Insurance Analytics Market Introduction

Business intelligence and analytics have become a vital part of the insurance industry. Increased affordability of storage systems coupled with the emergence of social media and the internet in the few years has led to generation and assimilation of the huge amount of unstructured data. Insurance companies today, are on the lookout for means to effectively utilize the available data for better decision-making and improve services. Analytic solution help companies to predict the expected cost of insurance associated with the coverage. Additionally, it enhances risk assessment process and enables the company to detect and prevent fraudulent behaviors. Furthermore. insurance companies are prioritizing technology investments to analyze customer data and gain new insights into how to better serve their clients. Improvement in services results in higher policy retention, increased revenue, and better client relationships. Moreover, a bevy of regulatory challenges has influenced insurance companies to reform their business strategies to outperform competitors. This, in turn, has increased the insurance company's expenditure on advanced data analytics solutions and services.

Market Dynamics

Increase in need for leveraging data for information purposes and gain insights for decision making is accelerating the adoption of insurance analytics solutions and services. In addition, the emergence of IoT, the upsurge in penetration of mobile device, increasing digitization across organizations, and stiff competition in the market is projected to boost the overall insurance analytics market growth. In contrast, lack of awareness and lack of skilled workforce in emerging markets are anticipated to have an adverse effect on the overall insurance analytics market size during the forecast period.

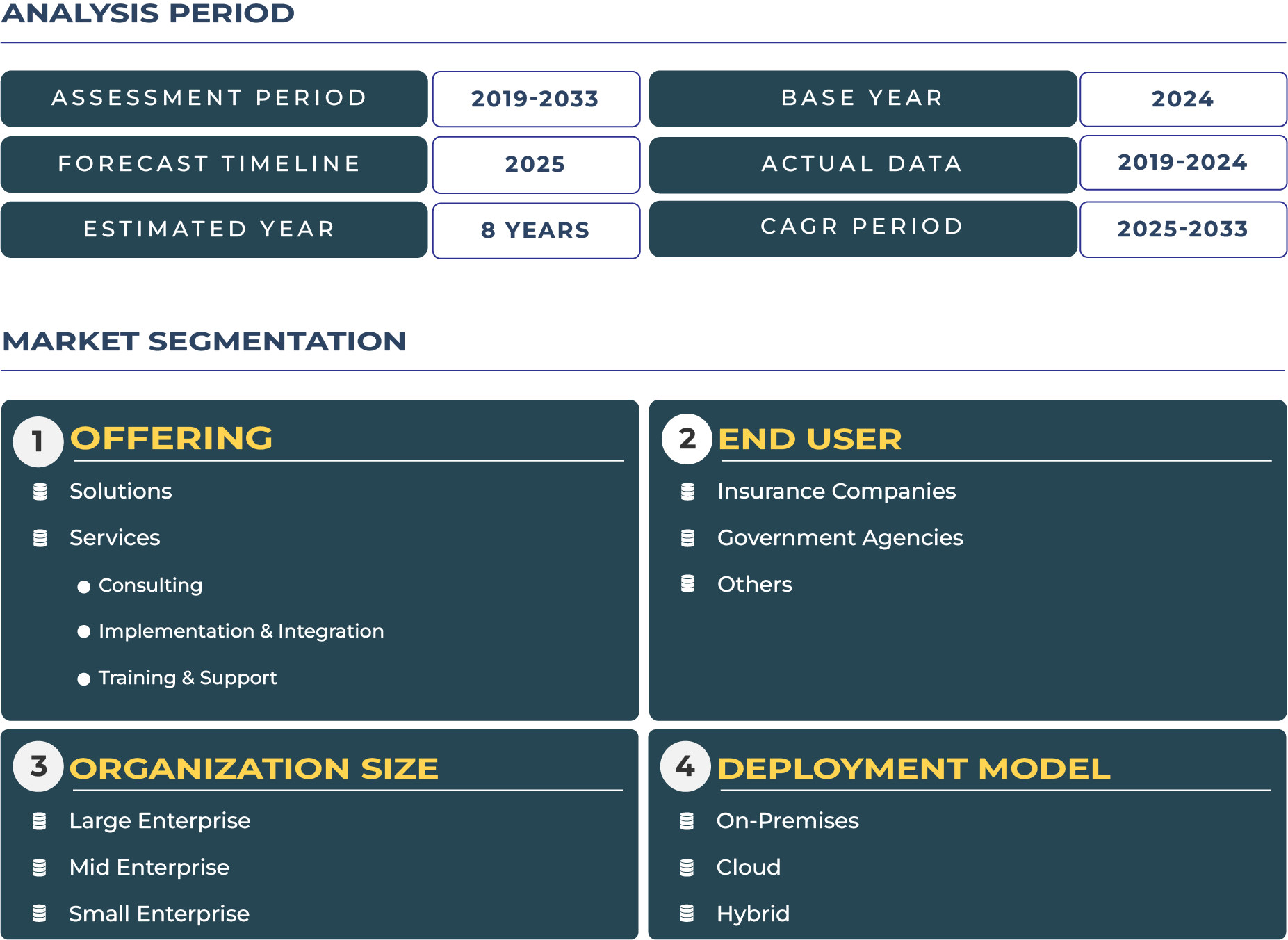

Market Scope

The insurance analytics market is segmented based on offering, solutions, services, deployment model, organization size, end users and regions.

By offering, the global insurance analytics market is bifurcated into solutions and services. Based on services, the insurance analytics market is segmented into consulting, implementation & integration, and training & support. By deployment model, the market is bifurcated into cloud-based and on-premise solutions. By organization size, the market is segmented into large enterprises and small-medium enterprises. Based on end users, the market is segmented into insurance companies, government agencies, and others. By region, the global insurance analytics market is analyzed across six major geographies such as North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, and Middle East & Africa (MEA).

Insurance Analytics Market Competitive Landscape

Prominent players identified in the insurance analytics industry are Avanade, IBM, Lexisnexis, Microsoft, Microstrategy, Mitchell International, Opentext, Oracle, Palantir, Pegasystems, Prads Inc., Qlik, Salesforce, SAP, SAS Institute, Tableau Software, Tibco Software, Verisk Analytics, and Vertafore.