Australia Media Market Growth and Performance

- Revenue in the Australia media market is estimated to stand at US$ XX.02 billion in 2024.

- In the media industry in Australia, XX.76% of total revenue will be generated through XX end user by 2033.

Australia Media Industry Outlook

Evolving with Technology and Culture

The Australia media market stood robust at approximately USD XX billion in 2024, supported by a near-universal internet penetration of 96%, smartphone ownership of 90%, and smart TV usage at 64%. This digitally native population, coupled with rising regional connectivity, is steering media consumption trends towards connected TV (CTV), AI-curated recommendations, and immersive content.

Emerging technologies are redefining the Australia media industry ecosystem. From CTV growth to regional digital content expansion, players are capitalizing on increasing demand for personalized and on-demand media. Rural digital inclusion programs, spurred by government initiatives, are ensuring that media penetration is not limited to metropolitan hubs, laying a foundation for long-term nationwide engagement.Paid User Dynamics, Disposable Income & Export Revenue Impact

Australia’s OTT paid user base crossed 24 million in 2023, driven by a culture of multi-subscription models across platforms like Netflix, Stan, and ABC iView. With an ARPU of approximately USD 7.2 (AUD 11/month), monetization potential remains strong. Furthermore, a high disposable income of nearly USD 33,500 (AUD 51,000) boosts user willingness to pay for premium, ad-free experiences—especially in urban and youth segments.

The Australia media sector also earns international recognition, with media exports valued at around USD 620 million (AUD 950 million) in 2023. Global demand for Australian film, TV formats, and digital documentaries is expanding the nation's soft power while supplementing the local industry’s economic resilience.Preferred Media Types, Local Content, and Shifting Habits

Australian consumers clock 6.8 hours of media consumption daily, with a preference hierarchy led by streaming services, podcasts, TV, and digital radio. Notably, local content, especially Australian dramas and news, garners significant viewership—driven by trust, cultural relatability, and government-led local content mandates. OTT platforms like Stan and ABC iView have surged ahead with Aussie originals, capturing loyal viewers seeking homegrown narratives. Additionally, the rise of sports streaming—particularly AFL and NRL—has further embedded streaming as a default media format for multi-generational households.

Platforms, Influencer Culture, and Youth-Centric Trends

In 2023, Netflix Australia led the subscription race with 6.7 million users, followed by Stan (2.8M), ABC iView (3.1M), and Foxtel Now (1.6M). A defining trend is the shift toward creator-driven micro-content via platforms like TikTok, YouTube Shorts, and Instagram Reels. With 28% of the population aged 15–34, young Australians are shaping demand for short-form videos, interactive content, and community-driven storytelling. Their average media spend of USD 20–33/month reflects a clear willingness to pay for exclusivity and enhanced user experience. The influencer economy has also emerged as a force multiplier for content discovery and engagement. Local creators are now integral to promotional strategies, particularly for OTT launches and niche genre traction.

Consumer Preferences, Pricing Sensitivity & Regional Influence

Australian viewers are discerning—demanding value bundles (e.g., sports + entertainment), HD streaming, and zero-ad environments. While urban consumers lean toward premium, ad-free services, regional users and families exhibit moderate price sensitivity, often opting for freemium or bundled offerings. This dichotomy is pushing platforms to diversify tiering strategies and improve regional content relevance.

Regulatory Support for Australia Media Industry

The government has reinforced its support via Screen Australia with funding for local productions and digital skill upliftment. The 2024 announcement of local content quotas on SVOD platforms—effective by 2026—aims to amplify Australian storytelling globally. Top players are adapting quickly. Nine Entertainment integrates TV, live events, and its digital arm 9Now to build a cross-platform audience. Stan has co-produced hits with NBCUniversal, while ABC & SBS are doubling down on regional content and multilingual OTT.

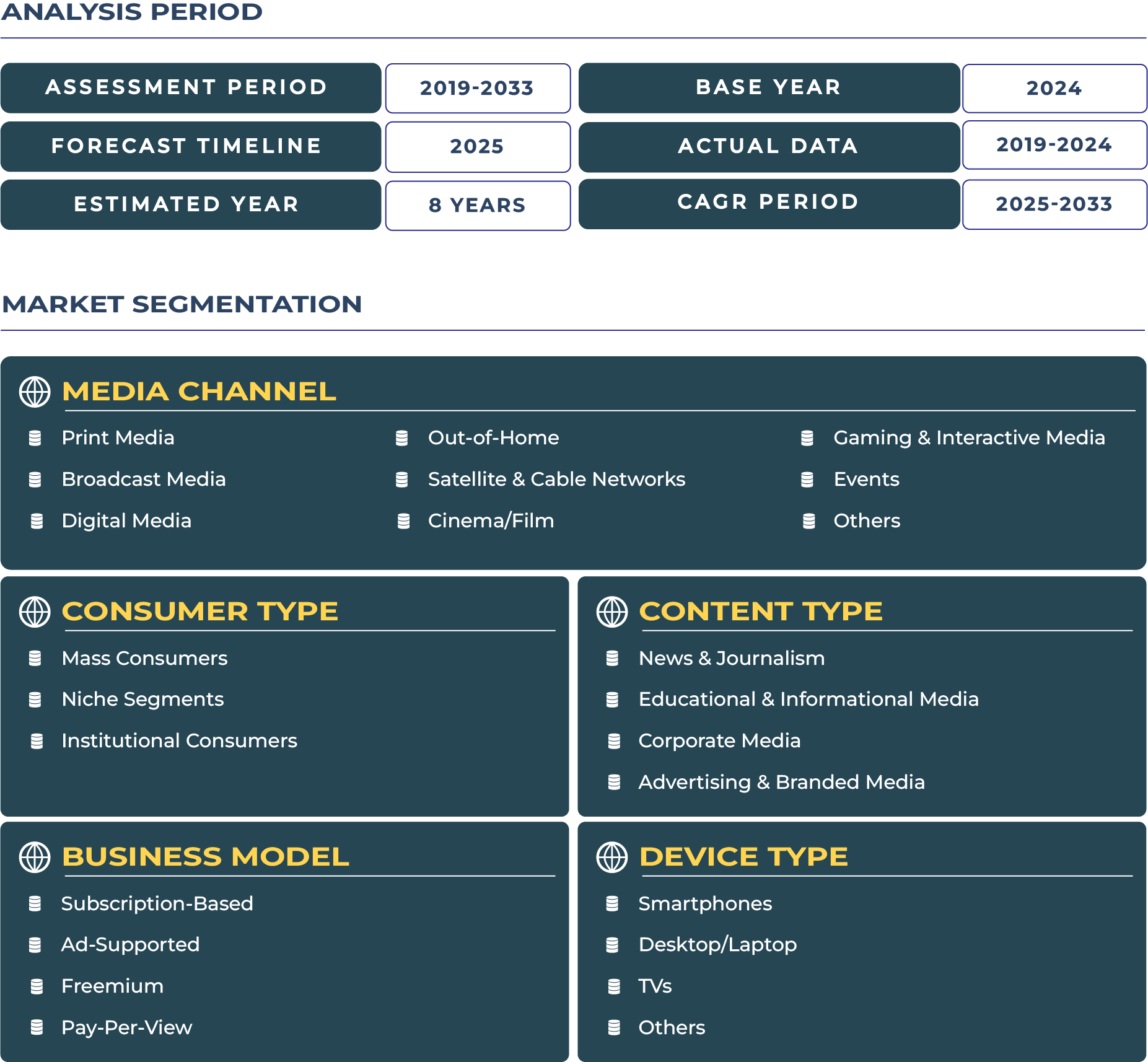

Australia Media Market Scope