaint handling allow brokers to position themselves as credible advisors rather than sales agents.

Cultural Risk Aversion and Personalization Demand Anchor Broker Relevance

Germany’s cultural aversion to risk—especially in retirement and health planning—injects continued relevance for broker intermediaries. Sophisticated consumers, often with high insurance literacy, demand customized insurance designs suited to their life-stage preferences, including flexible pension-linked riders and estate continuity endorsements. This drives sustained demand for independent and retail brokers who can translate regulatory complexity into client value.

Insurance penetration in Germany remains moderate compared to Northern Europe; with per capita P&C premiums around €2,670 (versus €4,420 in the Netherlands). This presents latent growth potential, particularly in life, disability, and specialty insurance. Captive brokers attached to banks or insurers can leverage digital distribution to reach cautious clients, but must navigate customer fatigue around policy rationalization. Profitability lies in those who streamline advice through modular frameworks.

Modular Product Innovation Anchors Competition in German Brokerage Market

The competitive landscape in Germany comprises heavyweights such as Allianz, Aon Germany, Willis Towers Watson, Ecclesia, and international consolidators like Acrisure and Castik Capital-backed platforms. These firms are accelerating product innovation and technological integration to meet demand for modular offerings.

For instance, in March 2024 Allianz Germany launched flexible insurance bundles for freelancers—allowing brokers to tailor between disability, cyber, and health modules with tiered premiums in real-time during consultation. Aon and Willis Towers Watson remain focused on ESG advisory and cyber-breach readiness for corporate clients, capitalizing on risk advisory rather than policy placement.

Wholesale broker Ecclesia leverages M&A to build specialty footprints in environmental and marine lines. Meanwhile, independent digital brokers such as Wefox and Clark utilize chatbot-enabled onboarding and NLP-driven policy summaries to streamline client advisory. This bifurcation of scale and innovation–specialist agility exemplifies the multi-tiered competitive dynamics of Germany’s insurance brokerage ecosystem.

Conclusion: Modular Advisory as the Keystone of Germany’s Brokerage Evolution

Germany insurance brokerage market stands at a transformation juncture where cultural caution meets modular innovation. Brokers who can synthesize regulatory rigor, ESG alignment, and advanced digital tools to deliver personalized, advisory-rich solutions will define the next market wave. Amid price compression in commodity lines, structured advisory models rooted in risk aversion and customization become the catalyst for sustained growth. As Germany continues its conservative yet strategic evolution, broker intermediaries that integrate modular product frameworks with digital acumen will shape a resilient and client-centric insurance landscape by 2033.