UK Insurance Brokerage Market Outlook

Embedded Fintech Ecosystems Reinvent UK Insurance Brokerage Access

The United Kingdom insurance brokerage market stands at a critical inflection point, propelled by the seamless integration of embedded insurance within fintech and banking applications. Consumers increasingly expect financial services—ranging from loans to mortgages—to include insurance options at the point of decision. This trend is particularly pronounced as banks collaborate with brokers to integrate home, life, health, and auto insurance into digital platforms. This embedded insurance model is reshaping the distribution landscape, reducing friction in the customer journey and significantly enhancing accessibility. For retail and independent brokers, partnering with digital finance providers opens new distribution channels and enables client acquisition at scale.

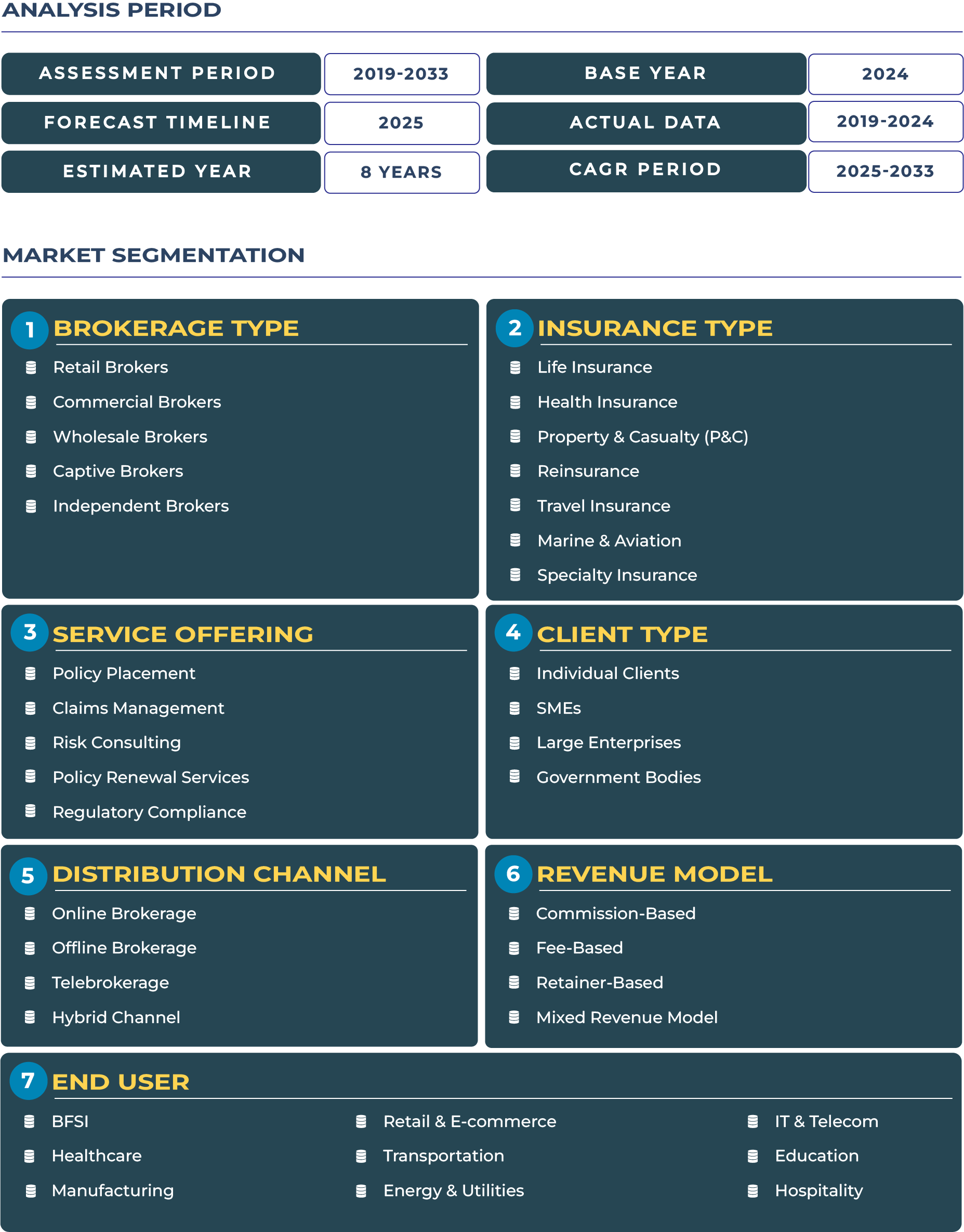

The UK insurance brokerage market is projected to be valued at approximately USD 27.4 billion in 2025 and is expected to grow to USD 44.2 billion by 2033, representing a compound annual growth rate (CAGR) of 5.9% between 2025 and 2033. This expansion is underpinned by increased digital engagement, a favorable regulatory environment, and strong growth in embedded insurance partnerships across fintech and banking ecosystems.

Personalized Brokerage Through Smart Data and Health Expansion Drives Growth

The brokerage landscape in the UK is undergoing a transformation fueled by AI-driven personalization and health insurance expansion. Brokers are adopting predictive modeling and behavioral analytics to recommend optimal coverage maps that adapt to individual lifecycle stages. These data-driven tools empower retail brokers to offer personalized policies—ranging from term life to health and wellness coverage—that integrate seamlessly with consumer preferences and data footprints.

Health insurance is gaining particular traction, with a growing appetite for supplemental and private medical insurance. As consumers spend more time on digital platforms, brokers are leveraging e‑health records and wellness app integrations to tailor health cover bundles. This shift is leading to the proliferation of advisory-driven distribution models, where brokers provide guidance backed by data insights, enhancing service quality in a market increasingly characterized by hybrid and embedded insurance solutions.

Legacy Claims Processes and Insurtech Competition Limit Brokerage Momentum

Despite significant digital progress, the UK insurance brokerage market faces headwinds posed by entrenched claims systems and competitive pressures from direct-to-consumer insurers. Lengthy claims processing and system complexity continue to frustrate clients, prompting them to circumvent brokers in favor of insurers offering faster, more transparent resolutions.

In parallel, digitally native insurance carriers now offer affordable, pre-packaged products with online pricing and binding functionalities. These direct channels—especially prominent in personal lines such as motor and travel—are eroding traditional broker value propositions. Brokers must now focus on differentiating through advisory expertise, bundled solutions, and responsive service delivery to counter market erosion by digital-first insurers.

API‑Driven Distribution and On‑Demand Insurance Reshape Brokerage Offerings

Emerging trends in the UK brokerage sector highlight the adoption of API‑driven distribution and on‑demand insurance, particularly in mobility and event-based coverage. Through fintech and mobility platform partnerships, brokers now embed insurance offers directly into apps, allowing customers to activate motor, travel, or device insurance at the tap of a button. These micro‑transaction models empower retail brokers to cater to demand for flexible and usage-based insurance.

Carbon footprint tracking and device‑use data are enabling brokers to create packages that align with consumer lifestyles—such as pay-per-mile auto insurance or device protection during travel. This trend is democratizing access to risk transfer solutions and expanding brokerage reach, especially among digitally engaged consumers and younger demographics who prefer convenience and control.

Gig‑Economy and Drone Insurance Create New Brokerage Niches

The UK’s gig economy and rapid innovation in drone technology are creating fresh opportunities for niche insurance brokerage models. Delivery drivers, rideshare operators, and freelance professionals face a unique set of exposures that traditional policies often do not address. Brokers offering tailored gig‑economy protection—covering accident, PII (public indemnity), and income disruption—are meeting a growing demand from self-employed workers.

Similarly, drone insurance is gaining prominence. Brokers specializing in this category are providing regulatory compliance assistance, payload coverage, and third-party liability protection. Commercial and wholesale brokers are further enabling public sector and logistics clients to insure drone fleets within drone‑operated ecosystems, showcasing advisory-centric and embedded insurance innovations.

FCA Reforms Simplify Brokerage Regulation and Promote Innovation

Regulatory reform has become a strategic lever shaping the UK insurance brokerage landscape. In July 2024, the Financial Conduct Authority (FCA) initiated a review of retail conduct and commercial insurance rules, aiming to streamline regulation and enhance international competitiveness—especially relevant post‑Brexit. The FCA’s new consumer duty establishes channels for innovation, allowing API-driven, embedded insurance partnerships between brokers and fintechs.

Ongoing efforts to modernize data‑sharing standards and introduce sandbox environments enable brokers to collaborate with InsurTechs under regulatory supervision. These reforms signal a shift toward issuer‑agnostic, customer-centric models, driving innovation in advisory-led brokerage and reducing compliance burden across regional markets.

Digital Engagement and Licensing Prerequisites Shape Market Access

Key macro factors underpinning performance in the UK insurance brokerage sector include high consumer digital engagement and evolving licensing requirements. As of 2024, over 95% of UK adults use smartphones—a foundational driver enabling embedded insurance adoption and API-based distribution.

Conversely, complex licensing frameworks—imposed by both the FCA and Prudential Regulation Authority (PRA)—require brokers to maintain senior management oversight and continuous professional development. While this structure ensures professionalism and risk governance, it also raises entry barriers, particularly for small-scale independent and captive brokers seeking to adopt fintech innovation.

Embedded Insurance Partnerships Define Competitive Edge Among UK Brokers

Competition in the UK brokerage market is intensifying as leading players and new entrants pursue embedded insurance partnerships and digital-first distribution strategies.

- Aviva forged a landmark deal with Monzo Bank in April 2024, embedding digital life and home insurance directly into Monzo’s banking app—enhancing access and simplifying policy issuance.

- Aon UK and Willis Towers Watson have ramped up capabilities in strategic risk advisory, with WTW offering cyber, employee benefits, and actuarial services to FTSE‑100 clientele.

- Arthur J. Gallagher and Marsh UK have accelerated API-based distribution, embedding specialty insurance (e.g., environmental liability, political risk) within trade-finance platforms.

Independent brokers are increasingly turning to InsurTech partners and robo-advisors to deliver micro‑insurance and on-demand coverage throughout digital ecosystems. This evolution underscores a broader market transition toward advisory-centric, technology-enabled brokerage models.

Conclusion: Embedding Brokerage in UK’s Fintech Ecosystem to Sustain Growth

The UK insurance brokerage market has entered a transformative era, shaped by embedded fintech collaborations, advisory-driven service delivery, and on-demand insurance innovation. Brokers who leverage API ecosystems, regulatory reform, and consumer-focused service models will be well-positioned to harness sustainable growth in both personal and commercial lines. As fintech penetration deepens and digital engagement becomes the norm, brokers able to combine domain expertise with embedded distribution will define the next phase of the UK insurance brokerage landscape.